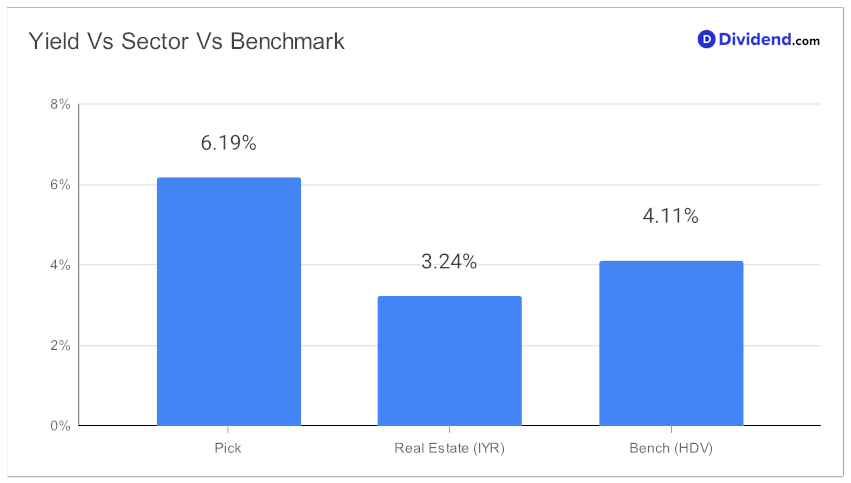

In the realm of investment, consistency is a prized fortune, and for monthly dividend aficionados, there emerges a champion from the eREIT sector. Commanding attention with a forward dividend yield of 6.19%, this powerhouse not only surpasses industry averages but also offers reassurance against the deceptive allure of dividend traps. Standing tall within the top echelon of dividend stocks, it boasts an illustrious 30-year history of dividend increments, an emblem of stability and confidence for investors who cherish financial predictability.

What’s more, investors are on the cusp of opportunity; the entity is poised to roll out its next non-qualified dividend payout of $0.256 per share. This imminent disbursement, scheduled to go ex-div on October 31, presents a not-to-be-missed venture for steadfast investors.

Yet, the intrigue doesn’t end with these compelling highlights.

This year, REITs faced downturns mainly due to credit issues and rising rates. However, our monthly dividend-paying REIT stands out as highly dependable, focusing on tenants offering essential goods and services. Despite challenges, the REIT showed growth in its adjusted funds flow from operations (AFFO) in the most recent reported quarter, highlighting its cash flow stability and strong income potential.

Delve into our comprehensive stock analysis that follows, where rigorous assessments meet criteria like Yield Attractiveness and Dividend Safety. While Returns Potential and Risk are secondary, they bolster the stock’s profile, painting a holistic picture of a robust monthly payer. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 3, 2023.

This exploration is indispensable, equipping dividend investors with insights for a fortified portfolio.