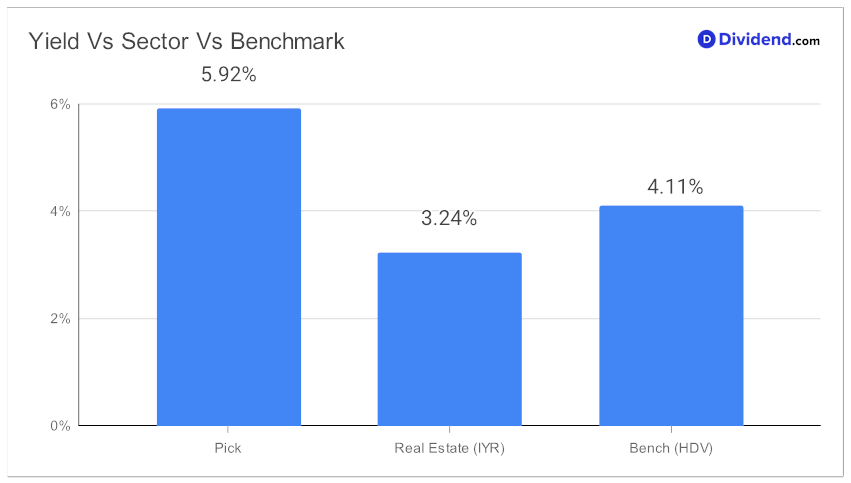

In the realm of monthly dividend investing, a standout performer reaffirms its place in the coveted Best Monthly Dividend Stocks model portfolio. This well-covered mid-cap equity REIT (eREIT) continues to capture the market’s confidence, showcasing a forward dividend yield of 5.92% that proudly sits in the top 20% of dividend stocks. While slightly below the eREIT industry average of 6.1%, discerning investors know it’s the balance between yield and stability that matters, avoiding the deceptive allure of potential dividend traps.

What’s particularly striking is the company’s 3-year dividend compound annual growth rate (CAGR), a robust 43% that also places it in the upper echelons of all dividend stocks. Though its year-to-date (YTD) returns modestly sit at 3% compared to the S&P 500’s 15%, it notably outperforms the eREIT industry’s -5%, highlighting resilience in a turbulent sector.

Investors eagerly anticipating the next payout won’t have to wait long, with an upcoming disbursement estimated at $0.080 per share around November 17. This timely injection underscores the firm’s commitment to rewarding shareholder loyalty with consistent, attractive payouts.

For dividend investors, these compelling points form the tip of the iceberg. Delving into the subsequent in-depth stock analysis reveals the meticulous recommendation process. Prioritizing Yield Attractiveness and Dividend Safety, with a prudent eye on Returns Potential and Risk, this exclusive review caters specifically to the unique demands of monthly payers. Additionally, while arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 5, 2023.