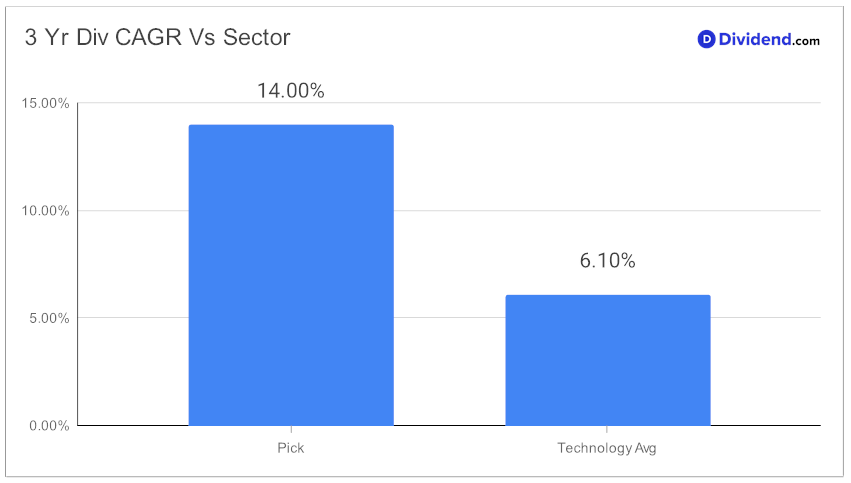

For those balanced investors with an eye for dividends within the Technology sector, a leading Tech Services large-cap stock emerges as a compelling component of the Best Sector Dividend Stocks model portfolio. This company’s commendable 40+ year track record of consistent dividend increases places it within the elite top 10% of dividend-distributing entities. Not merely content with historical performance, it boasts a 14% compound annual growth rate in dividends per share over the past three years, ranking it impressively in the top 20%.

Looking forward, the anticipated next dividend payout is estimated at a generous $1.400 per share, expected around January 11th. This next payout is not just a number but a testament to the company’s robust financial health and commitment to shareholder returns.

The recommendation process is meticulously designed, optimizing an equal blend of yield, dividend safety, return potential, and risk, specifically tailored for Technology sector dividend stocks. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on October 26, 2023.

Dive deeper into this analysis, and discover why this stock may be the smart addition to diversify and strengthen your dividend-focused portfolio.