Investors seeking a balanced dividend portfolio should take note of a well-covered mega-cap Tech Hardware stock that has been reaffirmed as a holding in the Best Sector Dividend Stocks model portfolio. This stock boasts a 37% forward payout ratio, which is not only low but also aligns with the Tech Hardware average of 43%.

The stock’s impressive 13-year dividend increase track record ranks in the top 10% of dividend stocks, and future increases are anticipated. Year-to-date, the stock has returned 20%, outperforming the S&P 500 by 1%.

Investors can look forward to the next payout, an unchanged qualified $0.390 per share, going ex-div on October 3.

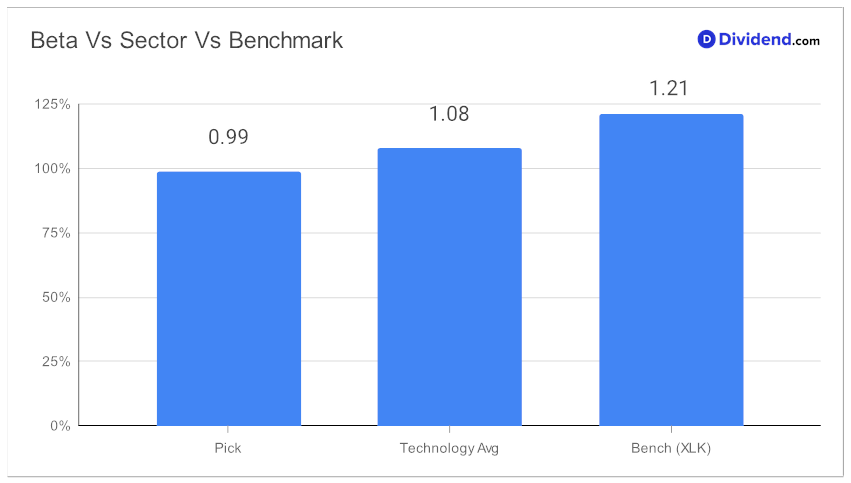

The stock is also less volatile, as evidenced by its relatively low beta compared to its sector average and benchmark.

We also take into account the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on August 17, 2023.

The recommendation process for this stock optimizes for an equal blend of yield, dividend safety, returns potential, and risk among Technology dividend stocks only.

Stay tuned for an in-depth stock analysis that will provide further insights into this promising investment opportunity.