In the constellation of dividend stars, there’s one Tech Services giant that remains a steadfast beacon for balanced investors seeking a harmonious blend of yield, security, and growth potential. This large-cap stalwart, a paragon in the technology sector, upholds a forward payout ratio of 35%—a figure that aligns perfectly with the sector’s average, while its 12-year history of dividend hikes places it in an enviable position within the top echelon of dividend players.

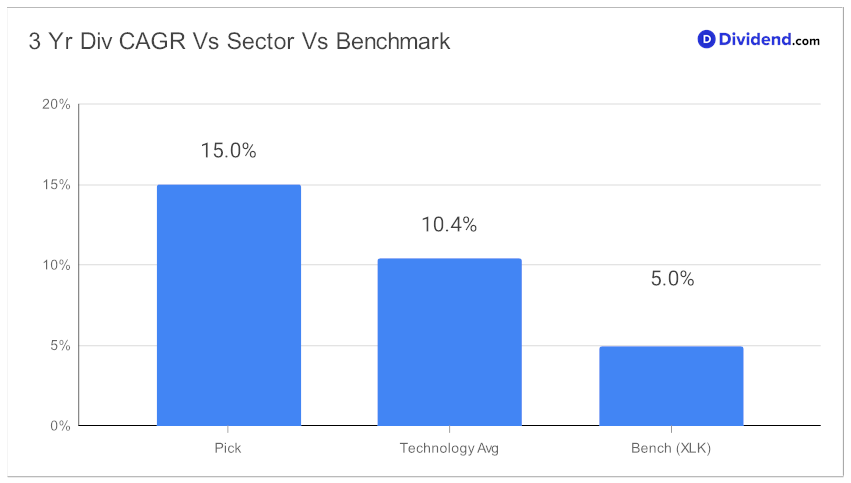

But that’s just the opening act. With a 3-year compound annual growth rate of 15% in dividends per share, it’s not just keeping pace—it’s setting the tempo for robust returns.

Stability? Absolutely. With a beta of 0.63, its performance waltzes to a different rhythm than the broader equity markets, suggesting a diversifying effect on your portfolio.

Year-to-date, this stock has outperformed, with a 13% return, nearly matching S&P 500’s and eclipsing some of its own tech peers. And let’s tune in to the immediate cadence: the next payout of an unchanged $0.470 per share, is just around the corner, going ex-dividend on the forthcoming November 14.

Stay tuned for our in-depth analysis, where we pull back the curtain to reveal how this Tech Services titan could orchestrate a symphony of gains and stability in your dividend portfolio.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2024 earnings call held on October 28, 2023.