Are you on the hunt for a large-cap Tech Services stock that has proven to be a reliable dividend payer? Look no further. We’ve recently added a promising holding to our Best Sector Dividend Stocks model portfolio that offers a blend of yield, dividend safety, returns potential, and risk. With a forward payout ratio of just 36%, it aligns closely with the Tech Services industry average of 33%, signaling a well-covered dividend.

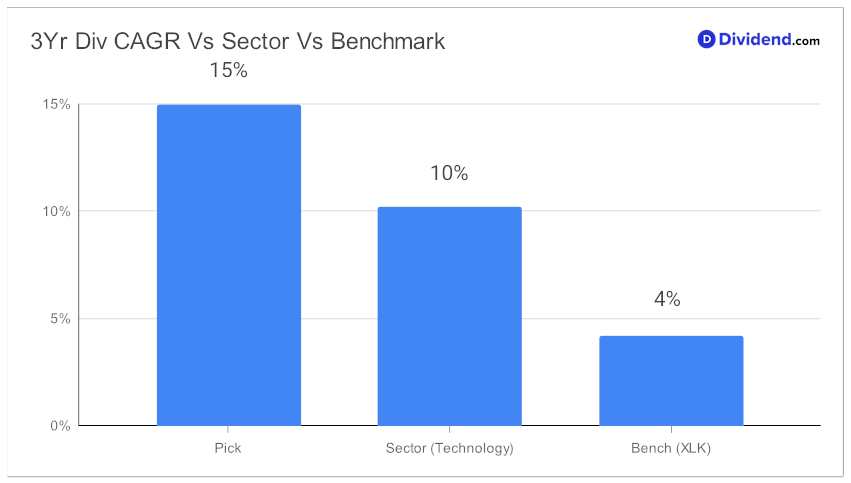

What sets this holding apart is its 12-year dividend increase track record, which places it in the elite top 10% of all dividend stocks. Going forward, it’s reasonable to expect even more hikes. Moreover, the stock has shown a 15% three-year dividend per share compound annual growth rate, ranking in the top 40% among all dividend stocks.

When it comes to performance, the stock has returned 8% year-to-date. Though it lags behind the S&P 500’s 17% and Tech Services’ 13%, its low beta of 0.61 suggests a lesser correlation with the equity market, adding a layer of diversification to your portfolio.

Attention to those eyeing the next payout: mark your calendar for an estimated dividend of $0.470 per share, expected to hit on or around October 26th.

We also take into account the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on July 29, 2023.

If these features have piqued your interest, stay tuned.

An in-depth stock analysis follows, optimizing for an equal blend of yield, dividend safety, returns potential, and risk specifically among Technology dividend stocks.