Investors seeking a balanced dividend strategy in the technology sector will find intrigue in a well-covered mega-cap Tech Services stock, recently reaffirmed as a holding in the Best Sector Dividend Stocks model portfolio.

With a forward payout ratio of 37%, not only is this stock’s payout well in line with the industry average of 33%, but it also boasts an 18-year track record of dividend increases, ranking in the top 10% of all dividend stocks.

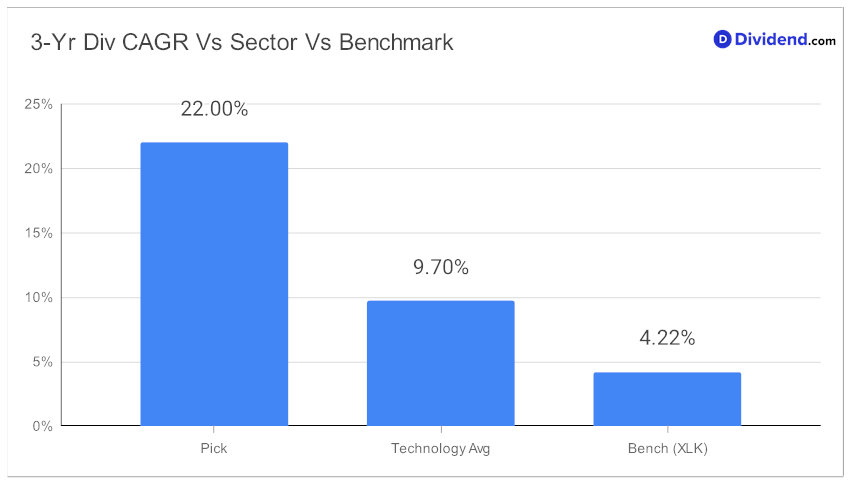

Its 3-year dividend per share compound annual growth rate (CAGR) of 22% places it among the top 20%.

Despite returning 17% year-to-date (YTD), just below the S&P 500 but ahead of the Tech Services industry, it still promises a forthcoming payout of an estimated $1.120 per share on or around September 22.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q3 earnings call held on June 22, 2023.

Delve into our in-depth analysis to explore how optimizing for an equal blend of yield, dividend safety, returns potential, and risk can make this stock a fitting choice for your portfolio.