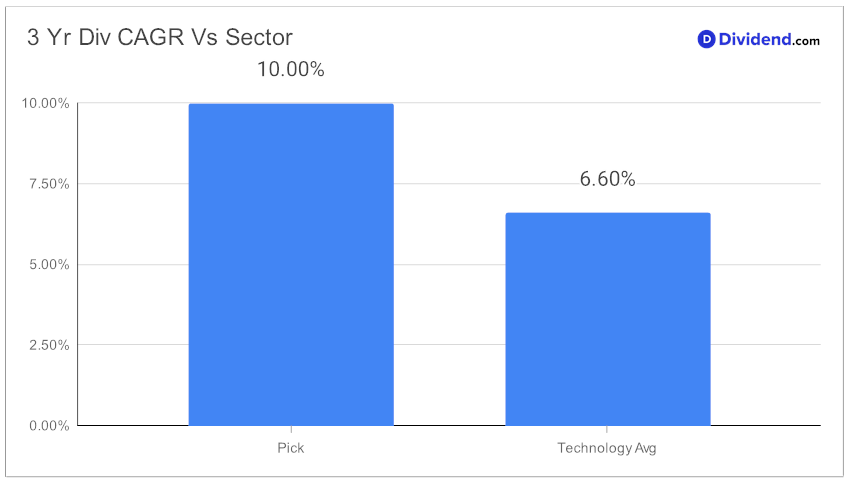

In the realm of technology dividend stocks, an exceptional performer has been added to the prestigious Best Sector Dividend Stocks model portfolio, marking a noteworthy development for balanced dividend investors. This well-covered large-cap Tech Services entity stands out not just for its robust 17-year track record of dividend increases—a feat placing it in the top 10% of its class—but also for its promising future growth prospects. With a 3-year compound annual growth rate (CAGR) of 10% in dividends per share, this stock comfortably positions itself in the top 40% of dividend-yielding stocks, showcasing a balanced blend of yield, safety, returns potential, and risk management.

The latest financial dispatch reveals an unchanged, qualified next payout of $0.800 per share, declared last Friday and scheduled to go ex-dividend on March 14. This update is crucial for investors looking for stable income streams amidst the ever-volatile market landscapes.

The inclusion of this stock in the model portfolio follows a meticulous recommendation process, aimed at optimizing investment outcomes by focusing on a balanced mix of performance indicators specific to Technology sector stocks. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2024 earnings call held on February 2, 2024.

The detailed analysis that follows will dive deeper into the strategic importance of this addition, exploring how it aligns with the investment philosophy of seeking high-quality, dividend-paying stocks that promise both growth and stability.