In the dynamic world of dividend investing, a standout large-cap semiconductor stock has recently made waves by securing a spot in the prestigious Best Sector Dividend Stocks model portfolio.

This inclusion marks a significant recognition for its balanced dividend appeal, especially among technology-focused investors. What sets this stock apart? A robust 20+ year history of consistent dividend increases, placing it in the elite top 10% of dividend stocks, with more hikes anticipated.

Financially, it boasts a healthy 31% forward payout ratio, aligning seamlessly with the industry average. Its performance speaks volumes, having delivered an 18% return year-to-date, mirroring the S&P 500. The next payout, a steady $0.800 per share, is scheduled for December 14, following its ex-dividend date on November 29.

2023 was a challenging year for our latest pick, led by a slowdown in smartphone sales. Rising inflation also limited consumer spending on discretionary items including personal electronics.

However, an expected recovery in smartphone demand in 2024 is likely to benefit our pick, which specializes in chips for mobile devices. Additionally, its new AI-integrated chips and a recent deal with Apple are likely to drive growth and provide revenue stability in the coming years.

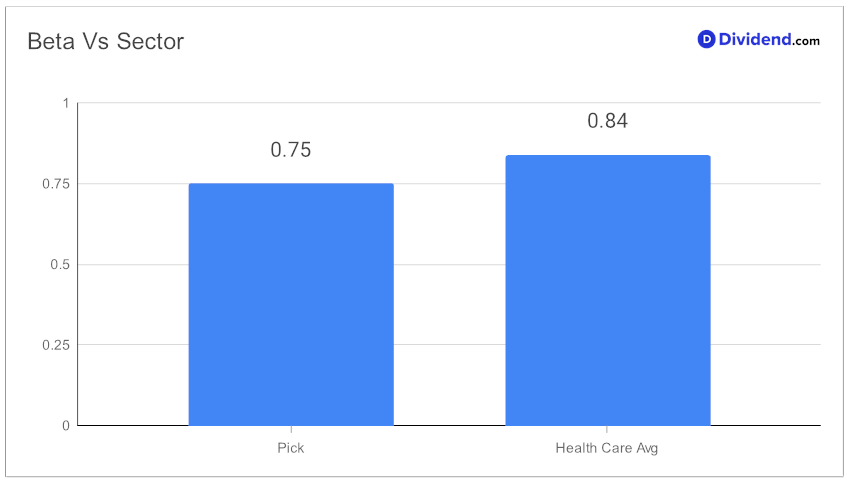

This stock represents an ideal blend of yield, safety, potential returns, and managed risk within the technology dividend space. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on November 2, 2023.

The upcoming in-depth analysis will delve deeper, exploring why this semiconductor giant is not just a current star but a promising option for future growth and stability in any balanced dividend portfolio.