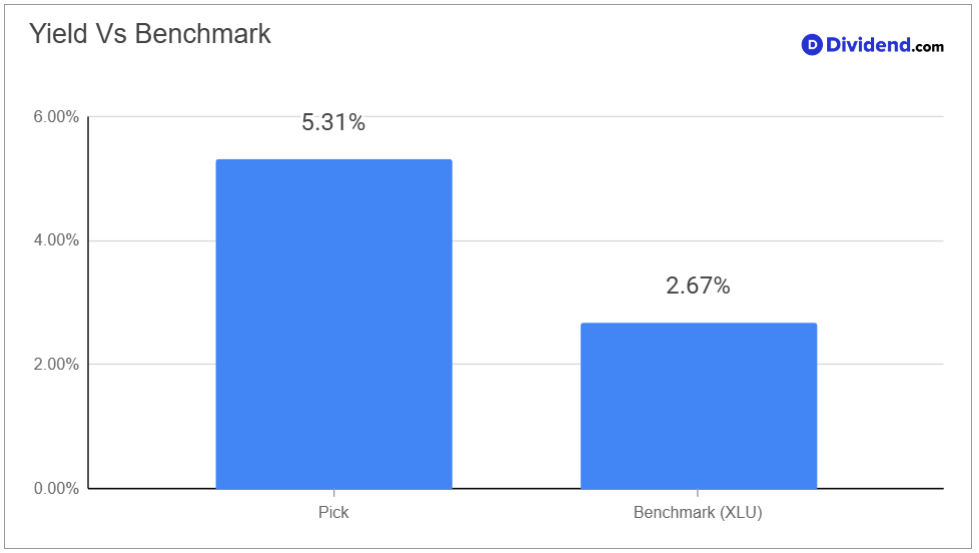

Dividend-focused investors seeking a high-yield, stable, and income-generating opportunity need look no further than this newly added utility stock in the Quality Dividends Portfolio. With an impressive forward yield of 5.31%—ranking in the top 20% of all dividend-paying stocks—this company exemplifies the balance of yield strength and dividend safety that income-oriented investors prioritize. Operating in the utilities sector, it plays a vital role in energy distribution and infrastructure, offering diversified solutions that include natural gas, propane, and electricity. Bolstered by a 30+ year track record of increasing dividends and a manageable 50% payout ratio, this stock offers the reliability and resilience essential for conservative portfolios.

Industry trends further amplify its appeal. As the global energy sector pivots toward cleaner and more sustainable solutions, this company is aligning its operations with the transition by expanding its renewable natural gas (RNG) and liquefied natural gas (LNG) projects. Its strategic focus on regulated utilities and midstream operations ensures a stable, fee-based revenue stream, making it well-suited for dividend-focused investors. However, like any investment, it does face risks, such as operational challenges in its propane business and weather-related demand fluctuations. Despite these headwinds, the company’s strong cost management and emphasis on infrastructure modernization position it for long-term growth.

The utility stock’s diversified revenue streams and defensive industry positioning make it a must-know for dividend investors. Dive into the full article to uncover why this stock earned a place in the portfolio and how it aligns with the broader goals of income stability, growth, and minimized risk.