We’ve all heard it over and over again – there’s no such thing as a “free lunch” on Wall Street, and while that may be a harsh reality, there are still dozens of things savvy investors can do to catch a break. Below, we offer a list of the most popular, as well as overlooked, financial tips that are aimed at either saving or making your more money.

1. Make Your IRA Contributions Early

Many of us wait until the end of the year–or even until the following April–to make the full IRA contribution. That’s a mistake; if possible, make the contributions early in the year to take full advantage of the tax benefits.

2. Replace Your Mutual Funds with ETFs

If you’re invested in mutual funds linked to any of the major benchmarks, whether it’s the S&P 500 Index or the Russell 2000, there’s no reason to pay more for identical exposure; make the switch to ETFs, which provide you with the same exposure and guarantee yourself higher returns thanks to the lower management fees.

Consider the table below which offers a glimpse as to how ETFs can help you save on investing costs, and thereby boost your returns over time; note that the table lists some of the most popular investment objectives, and also how much the ETFs and mutual funds that offer exposure to them cost (annual fees are listed in parentheses). One such ETF is IWM which tracks the previously mentioned Russell 2000.

| Investment Objective | ETF (Cost) | Mutual Fund (Cost) |

|---|---|---|

| Global Stocks | VT (0.18%) | VTWSX (0.30%) |

| Emerging Market Stocks | VWO (0.15%) | VEIEX (0.33%) |

| U.S. Bonds | AGG (0.08%) | VBMFX (0.20%) |

| International Bonds | BNDX (0.20%) | VTIBX (0.23%) |

| Commodities | DBC (0.93%) | PCRAX (1.19%) |

The cost difference between mutual funds and ETFs is further exemplified over a long-term investment horizon — Click Here for a visual representation of this.

3. Trade Commission-Free When You Can

There’s no shame in being a cheapskate when it comes to trading fees. Take advantage of new account signup promotions – online brokers are always boasting “50 free trades for first 90 days” or “100 free trades with $2,000 account minimum” promotions for example. If you can take advantage of free trading offers without burdening yourself with opening new and/or unnecessary accounts, do it.

For those that dabble in ETFs, this task is even simpler. Consult the Commission Free ETF List to get a better idea of what funds are available for commission-free trading on specific platforms.

The table below showcases the sheer number of ETFs available for commission-free trading on each of the most popular brokerage platforms:

| Trading Platform | Number of Comission-Free ETFs |

|---|---|

| Charles Schwab | 186 |

| Vanguard | 64 |

| TD Ameritrade | 101 |

| Fidelity | 83 |

| Interactive Brokers | 28 |

| Firstrade | 10 |

| E*TRADE | 82 |

4. Avoid Market Orders Like the Plague

It doesn’t matter if you’re buying stocks or ETFs, if you use market orders, you are virtually guaranteeing that you aren’t getting the best price because you are at the mercy of the sellers. Remember that every trade consists of a “bid” and an “ask” – this means you can often buy for less than ask, or likewise, sell for more than the bid.

Unless you’re absolutely adamant about acquiring a position right now, you’re better off placing a limit order somewhere inside the advertised bid-ask spread.

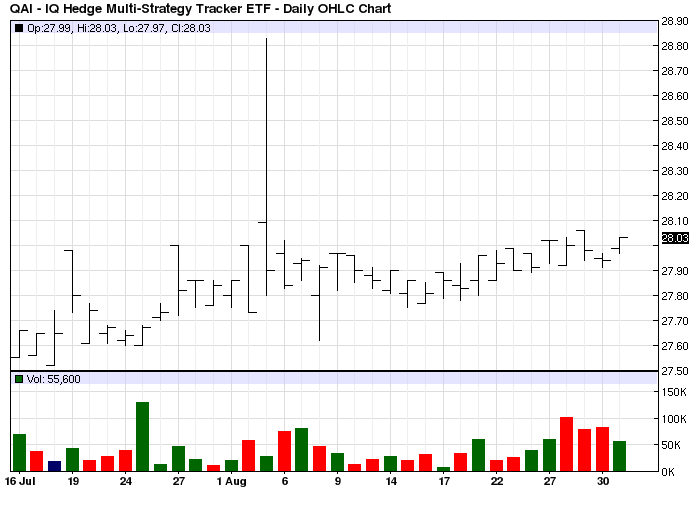

Consider the chart below which showcases how you can get burned by market orders; please note this example comes from the IQ Hedge Multi-Strategy Tracker ETF (QAI) during August in 2012.

Take note of the spike seen on 8/3/2012. In short, this spike is an example of a market order that ultimately burned someone seeing as how the price of the security soared temporarily, and then immediately retraced lower. In other words, a buyer overpaid for the security because they carelessly entered a market order, which left them at the mercy of the sellers at the time.

5. Stop Trying to Time the Market

What if you were a long-term investors who only took profits before major bear markets, and then bought back in at the bottom?

Now back to reality – no one is skilled (lucky) enough to consistently “buy the bottoms” and “call the tops” on Wall Street, and if they were, you’d likely have to pay them an arm and a leg to manage your money. The overwhelming majority of self-directed investors should not cloud their minds or their strategy books with market timing techniques, as they will likely incur unnecessary trading fees over time; countless studies demonstrate that “perfect timing” does not pay off as many would expect.

6. Contribute to Your 401(K) Plan

If your employer offers to match your contributions to your retirement plan, make sure you take them up on it; this is essentially “free money” that you’d otherwise be leaving on the table. Plain and simple, you should take full advantage of any company 401(k) match before you worry about contributing to your other retirement accounts like your IRA.

7. Rebalance with Taxes in Mind

Think first, sell later. It pays to plan out what positions you’re looking to get rid of, because any capital losses you might have could be used to offset gains you’ve accumulated elsewhere. Tax loss harvesting is a surefire way to improve the after-tax returns of your taxable investments.

8. Be Cheap

Unless you’re a seasoned active trader moving in and out of “round lots” (100 shares) of Apple (AAPL ) on a regular basis, there’s absolutely no reason for you to go beyond discount brokers. Going with a “discount” broker does not mean you are sacrificing quality of service or trade execution in today’s age of technology; in fact, you’ll likely have access to many of the same research tools as someone paying for a “top of the line” full-service broker.

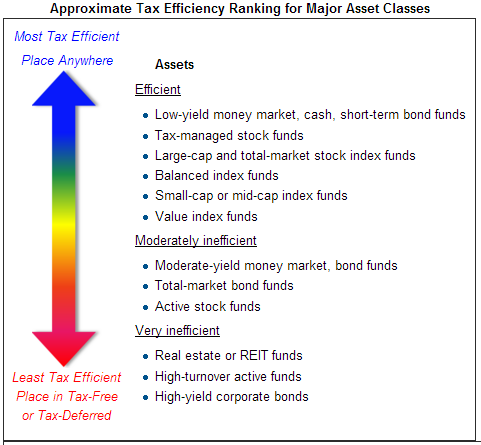

9. Shelter Your REITs

If you own any real estate investment trusts (REITs), make sure to hold those positions in a tax-advantaged account so you don’t incur taxes on the dividend income you earn through them. For young investors especially, keeping your REITs in a Roth IRA is a terrific way to maximize your retirement portfolio’s earnings potential over time, because you can effectively take advantage of “the power of compound returns” without the burden of taxable events.

Click on the image below for a more in-depth explanation regarding the different account types and what securities to hold in each one:

10. Put Your Cash to Work

It’s always prudent to have some extra cash lying around in your brokerage account in case a steep correction hits Wall Street and you want to add to your favorite, fundamentally-sound investments. With that being said, the cash in your brokerage account earns an ultra-paltry interest rate, which means you’re letting inflation slowly and surely eat it away.

Plain and simple, keep minimal amounts of cash in your non-interest bearing accounts. So where can you put that cash to work?

The table below list some popular alternatives to traditional cash accounts:

| Cash Account Alternatives |

|---|

| High-Interest Savings |

| High-Yield Certificate of Deposit (CD) |

| Short-Term Bond ETFs |

| Money Market ETFs |

| Inflation-Protected Bond ETFs (TIPS) |

11. Hold Longer When You Can

There’s no more surefire way to guarantee yourself a higher ROI than reducing the amount of taxes you will have to pay on a profitable trade. Avoid incurring short-term capital gains unless absolutely necessary; this means waiting at least one year before taking profits on an investment.

The table below showcases the significant difference between short-term and long-term capital gains tax rates:

| Your Income Tax Bracket | Short-Term Gains Tax Rate | Long-Term Gains Tax Rate |

|---|---|---|

| 10% | 10% | 0% |

| 15% | 15% | 0% |

| 25% | 25% | 15% |

| 28% | 28% | 15% |

| 33% | 33% | 15% |

| 35% | 35% | 15% |

| 39.60% | 39.60% | 20% |

As the table above reveals, you’re better off holding onto your investments for more than one year since you will ultimately incur far less taxes on any profit you may wish to take in the future.

Click here to learn more about taxes and be sure to also read A Brief History of Dividend Tax Rates.

12. Know Your Options

You can put your equity positions to work through the use of income-generating options strategies. While this may not be appropriate for many investors, taking the time to familiarize yourself with options can be a great way to not only increase your arsenal of strategies, but your portfolio returns as well.

13. Get a DRIP

Over a long-term horizon, you can make more money simply by harnessing the power of compound interest; dividend reinvestment plans (DRIPs) automate this entire process for little to no cost, and thereby warrant a closer look from every long-term income investor.

Learn more about Dividend Reinvestment Plans.

14. Avoid MLPs in Your IRA

If you own any master limited partnerships (MLPs), make sure to hold these investments in your brokerage account to avoid unforeseen tax nuances that are sometimes associated with having this type of security in a retirement account. MLPs can be a blessing to income-hungry investors and it’s important to remember that these securities are tax-advantaged to begin with, so be sure you understand the tax law around them before allocating capital.

15. Use All Tax-Advantaged Accounts at Your Disposal

Go beyond the traditional IRA, Roth, and 401(k) – there are a lot more tax-advantaged accounts out there than you might suspect. Savvy investors shouldn’t be hesitant to roll up their sleeves and get educated about everything from health care to education savings accounts if it could end up saving them some green down the line.

16. If You’re a Trader, Seek Shelter

Most people don’t fall into this category, but for those that actively manage their money, you might be better off moving your trading funds to a tax-sheltered account, like a traditional IRA or Roth; racking up a ton of short-term capital gains is a surefire way to deteriorate your trading margins and guarantee a smaller profit in absolute terms.

Keep in mind that you’re avoiding taxes at the expense of liquidity, since you can’t withdraw your tax-sheltered funds prior to retirement age without incurring a penalty fee.

17. Shelter Your TIPS

Treasury inflation protected bonds (TIPS) are meant to preserve your purchasing power, so be sure to shelter them from the tax man by keeping them in your 401(k) or IRA. You want to avoid paying taxes on the regular interest income earned from your TIPS because otherwise you will have a much, much harder time keeping pace with inflation.

18. Put Your Emergency Fund to Work

If you don’t already have an emergency fund, here’s how you can start to build one today. If you do have one, then make sure you’re putting that cash to work in a high-yield savings, money market account, or short-term CD; wherever you decide to park your “rainy day” funds, make sure you can easily withdraw them without incurring a penalty fee.

19. Find a Fee-Only Advisor

Many financial experts or planners accept commissions based on product sales – meaning that they benefit financially from selling you certain products (generally expensive mutual funds). Fee-only advisors don’t accept these fees, meaning they have fewer conflicts of interest and are less likely to park you in an expensive fund you don’t need. The National Association of Personal Financial Advisors is a good place to start your search.

If you’re looking for an advisor who won’t rip you off, we can personally recommend Portfolio Solutions; in addition to being ridiculously smart, their team is extremely focused on minimizing fees paid by clients.

20. Know (and Actually Use) Your Tax Breaks

You can make more money by keeping more money in your pocket after you pay the IRS. Take the time to educate yourself on any tax-related nuances that may pertain to you; there are countless overlooked tax deductions, so be sure to take advantage of every one that you can.

21. Avoid These Pitfalls

Unless you know something we don’t, for the most part, all of these should be avoided like the plague:

- Gold and silver coins (especially if seen on late night infomercial)

- Gold backed IRAs (especially if advertised as being “secure”)

- House flipping seminars (especially if seen advertised on a bench)

- Lottery tickets (especially if you live in New York)

- Reverse mortgages (especially if you’re retired)

- Programs that let you make $80 an hour working from home (especially if you hear about them in the comments section of ESPN.com)

- Penny stock newsletters (especially if the guy promoting them looks like a Sears appliance salesman)

- Buying a stock based on the opinion of someone on TV (especially if they’re described as an “expert”)

- Have more than 5% of your portfolio in your employer’s stock (especially if an “expert” on TV told you they’re bullish on it)

- Carrying a credit card balance (especially if it’s a card you signed up for at a department store)

- Extended warranties on your electronics (especially if you just throw away receipts anyways)

- Payday loans

- 401(K) Debit Cards (especially if you just got a payday loan from Montel Williams)

- Credit Insurance (especially if you have already racked up credit card debt)

- Rental Car Insurance (especially if you already have full coverage on one vehicle from your existing provider)

- Cash Value Life Insurance (especially if you already have other investments – this is akin to investing in a checking account)

- Private Mortgage Insurance (especially if you can afford a 20% down payment on your purchase)

- Accidental Death Insurance (especially if you’re a hypochondriac)

- Travel Insurance (especially if you already pay for life insurance)

The Bottom Line

There really is no free lunch on Wall Street. With that being said, there are still a number of creative ways for investors to boost their returns and ultimately grow their wealth over time. The above list is a great starting point for anyone who’s looking to take control of their personal finances.