Here at Dividend.com, we are dead set against the idea of company stock buybacks. That’s not just simple bias, though — read on to learn why buybacks are a colossal waste of company money and how investors are much better served with higher dividends.

The Drawbacks of Buybacks

Company buybacks occur when a company decides to repurchase shares of its stock either on the open market, or directly from shareholders in private transactions. Companies partake in share buybacks as a way of “investing” in their company with their excess cash flow. Many investors erroneously believe that share buybacks are somehow profitable to them, but in reality they are designed to benefit the corporation and its insiders — not shareholders.

Be sure to also read the 40 Things Every Dividend Investors Should Know About Dividend Investing.

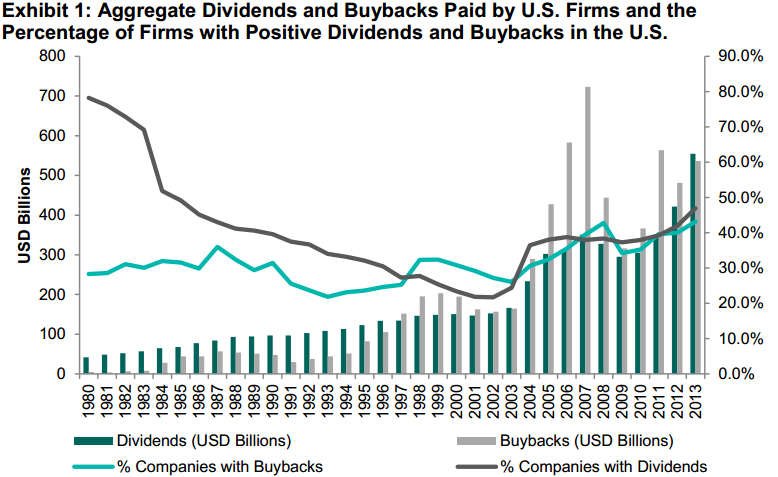

The graph below, compiled by S&P Dow Jones Indices, sheds light on how buybacks have truly accelerated over the last decade, even outpacing dividend distributions in some years:

EPS Numbers Too Low? Just Buy a Bunch of Shares

Buying back shares is a common technique to artificially increase earnings per share (EPS). This process helps the company meet or exceed analysts’ estimates, as well as the company’s own internal company targets. Share repurchases can also help temporarily keep a stock’s price afloat — not because the market believes the stock is of high quality, but simply because the company is throwing its own money at its own stock.

More Money for Insiders

Big surprise: hitting those EPS targets often results in hefty bonuses for executives. Also, companies often buy back shares directly from insiders looking to cash in on lucrative stock options. Finally, companies may even resort to buying back shares only to reissue them to employees as bonuses. “Borrowing from Peter to pay Paul” ring a bell?

Financial Risks Abound

Corporations can put themselves at substantial risk when buying back shares. Since buybacks are often seen as a one-off event, companies are willing to risk substantial sums on the practice. Additionally, what happens when a company buys back a bunch of shares before the stock falls significantly? That money floats up to a place we like to call “buyback heaven.”

See also A Dividend Investor’s Guide to Measuring Risk.

Company Pays Itself Instead of Shareholders

A public company is supposed to act in the best interest of its shareholders. Buybacks, on the other hand, are an artificial means to a financial end for insiders, and a crutch used to beef up a company’s per-share profits. These effects provide zero benefit to investors who used their hard-earned money to invest in a company.

Now here’s a novel idea: If a company is so averse to dividends for some reason, why not spend excess cash to expand operations? Maybe make a smart acquisition or two? Legitimately growing the company’s revenue and profits is always a welcome move for shareholders.

Dividends Are the Answer

Although some may think that a company paying dividends is a weakness, showing that the company needs to entice investors to invest in the company, dividend payments are much more profitable to investors than company buybacks are.

Be sure to also see the Top 10 Myths About Dividend Investing.

Confidence and Stability

When a company pays solid dividends, it shows the firm is confident in its future cash flows. The corporation is comfortable in its ability to afford ongoing payouts to shareholders. Unlike buybacks, which can start or stop at any time, most U.S.-based companies have a pretty firm dividend policy. The ongoing nature of dividends is another reason they rise above buybacks.

Let the Shareholders Buy Back Shares — If They So Choose

Dividends allow shareholders the opportunity to invest back into the company. Many long-term investors choose to automatically reinvest their dividends into additional company shares, and most major companies offer DRIPs to make this process easy. While shareholders have zero control over when company management decides to waste money on buybacks, dividends offer the flexibility of collecting cold, hard cash, or buying more company shares.

There are a lot of misunderstandings when it comes to dividend stocks; don’t invest for the wrong reasons, check out our guide to Myths and Facts About Dividend Investing.

Hands are Tied (In a Good Way)

Higher dividend payments prevent companies from retaining too much cash, which can then be wasted on foolish ventures like share repurchases and ill-conceived acquisitions. Instead, the company is focused on executing its business and keeping shareholders happy with steadily increasing dividends.

Dividends: The Ultimate Reward

What’s more attractive than owning an asset that pays you regularly simply for owning it? Dividends are a great “thank you” to shareholders and the single best way to attract a solid long-term investor base. This process decreases share price volatility, improves company visibility, and attracts all kinds of shareholders, from mom-and-pop investors to big-time fund managers.

The Bottom Line

Although many investors may think that buyback programs are benefiting them, intentions are often in favor of the company itself, and more specifically company insiders. Dividends on the other hand ensure direct payment to the shareholder, with much less risk than share buybacks. Any way you slice it, offering dividends is simply the right thing for the companies to do.