Dividend.com is constantly developing new and innovative tools to help income investors identify and execute on the top dividend-paying stocks.

The Most Watched Stocks List can be accessed in the Premium section, Dividend.com’s most popular membership plan. The list can be sorted by company name, stock symbol, DARS Rating, dividend yield and ex-dividend date.

In addition to the list of Most Watched Stocks, Premium members receive exclusive access to our ex-dividend date search, dividend screener, special dividend list, special dividend research reports, full dividend history and our proprietary DARS (Dividend Advantage Rating System).

The Most Watched Stocks List is jam-packed with features that can help dividend investors to better navigate the complex stock market and boost their portfolio earnings. The list brings five powerful features to the forefront, allowing investors to track their top stock picks seamlessly and effortlessly. Below is a brief recap of what you can expect to find when accessing the tool.

Watchlist

Dividend.com’s databases aggregate all the stocks being tracked by users in their watchlist tool. What came out of this was the motivation to let every Premium user know what their fellow dividend investors are tracking. Hence, the Most Watched Stocks List tool was born.

The Most Watched Stocks List has been designed to help income investors navigate the top dividend stocks being tracked by one of the world’s most advanced investing communities. The stocks are generated by our Premium members’ watchlists, giving you a real-time snapshot of buying interest in the market. The list is updated at the end of every week, helping investors identify dividend stocks that are moving up or down on investors’ radars. If you’re interested in the stocks that the dividend investing community is currently invested in, then the Most Watched Stocks List is your go-to guide.

The animated image below shows companies 16-20 on the watchlist for the week of March 13.

The watchlist tool has been designed to allow dividend investors to keep track of their favorite stocks through one easy-to-use interface. Premium members can directly add as many stocks to the watchlist as they need. Once inside the list, Premium members enjoy a complete rundown of vital stock information, such as yield and the next ex-dividend date.

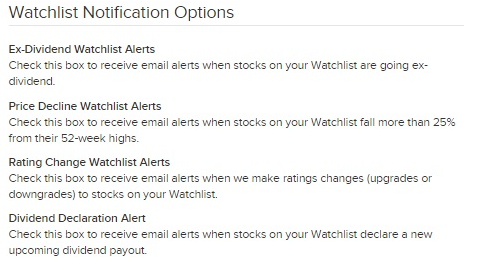

The watchlist also automates email alerts for every stock that is about to go ex-dividend, ensuring you have the right information to make your next move. Members can enable this by opting for notifications using the Edit Profile link. This link gives you access to several notification options, as seen below.

Once you’ve become a Premium member, you will have your very own access to a personal My Watchlist page, which allows you to manage stocks in your list by adding new names, deleting names and more. As a Premium member, you’ll also have the opportunity to check out Watchlist articles, which can help you get the most out of your portfolio strategy by adding narrative to your analysis.

Since longevity and consistency in dividend payouts are what every dividend investor wants, the watchlist is a potentially powerful tool for those looking to track investment opportunities over time. By going Premium, you can unlock the top 20 stocks that almost every dividend investor is currently holding. This could help you confirm your current position or force you to reassess your entire portfolio strategy.

Trend Feature

Every weekend, Dividend.com updates the Most Watched Stocks List by calculating the number of stocks that were added or removed by our universe of Premium members. Our algorithms track all the stocks that have been added or removed from each member’s watchlist, giving us a new tabulation of the Most Watched Stocks. A down arrow in the trend column denotes that investors have removed the stock from their watchlist on a net basis. An up arrow in the trend column indicates that investors have added the stock to their watchlist on a net basis.

Up and down arrows provide signals that help you identify what’s moving up or down on investors’ radars, so be sure to check the page every week.

ETF Exposure

Dividend.com understands that many income investors are also involved in exchange-traded funds (ETFs), a highly liquid financial asset that provides transparency, tax efficiency and exposure to diverse markets. That’s why every stock on the Most Watched Stock List has a column for ETF exposure. This column gives dividend investors information about which ETFs hold a significant stake in that particular stock. By clicking the link, users will be redirected to our sister website, ETFdb.com, for a full list of ETFs.

For example, investors interested in Southern Company (SO ) can click here to discover the ETFs with exposure to the company. The following table, taken from ETFdb.com, highlights all of the ETFs with exposure to SO.

DARS Rating

The Most Watched Stock List also has a column for the security’s DARS rating. Dividend.com’s proprietary Dividend Advantage Rating System (DARS) explains a security’s overall ranking based on relative strength, overall yield attractiveness, dividend reliability, dividend uptrend and earnings growth. Each of these factors is weighted on a five-point scale to determine the security’s overall DARS rating.

A higher DARS rating in the table and a high rank in the Most Watched Stocks List are a strong indication that you should consider purchasing that stock. Learn more about our DARS rating criteria, including how to interpret the data, here.

Export to Spreadsheet Option

Finally, Premium members have the option of downloading the entire list into spreadsheet format, which allows you to conduct custom analysis and comparisons over time. This option enables you to organize the weekly lists in tabular format where you can track the occurrence and ranking of your favorite dividend stocks.

The Bottom Line

Although the Most Watched Stocks List was only recently launched by Dividend.com, it has been years in the making. It provides a completely unbiased look at investors’ favorite dividend-paying stocks, giving you a reliable barometer in which to compare the companies moving in and out of our members’ portfolios.

To keep track of the latest dividend news and analysis, subscribe to our free newsletter.