Using a company’s dividend history to determine the intrinsic value of its stock is a common method used by investors and analysts. By calculating the present value of future dividend payments, this valuation method provides a fairly accurate indication of whether a stock is under- or overvalued.

Depending on a given stock’s dividend history and projected future dividend payments, different dividend discount models may be used. The Gordon Growth Model is the simplest of these formulas, but does not account for any change in dividend growth over time. To account for slightly more volatile dividend activity, the two-stage dividend discount model can be used instead.

What Is the Two-Stage Model?

The two-stage dividend discount model comprises two parts and assumes that dividends will go through two stages of growth. In the first stage, the dividend grows by a constant rate for a set amount of time. In the second, the dividend is assumed to grow at a different rate for the remainder of the company’s life. In this way, the second part of the two-stage model is basically identical to the Gordon Growth Model, so a firm grasp of the more basic formula will help you to better understand the two-stage model and other, more complex, formulas.

The two-stage model is often used to determine the intrinsic value of a stock issued by a company that is undergoing rapid expansion. Newer companies that have proven their staying power but are still in their initial stage of rapid growth are good candidates for this valuation method. The first stage of two-stage dividend growth is generally assumed to be quite aggressive, reflecting the company’s swift expansion, while the second stage assumes a lower, more sustainable rate of dividend growth.

Discount Models and the Time Value of Money

When using projected dividend activity to determine the value of a stock, analysts use discount models because they account for the time value of money by using a required rate of return, or discount rate, to determine the present value of future dividend payments.

The time value of money simply refers to the fact that a dollar earned tomorrow is worth less than a dollar earned today because a dollar earned today could be invested and generate interest. The further down the road a payment is received, the less it is worth in the current moment.

This adjustment to the current value of future income is accomplished through the use of the discount rate. Discount rate, interest rate, and required rate of return are all synonyms for the amount of income an investor either expects to receive or is trying to generate, depending on the scenario, expressed as a percentage of the initial investment.

To earn $1,100 in one year at an interest rate of 10%, for example, you only need to invest $1,000 today. The present value of $1,100 at a discount rate of 10%, therefore, is $1,000.

Two-Stage Dividend Discount Model Formula

Like its predecessor, the Gordon Growth Model, the two-stage dividend discount model requires very little information to calculate. All that is needed is the anticipated dividend payment one year from the current date, the required rate of return, and the anticipated dividend growth rates.

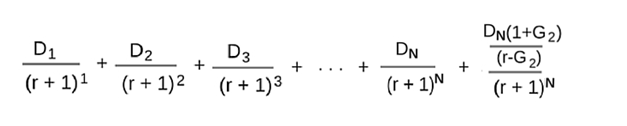

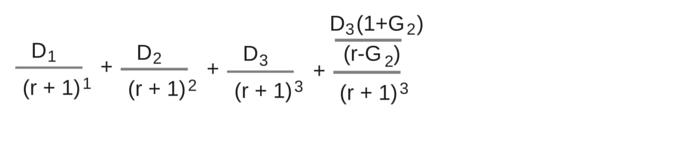

Though this formula seems intimidating, it is actually quite simple once all the variables are in place. In this case, D1 is the dividend to be paid one year from now and G2 is the dividend growth rate for stage two. The variable r represents the discount rate or expected rate of return, which remains constant. Finally, N represents the number of years the first dividend growth rate covers.

Example

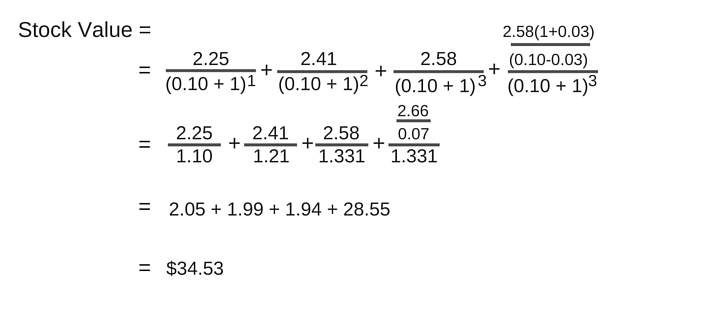

As discussed in the article on the Gordon Growth Model, Procter & Gamble (PG ) has paid consistent quarterly dividends for years. However, its dividend growth slowed in the 2015 fiscal year, making a one-stage dividend discount model unsuitable for accurate valuation. This example will use P&G’s 7% dividend growth rate for 2011-2014 in the first part of the formula and the 2015 growth rate of 3% as the projected future rate for the second stage. The result will be an estimate of the true value of P&G stock in 2011 based on its ‘projected’ dividend growth and a required rate of return of 10%.

The first step of this calculation is to determine the values of the first three dividend payments made between 2012 and 2014, based on the 2011 payment of $2.104 per share and a growth rate of 7%.

- D1 = $2.10 * 1.07 = $2.25

- D2 = $2.25 * 1.07 = $2.41

- D3 = $2.41 * 1.07 = $2.58

Since the values of the first three dividends have already been calculated, all that is needed to break down the steps of this equation is to determine the present value of all future dividends at the 3% growth rate. First, calculate the value of the dividend to be paid in 2015 based on the second-stage growth rate of 3%.

- D4 = $2.58 * 1.03 = $2.66

Now, using the Gordon Growth Model, calculate the value of all future dividends paid after 2015 based on the stable 3% rate.

- VDFuture = D4 / (r – G2)

- VDFuture = $2.66 / (0.10 – 0.03) = $38

Finally, calculate the present value of all future dividends by discounting each dividend value using the required rate of return and the power of compounding.

- PVD2012 = $2.25 / 1.101 = $2.05

- PVD2013 = $2.41 / 1.102 = $1.99

- PVD2014 = $2.58 / 1.103 = $1.94

- PVDFuture = $38 / 1.103 = $28.55

Sum the present values of all dividends to render the intrinsic value of P&G’s stock in 2011 based on the projected dividend growth rates of 7% and 3%.

- Stock Value = $2.05 + $1.99 +$1.94 + $28.55= $34.53

Interpretation

While this example follows the actual dividend activity of P&G, the results do not align with the stock’s actual market value in 2011. In fact, throughout 2011 the value of this stock stayed above $60 per share, nearly doubling this model’s estimate in December. An analyst employing the two-stage method anticipating a drop in dividend growth would have considered the stock to be considerably overvalued.

This indicates that analysts at the time may have been employing a more simplistic dividend discount model, like the Gordon Growth Model, that assumed the company’s previously healthy dividend growth rate would remain stable. The sudden drop in dividend growth in 2015 may have come as a surprise to many investors who assumed dividends would continue to increase by about 7% each year. The stock has taken a substantial tumble since the dividend reduction, reflecting investors’ wavering confidence in its profitability.

Benefits and Drawbacks

While the two-stage dividend discount model can provide a more accurate valuation than simpler formulas, it does inherit some disadvantages from its single-rate predecessor, the Gordon Growth Model. Firstly, both models assume constant rates of growth, which is rarely an accurate representation of dividend growth. Though the two-stage model does account for multiple growth rates, it assumes that the switch happens over night, rather than accounting for a gradual decline between the first, more aggressive growth rate, and the stable growth rate in the second stage.

Another drawback shared by all dividend models is that they do not account for outside factors that influence stock prices, such as public sentiment or company innovations. These valuations are based solely on dividend payments and do not provide a comprehensive reflection of the true value of a stock.

Check out the Three-Stage Dividend Model, the H-Model and the Dividend Discount Model.

Image courtesy of Gualberto107 at FreeDigitalPhotos.net