Prudent income investors know the importance of a reliable payout track record; after all, the power of compounding returns requires a long-term horizon as well as consistent annual dividend increases. There are, however, dozens of companies out there that might warrant a closer look, but simply do not get onto the radar screens of more conservative investors.

We’re talking about fundamentally-sound, dividend paying stocks that have only recently started to pay out a distribution, which means their payout track record is simply not old enough yet to qualify them for inclusion in the 10-Year or 25-Year Dividend Increasing Stocks [see also: The Biggest Dividend Stock Collapses of All Time].

As such, below we look to investigate one of the age-old questions in the income investing world; that is, what happens when stocks announce dividends? We will take a look at four companies and highlight how their stock initially reacted on the day that the dividend announcements were originally made, as well as their performance one year after the first dividend was actually paid out.

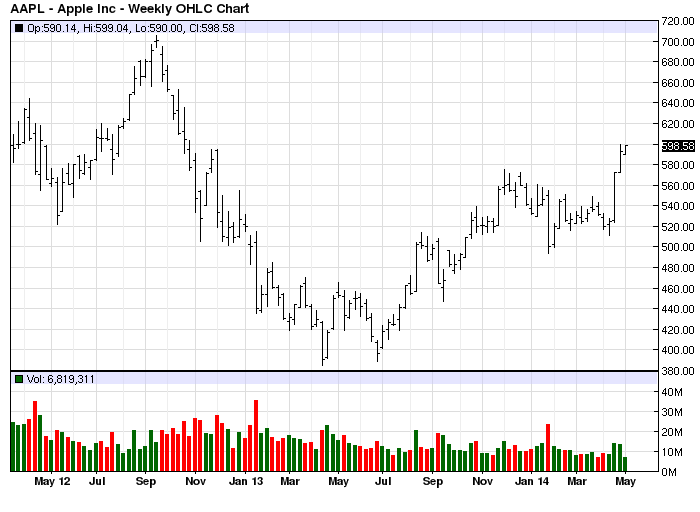

Apple {% dividend aapl %}

| Dividend Announcement | Initial Reaction | First Distribution | One-Year Later |

|---|---|---|---|

| 3/19/2012 | +2.65% | 8/16/2012 | -21.06% |

Shares of Apple opened higher on the morning of March 19th, 2012, after the company issued a press release detailing plans to initiate a quarterly dividend and a share repurchase program. The fact that shares had a fairly muted reaction to the Apple dividend announcement makes sense when we consider it in context; prior to the announcement on March 19th, shares of Apple had been sitting on a year-to-date gain of nearly 45%, which explains why many were hesitant to jump in long even in light of the good news [see Apple’s Worst Day Ever].

In retrospect, the first distribution payment came at a time when the stock had already enjoyed a stellar uptrend; shares of Apple continued to climb as high as $705.07 a share on 9/21/2012 only to give into heavy profit taking pressures over the following year as investors battled to cope with Apple’s transition from a higher-flying growth stock to a mega-cap value play [see also: Dividends in Focus: Industry Leaders]

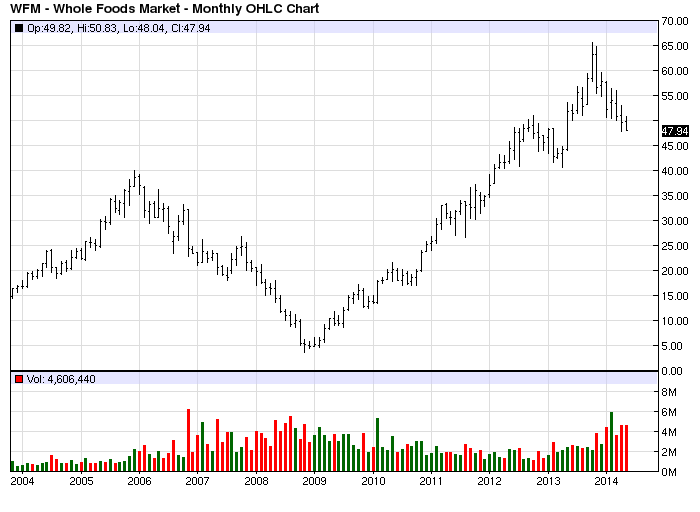

Whole Foods Market {% dividend wfm %}

| Dividend Announcement | Initial Reaction | First Distribution | One-Year Later |

|---|---|---|---|

| 11/12/2003 | -2.13% | 1/16/2004 | +39.47% |

Shares of Whole Foods opened lower on the day that its board members announced they would start paying a dividend; the surprisingly negative initial reaction was quickly overturned when the stock rallied over 10% the following day on November 13th, 2003. The stock had been trading sideways and was only up about 13% year-to-date prior to the dividend announcement in mid-November of 2003, which could explain why it had an easier time sustaining bullish momentum over the next year.

In retrospect, the dividend announcement spurred buying activity for the organic grocer, but the stock peaked soon thereafter at the end of 2005 and proceeded to decline for the next three years in a row until finding a bottom just below $5 a share in early 2009.

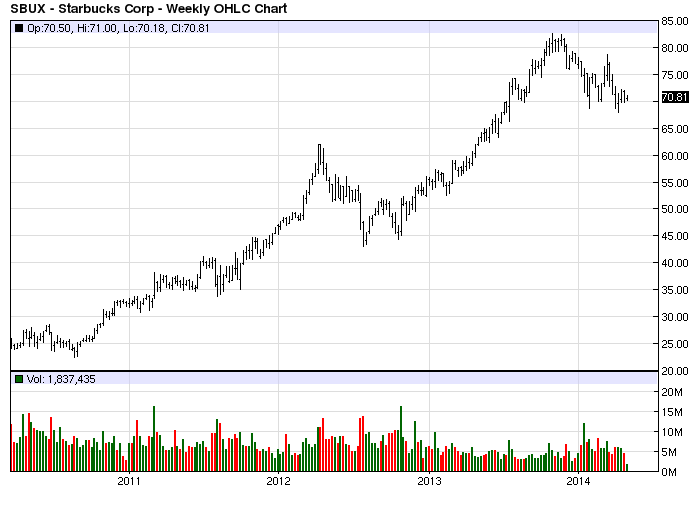

Starbucks {% dividend sbux %}

| Dividend Announcement | Initial Reaction | First Distribution | One-Year Later |

|---|---|---|---|

| 3/24/2010 | -0.47% | 4/23/2010 | +35.25% |

Shares of Starbucks opened lower on the day that company officials announced the firm would initiate a distribution to shareholders following years of reinvesting profits; the initial negative reaction persisted and the stock proceeded to lose another 4.3% the following day on March 25th, 2010. The stock traded sideways for the next couple of months until breaking out higher in November as investors digested news of the distribution and evaluated how the company would transition from a hot growth stock to a stable dividend-payer [see also Best Global Brands That Pay Dividends].

Ultimately, the transition from a growth stock to a big name dividend-payer was well received by the market, as evidenced by Starbucks’ impressive gains in the year following its first dividend payment; furthermore, the company has been raising dividends every year since paying out its first one in 2010.

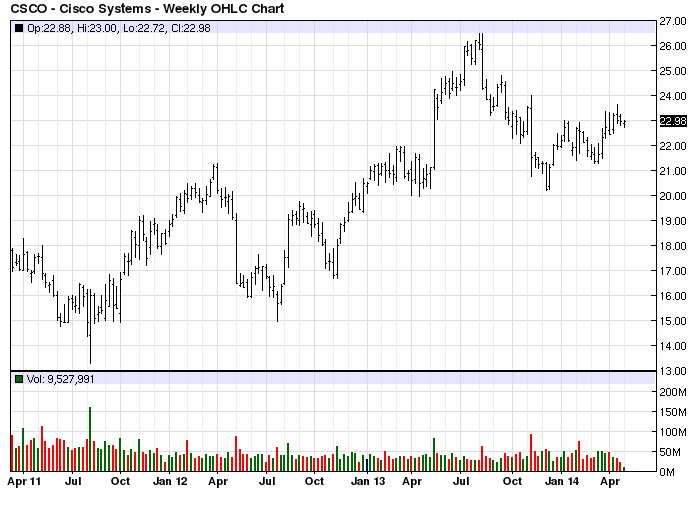

Cisco Systems {% dividend csco %}

| Dividend Announcement | Initial Reaction | First Distribution | One-Year Later |

|---|---|---|---|

| 3/18/2011 | +0.82% | 4/20/2011 | +17.60% |

Shares of Cisco inched slightly higher after the computer networking giant announced it would start to pay a dividend. Despite the upbeat announcement and positive initial reaction, bearish pressures reigned supreme and the stock proceeded to sink another 18% following the announcement date until finally finding a bottom in early August of that same year. Over the next year, Cisco managed to turn in a solid 17% gain, but this came with much volatility along the way; at the end of 2012, the stock was only up about 8%, compared to the S&P 500, which gained 13% that same year. For more information, check out The Nasdaq: A Dividend Overview.

The Bottom Line

At first thought, many would suspect that dividend announcements lead to very positive returns for the stock in the near-term, seeing as how the news should be welcomed by existing and prospective shareholders. However, the examples highlighted above reveal that this isn’t always the case.

Among other things, investors must consider the stock’s return and investors’ sentiment regarding the company prior to a dividend announcement in an effort to better gauge the potential reaction; for example, a dividend announcement may have a vastly different impact on a company that has been enjoying a steep rally for the past few months compared to a security that has been lagging or even falling.