When going through a firm’s dividend policy, we often find the upper band and the lower band between which the company aims to maintain its dividend payout ratio. A company’s target payout ratio is usually in line with the earnings they are expected to generate and the target that companies within that industry are gunning for.

Utilities generally have a higher payout ratio than other industries. Utilities on average have maintained a target payout ratio of close to 60%, while technology, as an industry, has maintained a payout ratio of close to 35%, which is gradually rising.

Payout ratio targets given by companies are publicly-available information. One can estimate the dividends going forward by looking at the target payout ratio and comparing that to their current payouts.

Example

Consider the example of this small cap electric utilities provider IDACorp (IDA ). In their annual report, you can find the following information regarding their target payout ratio:

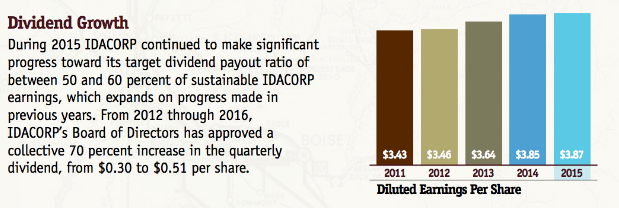

IDACorp’s payout ratio based on 2016’s estimate comes in at 52.48%. Its dividend per share is $2.04 and its earnings per share estimate for 2016 is $3.89. IDACorp was added to our Best Dividend Stocks list on June 17, 2016 and has since given a price appreciation of 8.44% as of writing this article.

One of our key motivating factors in adding this stock to the Best Dividend Stocks list is the stocks payout ratio of 52%, which is well below the company’s target range of 50-60% as per the company’s statement. It gives us confidence that this utilities company would continue to raise dividends in order to meet their payout targets.

What bolstered our confidence more when we added this stock was its expected earnings growth in 2017. The company is expected to give an earnings growth of 3.34% in 2017 – and based on the share price when it was added, the stock only traded at 18.5 P/E – which is exceptional given that utilities are trending and the company has such a strong payout history.

Another report in the company’s annual report explains how the target payout ratio can affect a company’s dividend growth. IDACorp’s Board of Directors has approved a collective 70% increase in quarterly dividend from $0.30 to $0.51 just so they can achieve their target payout ratios of 50% to 60%.

What Is a Good Payout Ratio?

A target of 50% to 60% is right in the sweet spot for dividend investors looking for companies that have a good mix of earnings retention and dividend payouts. A mid-50% payout ratio signals positive intent from the company to declare dividend payouts and also retain to grow. Target payout ratios vary by industry. A payout ratio that’s slightly less than the industry average is always preferred. Utilities, historically, have had the highest payout ratios compared to all other industries.

Payout Ratios by Industry

The above data from dividend.com reveals utilities have the highest payout ratios at 65%, compared to the universal average of 35%. Target payout ratios should always be compared to the industry they operate in. If IDACorp’s Board of Directors had declared a target payout ratio of 40% to 50%, and if their payout ratio was at the lower band of the range, then it wouldn’t have made sense to recommend this stock because even though there is room for the dividend to grow based upon their target, they are well below the industry average of 65%.

The Bottom Line

Target payout ratios are just one of the five parameters we use to rate stocks. Relative strength, earnings growth for next year, the valuation of the company and the yield attractiveness are the other four. When all these factors are combined to rate stocks, it results in a potent combination of powerful dividend payers that display solid price performance along with a consistent dividend payout.

To learn the basics about the dividend payout ratio, read our article The Truth About the Dividend Payout Ratio. You can also read on negative payout ratios and the ideal payout ratio for more information.