One of the most innovative features of Dividend.com happens to be our flagship Dividend Advantage Rating System, or DARS for short. DARS is a one-of-a-kind ranking system that helps investors to identify the winners and the losers among many dividend-paying equities. It uses a proprietary screening methodology and logic to rank more than 2,500 individual dividend-paying tickers. The service is available only to premium members.

Currently, there are more than 7,000 tickers available for research on Dividend.com. Not every stock, fund or security will receive a DARS rating or rank position.

The reason is quite simple. DARS uses a series of key metrics – Dividend Reliability, Dividend Uptrend, Yield Attractiveness, Earnings Growth and Relative Strength – to provide the fodder necessary for scoring. Put simply, to earn a rating, a security must be able to realize a score on all five metrics. You may be wondering what exactly are the five metrics, how do they fit in our DARS Model and, perhaps more importantly, what kind of securities will the rating system track? Read on to find out.

Focusing on DARS

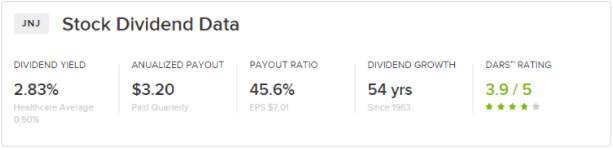

When you input a ticker for a stock or other income-producing security on Dividend.com’s homepage – in this case, we are using Johnson & Johnson (JNJ ) – you are redirected to its individual ticker page. On that page, near the top, you should see a box containing five different dividend metrics. This data includes the current dollar amount of annualized dividends as well as the securities dividend yield. A securities dividend yield is the dividend amount expressed as a percentage of a current share price. You’ll also get the number of consecutive years that a security has grown their dividend payment and their payout ratio. The last column in that box will represent the security’s possible DARS score. It’s this last column that we will be talking about today.

As explained in the opening, not every stock, closed-end fund, exchange-traded fund (ETFs) or other security types will see a DARS rating. It takes the five specific metrics that go into that score. Each of those five parameters (Dividend Reliability, Dividend Uptrend, Yield Attractiveness, Earnings Growth and Relative Strength) is weighted equally at 20% to give the overall DARS score. Understanding what these metrics are is critical to understanding why we can rate some securities on our DARS model and not others.

- Relative Strength: Momentum, it’s what makes the stock market go around. In our model, we’re talking about changes above or below an income securities 52-week high. Price action is one of the main contributors to overall total return, which is what the DARS model is trying to provide. Dividends are wonderful, but if a security sees its share price drop below a certain point, all the dividends in the world can’t make it worthy or profitable of an investment. By looking at relative strength, the model hopes to avoid dividend traps and instead focus on those stocks that will provide capital gains and dividends.

- Earnings Growth: Profits and dividends go hand in hand. Without continuously rising profits, you really can’t have any gains in income, at least not over the long term. In this case, we are looking at earnings growth estimates for the next financial year compared to annualized estimates for the current fiscal year. With that in mind, our DARS model will look at a firm’s projected earnings growth to find those securities with sustainable rates of profit increases. Since the overall objective of DARS is dividends, we rank modest-growth companies higher than every other company.

- Yield Attractiveness: The assumption from most investors is that a higher yield is always better. However, that is not always the case. A lower yield could be better regarding overall returns. Too high of a yield can signal trouble about a company or individual security. The underlying share price may have fallen too far because of company-based factors, and now the yield is high. A very high yield could also signal that a firm has run out of growth prospects and is now pushing excess cash out the door to attract/reward investors. Too small of a yield can also be an issue. It can signal that management doesn’t care about its shareholders. With that in mind, our DARS model defines a healthy yield that’s usually slightly above the yields of broader market benchmarks like the S&P 500 yield or the Dow Jones Industrial Average.

- Dividend Reliability: When looking at the reliability of a security’s future dividends, our DARS model will calculate a firm’s payout ratio. Dividend.com uses a forward-looking payout ratio rather than a trailing one. In this case, it’s the annualized dividend divided by the annualized earnings per share estimate. That payout ratio is essentially how much profit a security will return to investors as dividends. So a payout ratio of 55% means that for every $1 in profit, 55 cents will be handed back as dividends. The DARS model will put a premium on those securities with midpoint pay ratios that are not too high or too low. This midpoint reading indicates the potential for dividend increases and is not an overreaching scenario for a stock.

- Dividend Uptrend: The final metric that goes into the DARS model is its price-to-earnings (P/E) ratios. A lot can be discerned from looking at a security’s P/E. Regarding dividends, it helps to determine how investors are “valuing” the stock. Whether that be value, value+ income, growth, etc. Those stocks with the best propensity to pay dividends and to see capital appreciation tend to have lower, but not too low, P/Es.

What Can and What Can’t Be Rated

With some basic knowledge of all the parameters of DARS, we can now see why only some of the thousands of tickers on Dividend.com can be ranked by the model. Below is a table of all the security types that are currently on Dividend.com. This list includes everything from common stocks and ADRs to more elaborate fare like ETFs and convertible bonds. On the chart, we see what can and what can’t get ranked. The common thread in all of this is that to get a DARS rating, a security has to be able to score on all five metrics. Let’s look at that more closely.

| Security Type | Example | Relative Strength (% Change From 52-Week High) | Dividend Uptrend (Price/Earnings Ratio) | Yield Attractiveness (Dividend Yield in %) | Earnings Growth (Next Financial Year over Current Financial Year) | Dividend Reliability (Payout Ratio) | Rated |

|---|---|---|---|---|---|---|---|

| Common Stock - Non-Dividend Paying | (GOOG) | ✓ | ✓ | ✓ | ✓ | ✓ | Yes |

| Common Stock - Dividend Paying | (KO ) | ✓ | ✓ | ✓ | ✓ | ✓ | Yes |

| Common Stock - ADR | (UL ) | ✓ | ✓ | ✓ | ✓ | ✓ | Yes |

| Common Stock - MLPs | (BPL ) | ✓ | ✓ | ✓ | ✓ | ✓ | Yes |

| Common Stock - REITs | (PSB ) | ✓ | ✓ | ✓ | ✓ | ✓ | Yes |

| Preferred Stock | Liquid error: internal | ✓ | ✓ | ✓ | ✓ | ✓ | No |

| ETFs | (IEMG ) | ✓ | ✓ | ✓ | No | ||

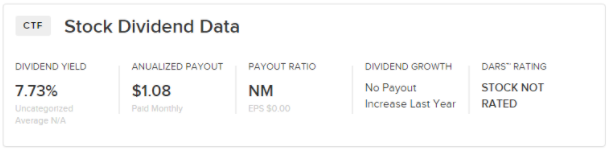

| Closed-End Funds | (CTF) | ✓ | ✓ | ✓ | No | ||

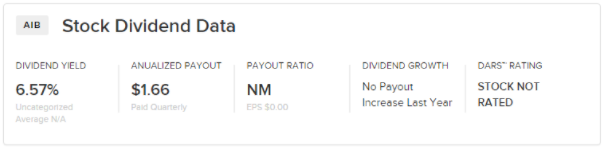

| Notes/Exchange-Traded Debt | (AIB ) | ✓ | ✓ | ✓ | ✓ | No | |

| Debentures | (DTQ) | ✓ | ✓ | No | |||

| Stocks Elected to Trade as Closed-end Funds | (OHAI) | ✓ | ✓ | ✓ | No | ||

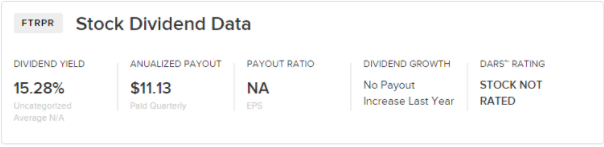

| Convertible Securities | (FTRPR) | No | |||||

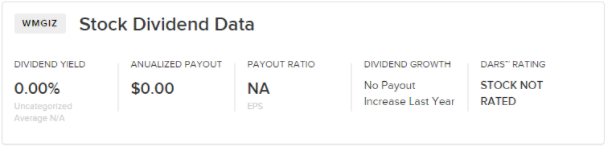

| Contingent Value Right | (WMGIZ) | No |

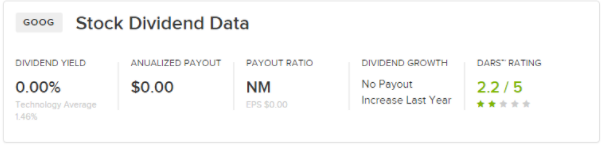

Common Stocks – Non-Dividend Paying

Alphabet Inc (GOOG) is a prime example of common dividend stock that does not pay a dividend. However, GOOG can still be ranked by our system. The tech giant has a P/E and forward earnings estimates. Its stock trades and has momentum/relative strength scores. And even though Alphabet doesn’t pay a dividend, it still technically has a payout ratio and dividend yield. In this case, both are zero. That’s all five metrics. As a result, GOOG can be rated by our DARS model. However, lacking two of the five parameters, Google doesn’t necessarily score very high on the system for dividend investors. But it can be ranked nonetheless.

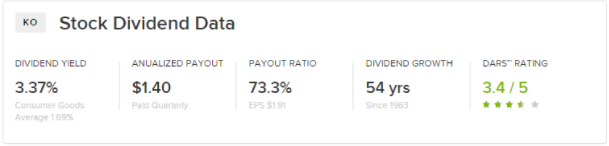

Common Stock – Dividend Paying

There shouldn’t be any surprises here but shares of a common stock like Coca-Cola (KO ) that pays dividends will have all five DARS metrics. We can quickly figure out payout ratios and yield information for common stocks like Coke as well as earnings, momentum and P/E ratios. Common dividend-paying stocks form the backbone of the DARS model and our ratings.

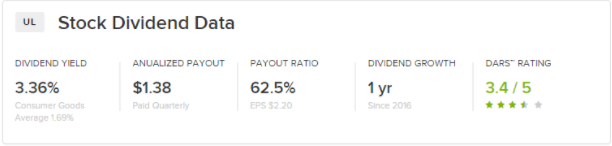

Common Stock – ADR

American Depository Receipts (ADR) may sound fancy but, in reality, they are just shares of foreign stocks that trade on American exchanges. Our example, Unilever (UL ), is structurally no different than GOOG or KO. It has a P/E, momentum, dividend yield, etc. Under that guise, ADRs – dividend paying or not – are able to be rated via the DARS model. They have all the necessary metrics to do so.

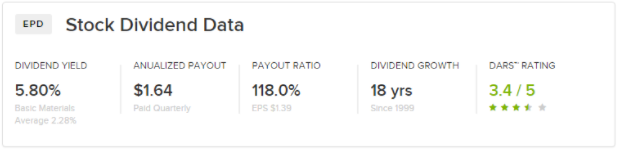

Master Limited Partnerships (MLPs)

While technically not stocks, but units in a partnership, MLPs will function much the same way in our DARS model. An MLP like Enterprise Product Partners (EPD ) meets all five requirements. It has yield, earnings, P/E ratios etc. and therefore, it can be ranked on the model. However, the caveat is to remember that their high payout ratios and yields are more of a function of their tax structure, rather than the underlying health of the firm. MLPs are gauged on cash flows available for distribution rather than profits/earnings. Even so, our DARS model can rank them. But additional due diligence may be required.

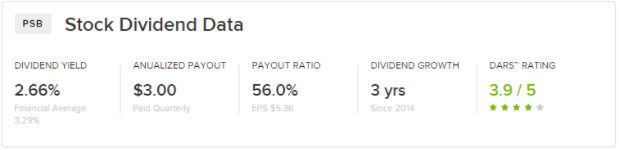

Common Stock – REITS

Despite being pass-through entities, real estate investment trusts (REITs) can be included in the DARS model for ratings. A REIT such as PS Business Parks (PSB ) will include all five metrics for the system. However, there is one quirk to REITs when it comes to dividend uptrend scores. As cash flow businesses, REITs don’t use this metric. Instead, they use Price to Funds-from-Operations (FFO). P/FFO is how much investors are willing to pay for a dollar’s worth of cash flow. It functions in much the same manner as P/Es . By using that metric, a REIT like PSB is ratable under DARS.

Preferred Stocks

These quirky half-bond/half-stock shares are not rateable in our DARS model. Technically, preferred stocks such as Deutsche Bank Capital Funding Trust VIII 6.375% Liquid error: internal have all five parameters. They are tradable, have relative strength scores, are considered equity, etc. However, because they are callable at a certain point and feature static dividend payouts, our model does not include them for ranking. It’s not exactly an apples-to-apples comparison when looking at them and common stocks. As such, preferreds will not feature a DARS score.

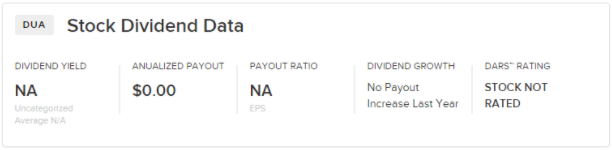

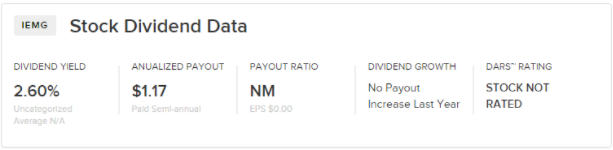

Exchange-Traded Funds (ETFs)

Despite being the hottest fund type currently on the market, ETFs are not ranked by our DARS model. The reason is that they are missing two key elements: a price-to-earnings ratio and earnings growth figures. While these items do exist for the stocks inside the ETF, the fund itself doesn’t have them.The popular iShares Core MSCI Emerging Markets ETF (IEMG ) as an entity is missing those key elements. As a result, we don’t have a dividend uptrend or an earnings growth score. Secondly, not all ETFs on Dividend.com track stocks. Many are bond oriented. That again eliminates ETFs from the scoring system.

Closed-End Funds (CEFs) and Stocks Elected to Trade as CEFs

Arguably the most quirky security used by income investors, closed-end funds (CEF) have a fixed number of shares but trade on the main exchanges. As a result, their values change based on supply and demand. CEFs have two values. One is their net-asset value or what the underlying assets are worth and the other is their market value or what investors are paying for those assets. A CEF like the Nuveen Long/Short Commodity Total (CTF) can trade at premiums or discount to its NAV. While some of the metrics are there such as the yield on share price, others such as Dividend Uptrend or Earnings Growth can’t be determined. Because of that, our DARS model can’t assign a rating to CEFs.

Exchange-Traded Debts/Debentures

There are plenty of other exchange-traded debts and IOUs that income investors can come into contact with on Dividend.com. Exchange-traded bonds like the Apollo Investment Corporation 6.625% Senior Notes Due 2042 (AIB ) or DTE Energy Company 2012 Series C 5.25% Junior Subordinate Debentures due December 1, 2062 (DTQ) have several of the metrics needed for a DARS scoring. However, as debt, they are missing one vital piece of the pie: earnings. Since they are not in and of themselves actual companies, they don’t have profits and, therefore, no P/E or earnings growth. As a result, we cannot rate them in the model.

Convertible Securities

While convertible securities such as the Frontier Communications Corporation 11.125% Series A Mandatory Convertible Preferred Stock (FTRPR) are similar to preferred stocks, they are technically bonds and not a kind of equity. That is until they are converted into shares of the underlying stock. As a result, convertible bonds don’t have earnings, P/E ratios, relative strength scores, payout ratios, etc. The only thing they do have is a dividend yield. But one metric is not enough to have a DARS ranking.

Contingent Value Right/Warrants

Finally, the last kind of security on Dividend.com is what’s called a Contingent Value Right (CVR). The easiest way to think of these derivatives is an option to buy a stock later at a certain price. So if you wanted to buy Wright Medical Group for a certain price later on, you could instead buy Wright Medical Group N.V. Contingent Value Right (WMGIZ).

Often, they are issued by firms as a way to raise money ahead of a buyout or other massive CAPEX expansion. Junior gold miners and other resource companies are often large issuers of warrants. As are smaller biotech firms. As “rights to buy” they don’t come with any standard stock metrics. There are no earnings associated with the warrant; no P/E, no dividend payout ratio. And given that they expire and have no yield or claims to cash flows/profits, our DARS model cannot and will not rank these securities. However, the underlying stocks they represent could be rated in DARS.

In the end, the overarching theme for investors looking at our DARS model is that to obtain a rating, a security has to be able to have a score in all five metrics. The rules-based logic and mathematical formula behind the rating system needs all the inputs – even if they are zero – in order to generate a score. With even one of these parameters, we still can’t give it a DARS rating.

The Bottom Line

There are over 7,000 tickers investors can currently explore on dividend.com. However, only about 2,500 have a Dividend Advantage Rating System score. That’s because not all securities or asset types will meet the requirements for rating. It takes all five metrics – Dividend Reliability, Dividend Uptrend, Yield Attractiveness, Earnings Growth and Relative Strength – to see a DARS score on a security’s individual ticker page.