Dividend investing is all about numbers. Your ability to interpret them will dictate your success in developing a sound investment portfolio that is profitable over the long term.

Dividend.com provides a snapshot of vital dividend information on more than 7,000 ticker pages, allowing investors to determine if a security meets their portfolio needs. As the following example demonstrates, this vital information includes dividend yield, annualized payout, payout ratio, dividend growth and the DARS Rating.

DARS, or the Dividend Advantage Rating System, is an innovative feature provided by Dividend.com. To learn more about this powerful formula, check out a recent article by Aaron Levitt: Why Doesn’t DARS Rate Every Stock?

The focus of this article is the dividend payout ratio. Specifically, we assess situations where the payout ratio is 0% or NM (Not Mentioned).

Dividend Ratio: Understanding the Basics

The dividend payout ratio refers to the amount of dividend shareholders earn relative to the total net income of a company. The amount that is not distributed to shareholders is retained by the company for growth and other purposes. In other words, the dividend payout ratio provides a snapshot of how much money a company is returning to its shareholders versus how much money it is keeping for the purpose of reinvestment, debt or cash reserves.

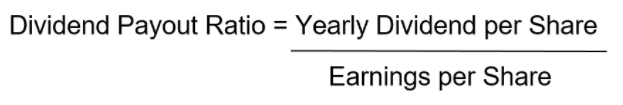

The payout ratio is a function of earnings per share (EPS) and annualized payouts – two important factors to consider when it comes to income investing. The payout ratio is calculated by dividing annualized payouts (i.e., yearly dividend per share) by the EPS. If either of these numbers is zero, the payout ratio for the stock will be 0% or NM.

The dividend payout ratio formula is outlined below:

Factors That Lead to Zero EPS and/or Annualized Payout

In the following examples, we outline specific instances that lead to zero EPS and/or zero annualized payout. When this occurs, the payout ratio will always appear as 0% or NM on our ticker pages.

Non-dividend Paying Company

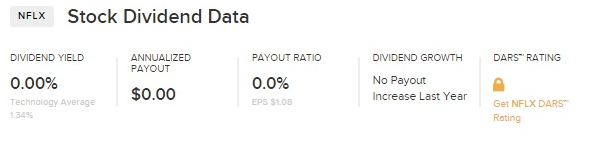

Companies that don’t pay dividends do not make payouts. Therefore, the payout ratio for these companies will always appear as 0% or NM. Dividend.com still lists these companies to provide a holistic snapshot of the equities market, and to provide continuity in the event that the stock eventually becomes a dividend payer.

Netflix (NFLX) is a high-profile stock that does not pay dividends. Its corresponding payout ratio is therefore zero. Google (GOOG) is another prominent non-dividend stock that lacks a payout ratio.

The technology sector has an average dividend yield of 1.36%. Click here to explore possible dividend plays in this fast-moving sector.

Special Dividends

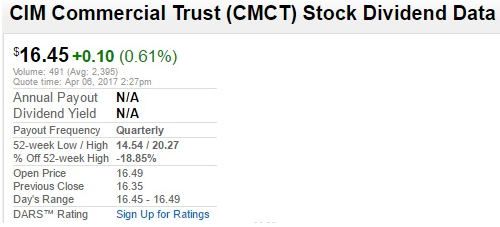

When a company declares a one-off special dividend, its payout is not annualized since it is unlikely to be a regular dividend player. As such, it is deemed to be a special or irregular dividend. This means its payout ratio appears as 0% or NM, like in the examples above. Some companies avoid paying dividends regularly due to irregular earnings, a lack of liquidity or internal policies that prevent them from doing so.

CIM Commercial Trust (CMCT) recently declared a special dividend, which will be payable on April 24, 2017. The ex-dividend date is April 12, 2017.

Premium members have access to a complete list of special dividends, which is available in our Dividend Tools section. To access this list, consider trying Premium for free.

Company Delays

If a company delays or misses a payout, our coding system will automatically mark the annualized payout as $0, which makes the dividend payout as 0%.

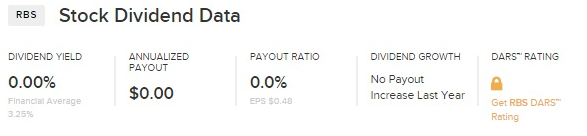

The Royal Bank of Scotland (RBS ) has delayed its dividend payments several times amid consecutive net losses and a worsening financial picture. The RBS ticker page can be seen with a $0 annualized payout and 0% payout ratio.

Click here for a full list of Dividend Payout Changes and Announcements.

Inactive Tickers

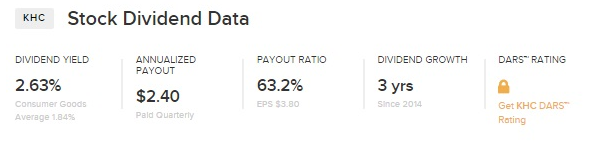

On Dividend.com, inactive tickers represent companies that are no longer trading due to a merger, acquisition or bankruptcy. One of the most prominent examples is Kraft Foods Group (KRFT), which in 2015 merged with Heinz (HNZ). The newly merged company now trades as the Kraft Heinz Company (KHC ).

Find KHC’s ex-dividend date by using the Dividend.com Ex-Dividend Date Search tool. This tool also allows you to search by common shares, preferred shares and other market funds like exchange-traded funds (ETFs) and notes.

Dividend Suspension

As with other cases, a dividend suspension triggers an automatic zero in our annualized payout coding. This leads to a 0% payout ratio. Suspended dividends remind investors that profit payments are not guaranteed. Both suspended and reinstated dividend payments must be announced publicly by the company.

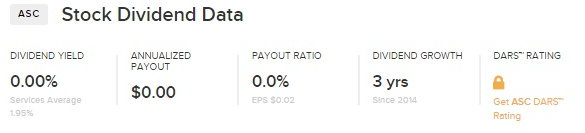

Ardmore Shipping Corporation (ASC ) is a recent example of a company that suspended its dividend payout. The company’s ticker reflects a $0 annualized payout and 0% payout ratio.

The Bottom Line

Dividend investing is income investing. Our code takes into account cases of special dividends, non-dividend paying companies, missed/delayed payouts and dividend suspensions where the payout ratio can be either 0% or NM.

To discover the most profitable dividend stocks, check out the free Dividend Stock Screener, which allows you to navigate the market by industry, market cap and payout frequency.

For the latest dividend news and analysis, subscribe to our free newsletter.