The general market convention suggests that the higher the estimated earnings growth the better it is. But, this may not be true for dividend investors who are chasing the yield more than share price appreciation. Below, Dividend.com analyzes how earnings growth estimates are linked to dividend investing.

Earnings - The Bottom Line

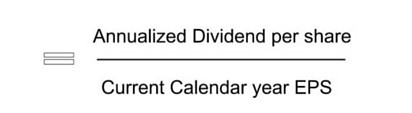

Earnings are simply the bottom line for any company. Earnings get distributed to investors in the form of dividends and whatever remains is re-invested back into the company. This distribution/retention is defined in the payout ratio formula. Dividend.com defines payout ratio as forward looking:

Where:

Annualized Dividend per share / Current Calendar year EPS

Annualized Dividend per share = Most recently observed dividend *previously observed frequency of dividend payments

Current calendar year EPS = Mean Analyst Basic EPS estimates for the current calendar year

An ideal payout ratio for a dividend investor is between 45% – 55% where half of the earnings are distributed and half of the earnings are reinvested back into the company. Earnings are absolutely critical for investors to receive a payout. No earnings mean no dividends, and no earnings growth means no payout increases. This brings us to our most important point of discussion—why high earnings growth stocks should be avoided and low (but modest) earnings growth stock should be preferred by dividend investors.

High Earnings Growth Estimates vs Low Earnings Growth Estimates

Since a dividend investor’s most important goal is not capital appreciation, but capital preservation while receiving income at the same time, high earnings growth estimate stocks should be avoided. Most companies that have matured like Procter & Gamble (PG ), Johnson & Johnson (JNJ ) or 3M (MMM ) never give extremely high double digit growth estimates for the next year, because they have reached a business stage where they don’t have a lot of avenues to grow further. They are already industry leaders in their verticals and, hence, distribute a large chunk of their earnings to investors.

Dividend Aristocrats are usually companies that have peaked in their business verticals. If next year’s earnings estimates are expected to come in very high, say 20%-30%, then it only means two things:

- The business hasn’t really peaked and still has avenues to grow which is why analysts’ growth expectations are coming in high.

- The company is still a high growth company and not an “income pick”. A large chunk of the company’s earnings are likely reinvested to achieve those dreamy earnings growth rates.

Companies with extremely high earnings growth estimates are usually never low beta stocks, which income investors prefer. These stocks could rise more than the market when the market rises and fall more than the market when the market falls, which are typical characteristics of a growth or a value pick.

In today’s market conditions stock like JNJ or American States Water (AWR ) don’t fall or rise as much as the market does. But, stocks like Gilead Sciences (GILD ) or Bed, Bath and Beyond Inc. (BBBY ) which were recently introduced are much more volatile.

This chart provides you with a better understanding of the high correlation between betas, earnings growth estimates and dividend history.

| Ticker | Company Name | Beta | Earnings Growth Estimates (FY2016 to FY 2017) | Payout Ratio % |

|---|---|---|---|---|

| (JNJ ) | Johnson & Johnson | 0.59 | 5.74% | 45.50% |

| (AWR ) | American States Water Co | 0.35 | 3.78% | 53.70% |

| (GILD ) | Gilead Sciences | 1.03 | 1.31% | 13.80% |

| (STZ ) | Constellation Brands | 0.83 | 13% | 25.50% |

*Data as of April 23, 2016

In the above analysis, we picked two dividend aristocrats and two new dividend initiators.

JNJ and AWR have grown their dividends for 52 year and 61 years respectively. With such a long dividend history, it’s reasonable to find their payout ratios between 45- 55% which we prefer. Their betas are much lower than the two recent dividend initiators that we compared in the form of GILD and STZ. Both the new dividend payers have very low payout ratios for obvious reasons but their earnings growth estimates come in much higher with the exception of Gilead Sciences. Gilead may have less earnings growth estimates going forward but it’s previous 4 earnings are as follows:

| Year | Diluted Normalized EPS |

|---|---|

| 2012 Year End | $1.68 |

| 2013 Year End | $1.84 |

| 2014 Year End | $7.37 |

| 2015 Year End | $11.87 |

Earnings have grown more than 10 times in the past 4 years but have now plateaued out which is not a bad thing if you are a dividend investor as that could potentially translate to low beta. For these and valuation reasons it was included as a Best Dividend Stock last year.

The Bottom Line

Single digit earnings estimates are not a bad thing if you are a dividend investor. It usually correlates to stocks that have a long history of paying dividends and have good payout ratios, coupled with low volatility(beta). Income investing should not be mixed with value or growth investing. Don’t be tempted by double digit growth estimates unless you check other important parameters like payout ratios and recent stock price performance.