Dividend Reinvestment Plans (also known as Dividend Reinvestment Programs, or DRIPs) are a great tool for long-term investors. The compounding interest of DRIPs allows investors to purchase additional shares of stock at little or no cost – simply reinvest the dividends, and when enough money is accrued, additional shares are automatically purchased. If an investor is enrolled in a specific stock’s DRIP plan, he/she will not receive dividend payouts in the form of cash. Instead the dividends paid will automatically buy additional shares of that company. These plans are beneficial to investors as they allow them to receive any growth from the stock as well as gains from compounding.

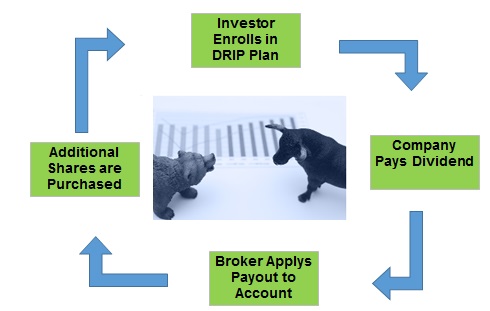

How Do Dividend Reinvestment Plans (DRIPs) Work?

When an investor enrolls in a dividend reinvestment plan, he/she will no longer receive dividends in the mail or directly deposited into their brokerage account. Instead, those dividends will be used to purchase additional shares of stock in the company that paid the dividend. There are over 1000 companies and closed-end-funds that have their own DRIP plans. In addition, investors can reinvest dividends from most companies through their broker.

To have a company’s next dividend payout be applied to a DRIP program, you must be enrolled by the stock’s record date. To see if the stocks you own have a company-run DRIP plan, click here. If the company that you own stock in does not offer a DRIP program, there’s no need to worry – most major brokerages allow investors to enroll any dividend paying stock in a DRIP plan.

What are the Benefits of Dividend Reinvestment Plans?

Enrolling in a DRIP is fairly easy. Most major brokers make enrollment simple and painless and will charge little or no commission. Cash dividends paid by the company are automatically reinvested into additional shares. Once the investor has enrolled in a DRIP, the process becomes entirely automated and usually requires minimal attention or monitoring.

Many dividend reinvestment plans are often part of a direct stock purchase plan. If the investor holds at least one of his shares directly, he can have his checking or savings account automatically debited on a regular basis to purchase additional shares of stock, usually at no cost to the buyer.

The fees to purchase through dividend reinvestment programs are normally small, if any. Dividend reinvestment plans also allow the investor to purchase fractional shares. Over decades, this can result in significantly more wealth in the investor’s hands.

The price paid for the shares through the dividend reinvestment is determined by an average costs of the share price over the given time. This way, an investor will not pay the highest or the lowest price for the shares.

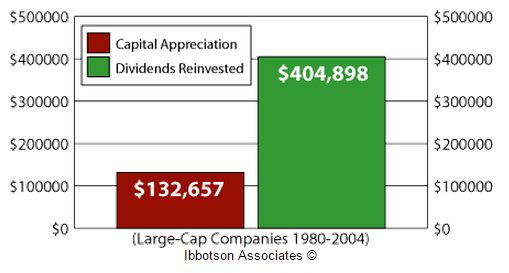

The Results of Reinvesting Dividends

Over the long term, enrolling stock in a DRIP plan can increase the value of an initial investment substantially. Below are two examples of how a DRIP program could have benefited investors in the past.

If you had $2,000 invested in Pepsi in 1980, that would be worth more than $150,000 by the end of 2004. You would have started with 80 shares, but by reinvesting dividends, you’d now have 2,800 shares.

If you had $2,000 invested in Philip Morris in 1980, that would be worth just under $300,000 by the end of 2004. You would have started with 58 shares. Today, thanks to stock splits and reinvesting dividends, you now would have more than 4,300 shares.

These are fantastic examples of compounding returns. The chart below also illustrates the long-term value of dividends reinvested.

How Does Partial Enrollment in a DRIP work?

Let’s say that Thomas Henderson owns 500,000 shares of General Electric and the stock trades at $49.75 with an annual dividend of $2.72 per share ($0.68 per quarter). William would like to receive some cash for living expenses but would like to enroll some of the shares in a DRIP. He calls his broker and has 300,000 shares enrolled in General Electric’s DRIP. When the quarterly dividend is paid, William will receive cash dividends of $136,000. He will also receive 4,100.5 additional shares of General Electric giving him holdings of 304,100.50 shares (300,000 shares * $0.68 dividend = $204,000 divided by $49.75 per share price = 4,100.5 new shares of General Electric).

Example of Full Enrollment in a DRIP Program

Let’s say that Mary Johnson owns 1,000 shares of Pepsi. The stock currently trades at $50 per share and the annual dividend is $0.88 per share. The quarterly dividend has just been paid ($0.88 divided by 4 times a year = $0.22 per share quarterly dividend). Before she enrolled in Pepsi’s dividend reinvestment plan, Mary would normally receive a cash deposit of $220 in her brokerage account. This quarter, however, she logs into her brokerage account and finds she now has 1,004.40 shares of Pepsi. The $220 dividend that was normally paid to her was reinvested in whole and fractional shares of the company at $50 per share.

The Best Dividend Reinvestment Plans

All investing carries risk, so investors should always do their homework before buying stock and enrolling in a DRIP plan. After an investor chooses a stock, he/she has the choice of enrolling in a company’s DRIP plan or enrolling in a plan with their broker. To see a list of the lowest cost DRIP programs click here.

For companies that do not offer their own DRIP, these brokers offer these programs commission-free:

| Broker | DRIP Policy |

|---|---|

| Ameritrade | Currently offers a free DRIP program, but notes this policy could change |

| E*trade | Free DRIP program |

| Charles Schwab | Free DRIP program (excludes ADRs) |

| Scottrade | Offers free Flexible Reinvesting Plan |

Key Lessons

- When you enroll in a DRIP, your dividends are automatically reinvested back into more shares of the stock.

- The true beauty of DRIPs lies within the compounding returns they can provide – a relatively small amount of shares can grow into a very large amount over the long term, even without future purchases.

- When enrolling in DRIPs, you can choose partial enrollment (where a portion of the dividends are returned to you in cash), or full enrollment (where all dividends are reinvested into more shares).

- To have your dividends be reinvested, you must be enrolled by the stocks record date.