There are several reasons why specific companies will not distribute dividends to investors. In some cases, such as Berkshire Hathaway, the management believes that the return to investors will be magnified by holding on to capital as opposed to distributing the funds back to investors. If you find a company that you believe will provide capital appreciation, you can create a synthetic dividend to replace the dividend distribution you are missing out on.

What is a Synthetic Dividend?

A synthetic dividend is a derivative product created by using options. A derivative is a financial product that is derived from other instruments. There are two basic types of options: the call option and the put option. The buyer of a call option on a stock or ETF has the right, but not the obligation, to purchase a stock or ETF at a specific price on or before a certain date. A put option provides the buyer with the right but not the obligation to sell a stock or ETF at a predetermined price on or before a specific date.

Option Basics

The price where the call option buyer can purchase the underlying stock is called the strike price of the option. The date when the option matures is called the expiration date. If the strike price of a call option is the same as the underlying price of a stock or ETF, the option is considered “at the money” (ATM). If the price of the stock is below the strike price of a call option, the option is considered “out of the money” (OTM). Additionally, if the strike price of the option is above the current price of the stock or ETF, the option is considered “in the money” (ITM).

The price of an option is called a premium, and it is made up of two components. The first is intrinsic value, which is the calculated the value of an option that is in the money. For example, if the strike price of a call option on stock XYZ is $100 and the current price of stock XYZ is $105, then the intrinsic value of the call option is $5. If the premium of call option XYZ with $100 strike is $6, then the time value of the option is $1, which is the difference between the value of the option ($6) and the intrinsic value of the option ($5).

Selling Call Options

When you sell an option, you are giving up the right to purchase a stock, and for this you receive a premium. If you own the underlying stock, you have a covered position, and if you don’t own the stock of the call you sold, you have a naked position.

Covered Calls

A covered call trading strategy is an income-producing strategy where you sell call options against stocks or ETFs that you already own. (Also check out how you can enhance your income play using covered calls.) You can cover your shares by selling one option contract for every 100 shares of a stock that you own. If you sell covered calls you are giving up some capital appreciation, as the buyer of the call will exercise the option if the price of the stock moves above the strike price.

An example of company that does not pay a dividend but might be attractive as it provides capital appreciation is Berkshire Hathaway (BRK-B). You can find non-dividend-paying stocks using the dividend screener at Dividend.com.

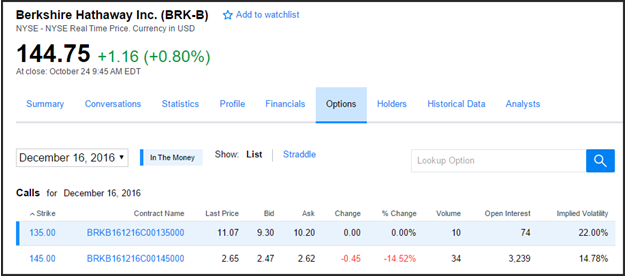

At the time this article was written, the price of the December 16, 2016 (expiration date) $145 calls had a bid price (at which someone would purchase the calls) at $2.47 and an offer price (at which someone would sell the calls) at $2.62. The expiration date is approximately 50 days away. Each option contract provides the right to purchase 100 shares of BRK-B.

Since BRK-B does not pay a dividend, the premium you receive when you sell the call option becomes a synthetic dividend. If you sell the call option at $2.47, the premium allows you to receive a cash flow that has a synthetic dividend yield based on the price of the underlying stock or ETF. In the case of Berkshire Hathaway B shares, your initial dividend yield would be calculated by dividing the premium $2.47 by the cash or margin you posted for the stock.

Understanding Payouts

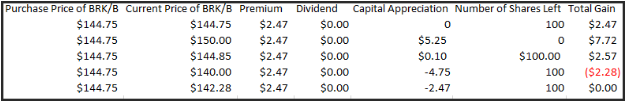

Here are a few scenarios that could occur with a covered call overlay, using BRK-B as an example. To illustrate, we are assuming you purchased 100 shares of BRK-B stock.

The stock price remains at your purchase price of $144.75.

- Here you would receive a premium of $2.47.

- You retain all your shares.

The stock price moves above the strike price, to $150, and gets called away.

- Here you would receive your premium of $2.47.

- You would also accrue a capital gain of $5.25 per share. (The difference between your stock purchase price and the strike price is your capital gain: $150-$144.75=$5.25.)

The stock price rises near the strike price, but remains below it, at $144.85.

- Here you would retain the stock and receive the premium of $2.47.

- You would also accrue an unrealized capital gain of $0.10 per share. (The difference between your stock purchase price and the strike price is your capital gain: $144.85-$144.75=$0.10.)

The stock price drops to $140.

- Here you would retain your stock and receive a premium of $2.47.

- You would also have an unrealized capital loss of $4.75, which is somewhat offset by the premium and the dividend.

Breakeven – the stock price drops to $142.28.

- Here you would retain your stock and receive a premium of $2.47.

- You would also have an unrealized capital loss of $2.47, which is offset by the premium and the dividend.

The Bottom Line

By selling a covered call to produce a synthetic premium you are giving up potential upside to generate a dividend payout. Stocks that produce a dividend will experience an enhanced payout with the use of the synthetic dividend. The benefits of receiving a synthetic dividend in the form of a premium not only protects you from declines in the price of the stock, but it can add considerably to the income you receive from holding a non-dividend-paying stock. Corporate actions have a huge impact on stock prices, which impacts call option pricing. Keep track of the latest corporate actions regarding dividends in our dividend payout changes page. Also be sure to check out our dedicated section on options and dividends, where we regularly cover topics related to options and dividend stocks.