There’s no question that investors are increasingly embracing environmental, social, and governance (ESG) ideals in their portfolios. Not surprisingly, many asset managers have rushed to provide ESG investment options to meet the demand. However, regulators are growing concerned over so-called greenwashing techniques.

Let’s take a look at how ESG’s growing popularity has led to increased government scrutiny and efforts by the industry to police itself.

Be sure to check out our ESG Channel to learn more.

ESG’s Growing Popularity

ESG investments could become a $1 trillion category by 2030, according to BlackRock, with the current trends marking just the beginning of what could be a decades-long growth story. During the first quarter of 2021, ESG funds experienced a record inflow of more than $20 billion.

Some of the most significant U.S. ESG funds include:

| Fund Name | Assets Under Management | Expense Ratio |

| PRBLX | $29.4 Billion | 0.84% |

| ESGU | $21.6 Billion | 0.15% |

| VFTNX | $14.6 Billion | 0.12% |

As of October 25, 2021

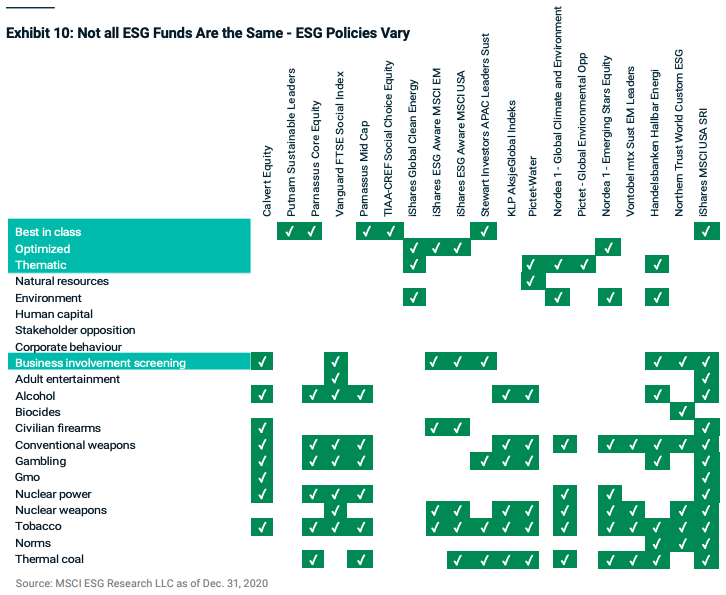

As MSCI points out in a recent report, each ESG fund has its own unique approach to the market. For example, some funds exclude certain non-ESG businesses, such as tobacco companies or weapons manufacturers. In contrast, others take a thematic approach by preferentially choosing certain companies, such as clean energy companies.

Government Tightens ESG Standards

European regulators have taken aim at asset managers using vague definitions of environmental, social, and governance investing. In March, the Sustainable Finance Disclosure Regulation introduced more stringent criteria before labeling anything ESG. In addition, there are different degrees of ESG assets (light to dark), quantifying their impact.

In response to the new rules, Allianz Global Investors, DWS Group, and other large fund managers began dropping the term ‘ESG integrated’ in their public documents, according to Bloomberg reports. U.S. and German regulators have also been looking into greenwashing accusations from Deutsche Bank’s former sustainability head, Desiree Fixler.

The U.S. is starting to have the same conversations, suggesting that ESG regulations could be forthcoming in the world’s largest financial markets. In fact, SEC Chair Gary Gensler said that ESG disclosure regulations would be central to his tenure.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

Mega Funds Push for Standardization

The financial markets often prefer self-regulation over the government’s heavy hand. For example, FINRA is a self-regulating organization, or SRO, that provides investor protections. The industry argues that self-regulation through SROs is more efficient and effective than government regulations that often come with unintended consequences.

To that end, CALPERS, Carlyle, Blackstone, and other asset managers with more than $4 trillion in assets under management banded together to standardize ESG data. The group’s goal is to develop a common language by aggregating emissions, diversity, and employee data across closely-held companies (e.g., private equity).

In addition to self-regulation over the long term, the group wants to streamline the process over the short term. Carlyle Group’s Megan Starr told Bloomberg that her firm receives more than 40 ESG information requests per month, asking for different sustainability metrics, translating to a lot of time and effort.

The Bottom Line

ESG investments represent one of the fastest-growing categories in the market, but loose regulations have led to confusion among investors. As the government steps in with new ESG regulations, the industry is moving to streamline definitions and develop its own ways to discuss its environmental, social, and governance impact.

Make sure to visit our News section to catch up with the latest news about income investing.