ESG bond issuance in developing and frontier markets reached $230 billion in 2021, according to the Institute of International Finance, up from just $75 billion a year ago. While they only represent a fraction of the overall market, emerging market bond issuances rose 227% compared to just 97% for mature markets—more than double the pace.

In this article, we will look at what’s driving the market for emerging market bonds, what challenges lie ahead, and how investors can participate in the market’s growth.

Be sure to check out our ESG Channel to learn more.

What’s Driving the Market?

Chinese GSSS bond issuances have been the primary driver of emerging market growth, representing about 46% of total emerging market volumes in 2021. With $145 billion worth of green bonds outstanding, the country is the third-largest market after France and Germany. In addition to China, Chile, India, Brazil, and Mexico were significant green bond issuers.

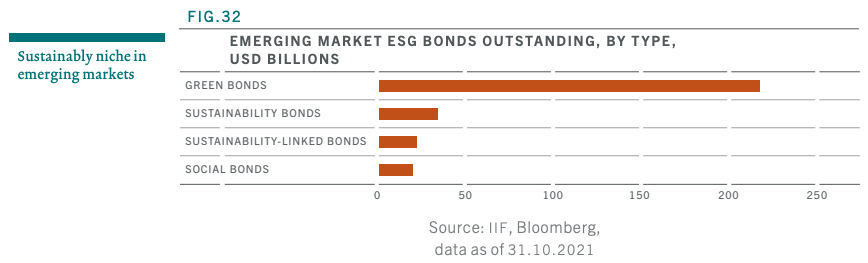

Breakdown of ESG bonds in emerging markets. Source: IFF

While green bonds represented the largest share of the market, sustainability bonds from China, Chile, and Mexico represented about 12% of all ESG bonds. Social and sustainability-linked bonds also picked up steam in 2021 across emerging markets, particularly among corporate issuers in emerging Asia, and in Chile and Mexico.

Supranational institutions and governments remain the largest issuers of emerging market ESG bonds, but financial and non-financial corporate issuances have become more common. Financial institutions account for 35% of all green bonds issued, while utilities and industrial companies make up 17% and 4% of issues, respectively.

Looking ahead, the IFF’s baseline projection suggests ESG bonds in emerging markets could grow from $50 billion in 2020 to $360 billion by 2023 and over $700 billion by 2025. Under its most bullish scenario, annual ESG bond issuances could reach $2 trillion by 2025, becoming one of the largest fixed-income markets in the world.

Key ESG Challenges Remain

Emerging market sovereign and corporate borrowers are increasingly reliant on international bond markets to finance ESG initiatives. According to the United Nations, there’s a $2.5 trillion per year financing gap to meet sustainable development goals. Green bonds could be vital to filling that gap and helping the world meet its climate goals and avert disaster.

Unfortunately, many emerging market borrowers are reluctant to open themselves up to the scrutiny necessary to build and maintain large ESG bond issuance programs. In addition to the high cost of independent ESG verification, successful programs require working with public sector balance sheets to ensure bond proceeds reach ESG-focused projects.

At the same time, many investors remain wary of emerging market issuers. Established markets have their own standards in place that asset managers are comfortable using to evaluate ESG performance. Emerging markets typically have less transparency and lower quality ESG data, making them harder for discerning asset managers to trust.

Investing in Emerging Market ESG Bonds

The good news is that a growing number of funds make it easier for investors to participate in emerging ESG bond markets.

For example, the iShares JPMorgan ESG EM Bond ETF (EMSA) provides exposure to investment-grade and non-investment-grade emerging market bonds issued by sovereign and quasi-sovereign entities in U.S. dollars that align to a larger weight in issuers with a higher ESG score and exclude certain industries, like tobacco or firearms.

Meanwhile, the iShares Global Green Bond Fund (BGRN) invests in investment-grade global green bonds that are directly tied to promote climate or other environmental sustainability purposes. While the fund is heavily weighted toward France, Germany, and the U.S., it includes exposure to China (2.54%), South Korea (1.39%), and other emerging markets.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

Emerging market bond issuances have soared over the past year, driven by Chinese green bonds. However, while emerging markets are quickly growing, they face many hurdles in bringing ESG bonds to market. The good news is investors can build some exposure into their portfolios using emerging market and green bond ETFs.

Make sure to visit our News section to catch up with the latest news about income investing.