Environmental, social, and governance (ESG) has continued to take the world by storm, with institutional and retail investors placing billions of dollars into funds tracking the factors. And while some of this adoption has been based on morals or belief structures, it turns out there’s some portfolio construction benefits as to why investors may want to consider ESG.

For one thing, they have less risk.

A whole slew of academic studies has now shown that ESG-heavy equities may actually reduce the overall risk of a portfolio. And over time, this lower volatility may help produce stronger returns. For investors, there’s now evidence that doing good via your portfolio may also do good for your bottom line.

Be sure to check out our ESG Channel to learn more.

ESG Equals Lower Tail-End & Systematic Risk

According to Bloomberg, global assets in ESG funds are set to hit a whopping $53 trillion by the end of the year, despite recent market hiccups. Some pundits have claimed ESG-focused funds tend to underperform the market. And that data seems to hold true – particularly when growth-oriented stocks are in vogue. However, those pundits may want to rethink their position. ESG does offer one huge benefit that over time can help on the returns front.

And that, ultimately, reduces portfolio risk.

That’s the results of a new study from MSCI. The ratings and indexing firm took a look at a variety of different stock-specific risk factors as well as macroeconomic systematic risks. It then looked at its own ESG data and ranking system and compared the two. The short answer is that stocks with high ESG scores had far less volatility than those with lower scores.

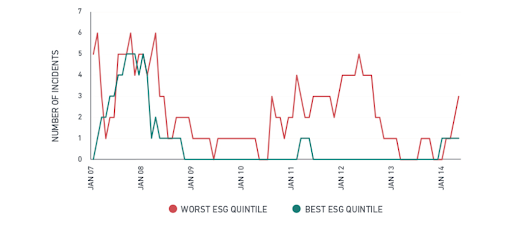

When it comes to focusing on tail-risk, ESG-heavy stocks are simply better. Looking at the MSCI World Index over a ten-year period, more than 95% of the stocks that ranked in the bottom fifth of ESG factors experienced drawdowns that were nearly 3x higher than those in the top fifth of ESG factor scores. And you can see the results in this chart.

Source: MSCI

Expanding the study further, MSCI also showed that equities ranking higher in ESG scores had lower systematic risk with better Z-score rankings than the averages. In addition, the top-ranked ESG performers also experienced lower betas than the overall market.

The beauty of MSCI’s study is that it’s not alone. Morningstar recently published its own look at ESG and risk factors and came up with similar results for its study period. Meanwhile, several academic papers have also shown that ESG stocks simply have less risk than their non-ESG peers.

ESG Factors Make a Difference

The one common element to all these studies is that the reason for the lower tail-end and systematic risk comes down to the ESG factors themselves and how they relate to company performance.

There are a variety of ESG inputs within a corporate structure, such as climate change and carbon emissions, energy efficiency, data protection and privacy, labor standards, bribery and corruption, and audit structures. When companies do these things well, they get rewarded.

On the corporate side, this plays out in a variety of performance-based ways. ESG-focused firms tend to have lower volatility of earning, revenues and cash flow. This plays out in higher dividend strength as well as lower borrowing costs for needed capital. Meanwhile, firms with higher ESG scores provide reduced regulatory and legal interventions/costs as well as cited upticks in employee productivity/satisfaction.

The end result is that all these corporate-level boosts via ESG translate into better investor level boosts. Because they “do better” on the corporate side, investors reward ESG-heavy stocks above their peers. Stability of cash flow means when times get tough, investors don’t have to worry and they don’t abandon these equities. Higher dividends provide a cushion.

With that, ESG stocks are rewarded with a lower risk profile versus the regular market. Data points to this being the case across a variety of equity assets classes and regions.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

Better Performing Risk Adjusted Returns

As for the returns themselves, numerous studies and data show that ESG-focused equities perform just as well as non-ESG-focused firms when looking at risk-adjusted returns. Volatility over long periods of time can be a portfolio killer, with higher highs and lower lows reducing performance. But because of their lower overall volatility to reduce tail-end and systematic risk, ESG equities provide a stable base of returns. The highs aren’t as high, but the lows aren’t nearly as bad.

This smoother return profile has plenty of benefits over the longer term.

For investors, this adds credence and support to using ESG factors when making investment decisions. Overall, the lower risk profile of the ESG-focused equities makes them a top choice for those seeking long-term returns. Data has now proven that to be true.

Make sure to visit our News section to catch up with the latest news about income investing.