Dividend.com got a chance to have a discussion with Stacey Morris, Director of Research at Alerian, a leader in providing investment benchmarks for the North American energy infrastructure space. Stacey shared her insights on the current status of the midstream energy space, factors affecting the energy sector and the role of Master Limited Partnerships (MLPs) in an investor’s portfolio. Read on to learn more.

Current Status of the Midstream Energy Space

Dividend.com: Tell us about Alerian and its various index offerings.

Stacey Morris (SM): Alerian provides benchmarks and unique insights designed to equip investors to make informed decisions about energy infrastructure and MLPs.

We launched the first real-time index to track MLP performance, the Alerian MLP Index (AMZ), in 2006. Since then, we have expanded our index offerings to reflect the evolving landscape while remaining at the forefront of the midstream energy sector. Beyond the AMZ Index, Alerian has a comprehensive suite of specialized indices that provide investors with the most accurate reflection of the North American energy infrastructure sector. Our benchmarks are widely used by industry executives, investment professionals and research analysts to analyze relative performance. As of June 30, 2019, over $13 billion is directly tied to the Alerian Index Series, through various linked-products including exchange-traded funds and notes.

A full list of investment products designed to track our benchmark series can be found here.

Dividend.com: How does growing U.S. energy production affect the midstream energy infrastructure space?

SM: For midstream, more is more. More U.S. energy production, whether crude oil or natural gas, requires more energy infrastructure to move and process those volumes. Midstream MLPs and corporations collect fees for each unit of energy transported, stored, or processed. Growing U.S. energy production means more volumes for midstream to essentially ship and handle.

Additionally, growing energy production is driving increasing energy exports from the U.S., which also requires more infrastructure. Midstream directly benefits from the growth in U.S. energy production and exports, which is expected to continue over the next several years.

Dividend.com: Does the volatility of crude oil and natural gas prices affect the midstream space and MLPs?

SM: Relative to other sectors of energy, midstream MLPs and corporations are more insulated from commodity price volatility due to the fee-based nature of their business models and have performed defensively in recent periods of oil volatility.

However, they are not totally immune to commodity price moves. To cite an example from earlier this year, West Texas Intermediate (WTI) oil prices fell over 21% from April 23 to June 17. During that time, Oilfield Service companies and Exploration and Production companies were down more than 22% on a total-return basis, while midstream MLPs were down less than 2%, as represented by the Alerian MLP Infrastructure Index.

Commodity prices have less of an impact on midstream bottom lines compared to other energy subsectors, but they are important in shaping investor sentiment and the outlook for the energy sector.

Role of MLPs In an Investor’s Portfolio

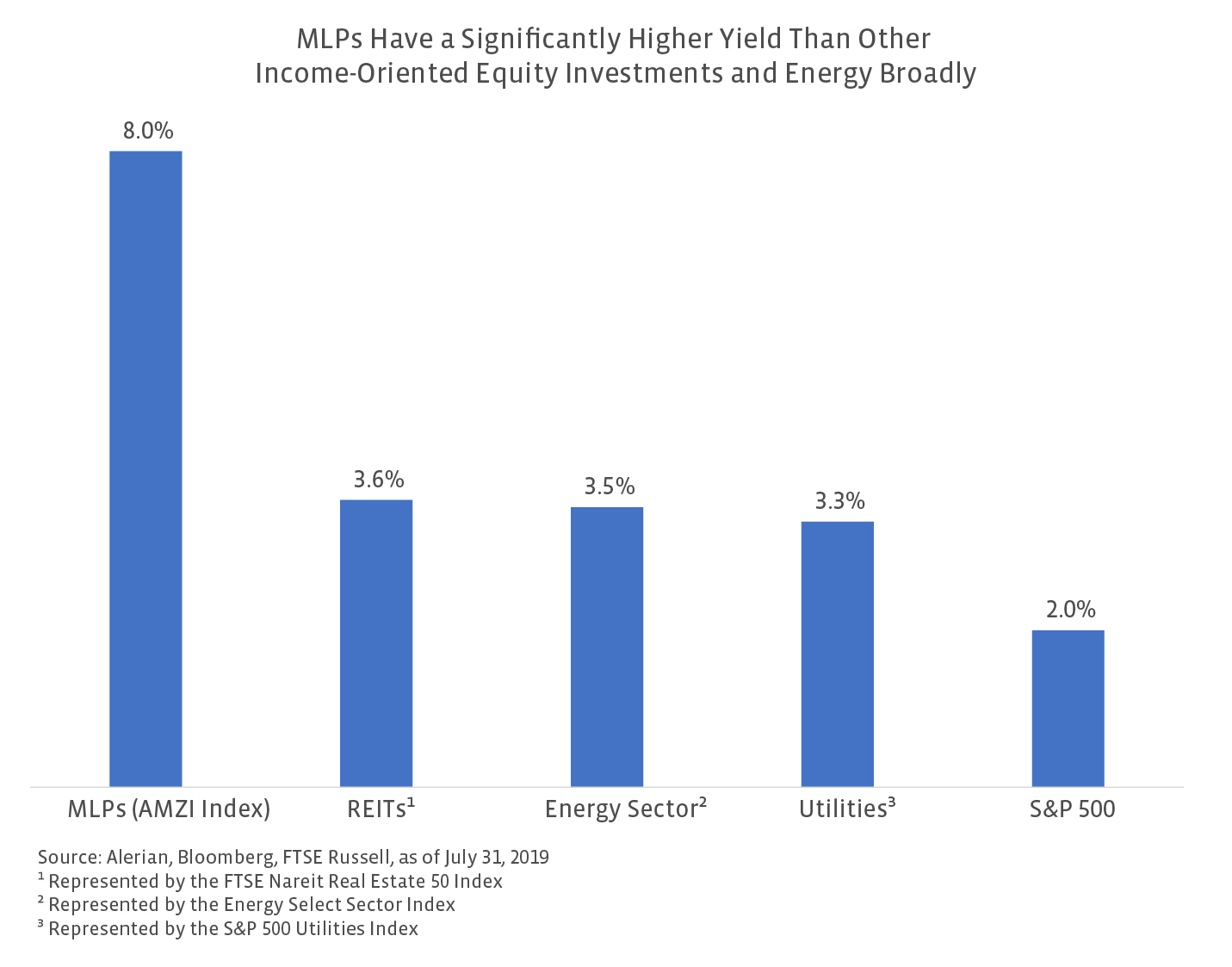

Dividend.com: How do MLPs compare with REITs, utilities and the broader energy sector in terms of yield?

SM: MLPs not only offer a higher yield relative to other income-oriented sectors and energy broadly, as shown below, but they can provide the added benefit of tax deferral.

MLPs are able to pass more of their cash flows onto investors as dividends (called distributions) because they do not pay taxes at the entity level. As an added benefit, typically 70-100% of MLP distributions are considered a tax-deferred return of capital. Taxes on the return of capital portion of the distribution are not paid until the investment in the MLP is sold.

A direct investment in an MLP will generate a Schedule K-1 for tax reporting, but there are a number of MLP access products that can provide MLP exposure with a 1099 tax form and no K-1.

Dividend.com: What role can MLPs play in an investor’s portfolio from a return and risk standpoint?

SM: The benefits of adding energy infrastructure MLPs to a portfolio include income, diversification, real asset exposure, and potential growth.

Alerian details these benefits and where energy infrastructure fits in portfolios in a recent whitepaper. The generous yield of MLPs does not come without some level of risk, and though more defensive than other energy sectors, midstream MLPs are still energy investments.

MLPs should not be considered a proxy for fixed income. That said, company-level improvements have helped better the risk profile of individual MLPs. These include reduced leverage, improved corporate governance, and a greater cushion between cash flow generated and distributions paid.

Despite stronger financial positioning, MLP yields are higher today than they have been on average over the last ten years. This likely reflects investor concerns around the energy sector more broadly against a backdrop of oil price volatility.

Dividend.com: To gain energy exposure, what are some of the factors that investors should consider when comparing MLPs with integrated energy companies such as Exxon?

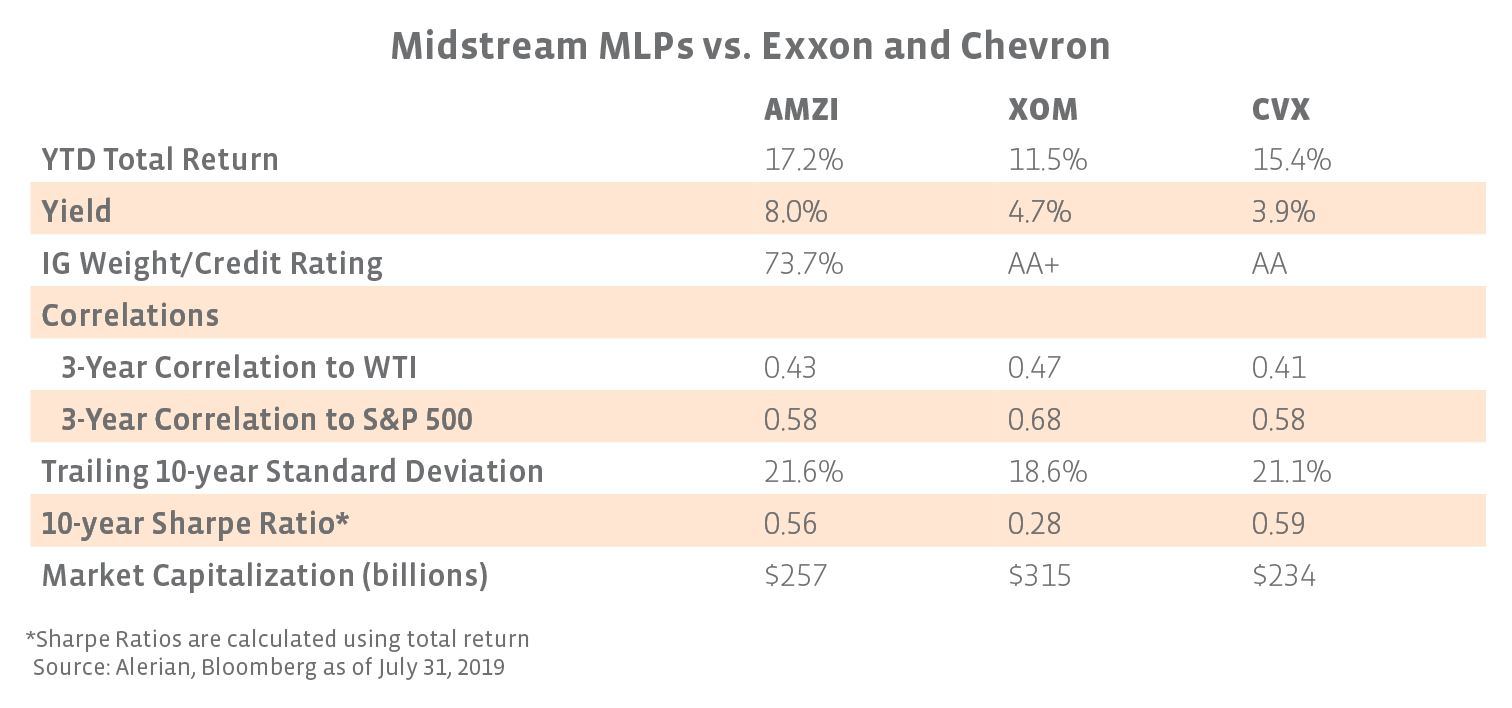

SM: Both midstream MLPs and the integrated majors can be thought of as defensive energy investments but for different reasons.

Midstream MLPs are defensive by nature of their fee-based business models, which limits the impact of commodity price fluctuations on cash flows. The major integrated energy firms tend to be defensive as a function of their size, business diversification, balance sheet strength and impressive dividend track records.

Relative to an investment in a major company like Exxon or Chevron, MLPs provide higher yields, as shown below, and more direct exposure to the growth in U.S. energy production, since the majors have a diversified global asset base. Compared to Exxon and Chevron, midstream MLPs have similar three-year correlations with oil prices and the broader market.

For a broader discussion, Alerian compared midstream to the majors, as well as broader energy, in this piece from June.

The Bottom Line

Stacey Morris helped us understand how midstream directly benefits from the growth in U.S. energy production and exports, which is expected to continue over the next several years. She also discussed the role of MLPs in an investor’s portfolio and how MLPs compare with integrated energy majors such as Exxon and Chevron.

Check out our expert opinion section here to get insights on what other experts are thinking.