Investors can often find strong returns and good advice by following various market gurus. So, what happens when one of the biggest hedge fund managers makes a bold call that goes against the grain. In this case, we’re talking about Pershing Square Capital Management founder, Bill Ackman.

Ackman has gained fame as an activist investor, pushing for sales, spin-offs and management changes at various firms that were trading for below their potential. He found success in several activist campaigns including those at fast food chain Wendy’s and regional mall operator General Growth Properties. With bets such as these, funds managed by Ackamn and Pershing Square have swelled to more than $18.5 billion in assets. This makes it one of the largest hedge fund groups in the world.

With that, Ackman’s latest bold call to short long-term Treasury bonds is an interesting one, and one that could net investors plenty of gains if they follow his lead and he’s correct.

Bonds & Their Inverse Relationship to Interest Rates

It’s no secret at this point we’re in a period of monetary tightening. Thanks to rising inflation and a CPI that hit levels not seen since the 1980s, the Federal Reserve has been raising rates. By increasing benchmark interest rates, it makes borrowing money more expensive and saving money a better deal. This cools off the economy.

For bond investors, this is a bit of a problem.

When it comes to bonds and rising interest rates, the relationship is like oil and water. They don’t mix very well. In fact, they repel each other. They have an inverse relationship. As interest rates rise, bond prices will fall. The reason is that when a new similarly maturing and credit-rated bond comes to market, it will have a higher interest/coupon to reflect the interest rate change. As a result, bonds currently on the marketplace will drop in price to match that new yield.

If you own a bond and hold it to maturity, it’s not necessarily a big deal. Your coupon will still be the same and you’ll still get the bond’s face value back in full when it matures. However, the reality is, most investors have FOMO and want the higher coupon.

The severity of the price drop is called a bond’s duration. Imputing factors like present value, yield, coupon, final maturity and bond features, duration looks to calculate just how badly your bonds will decrease in value when rates rise. Bonds with longer maturity timelines will have higher durations and fall by more than shorter ones. Part of that is the fact that 10 or 30 years is a long time to lock up your money with a certain coupon rate in a rising rate environment. A bond of 2 years? Not so much.

Ackman’s Short Thesis

This is where Ackman’s short thesis lies. The hedge fund manager believes that yields on the 30-year Treasury bond still have room to rise, which will in turn push down the price of the bonds.

The basis of this remains higher for longer inflationary rates. While inflation has come down significantly, Ackman believes that inflation will skirt 3% or 4% or even higher for the long term. That’s well above the Fed’s target of 2%. With that, the Fed will have to keep rates high and increase them for the long haul. Under that guise, the 30-year bond could see its yield climb to 5.5%. To quote Ackman, “Our view is basically you’re not being paid enough to enter into a 30-year contract with this government.”

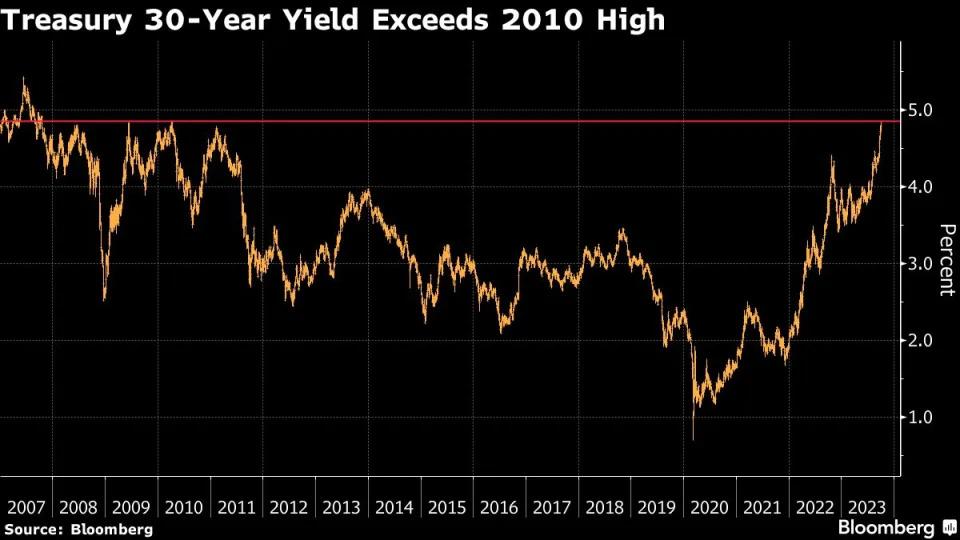

The yield on the 30-year Treasury recently closed at 4.8559%, the highest level since 2007 and before the Global Credit Crisis. This chart from Bloomberg highlights the 30-year Treasury’s rise.

Source: Bloomberg

Ackman also believes the supply of Treasury bonds will help keep rates high, with the U.S. Treasury issuing billions in bonds, notes and bills each week to cover the rising government spending and new infrastructure plans. To that end, there is an “oversupply” of long bonds.

The combination of a still strong economy and the oversupply of bonds will help drive down prices for the long bonds. As such, Ackman has initiated a short position in the 30-year and continued to double down on the position via options.

The Opposite Take

The flipside to Ackman’s thesis that is generally supported by many bond experts is that economic data is starting to slow. Consumers are starting to step away, jobs growth has slowed, and measures of manufacturing have started to contract, while housing sales have cratered. Businesses have started to delay CAPEX spending aside from technology. While recession has been pushed off, economic slowdown has not. At the same time, with rates being so high, the Fed has plenty of room to cut rates, which would send 30-year prices surging, if things start to get bad or below an acceptable level of growth.

At the same time, the Fed has paused now for the second time this year. Historically, rate cuts have happened after the Fed pauses multiple times in a period.

All of this means that we’ll have to wait and see if Ackman’s short thesis, while potentially correct in the short run, is correct in the long run.

Following Ackman’s Lead

Ackman does make some sound points with regards to his thesis and how long bonds still have room to fall. For those investors looking to follow his lead, making the same moves as him is possible. Going short on a vehicle like the iShares 20+ Year Treasury Bond ETF or PIMCO 25+ Year Zero Coupon U.S. ETF would provide gains as yields rise.

Rather than short Treasuries directly, the hedge fund manager has decided to use options contracts to make his short on the 30-year. You can use ETFs to gain similar exposure. Buying an inverse bond ETF could provide a hedge. A fund like the ProShares UltraShort 20+ Year Treasury ETF effectively shorts their respective bond indexes using swaps and options – sometimes with leverage. This provides a similar return profile as what Ackman is doing.

The key is that inverse and leveraged ETFs are a bit quirky, in that they are designed to provide exposure for a single day. Compounding over time can really skew their returns. Moreover, costs for owning these ETFs are high. Albeit, cheaper than using options.

Inverse Long-Term Bond ETFs and Mutual Funds

These funds were selected based on YTD total return, which range between 16% to 40%. However, However, note that inverse and leveraged ETFs are typically designed for one-day exposure and compounding of daily returns can lead to heavy losses if held for a longer duration. They have expenses between 0.89% to 4.34% and have AUM between $35M to $500M. Their dividend yield is between 0% and 3.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| TMV | Direxion Daily 20+ Year Treasury Bear 3X Shares ETF | $298M | 40.1% | 2.4% | 1.01% | ETF | No |

| TTT | ProShares UltraPro Short 20+ Year Treasury | $66.1M | 38.3% | 0.6% | 0.95% | ETF | No |

| TBT | ProShares UltraShort 20+ Year Treasury | $495.6M | 28.8% | 3.2% | 0.89% | ETF | No |

| RYJUX | Rydex Inverse Government Long Bond Strategy Fund Investor Class | $34.9M | 18% | 0% | 4.34% | MF | Yes |

| TBF | ProShares Short 20+ Yr Treasury | $192M | 16.3% | 3.4% | 0.92% | ETF | No |

In addition, if Ackman is right and long-term bond prices fall, short-term bonds will be the place to get returns. Continuing to hold T-bills, money market funds and the like will be fruitful. Investors will be able to get increasing yield in these short-term investments.

The Bottom Line

Bill Ackman’s short thesis on long bonds is interesting. Thanks to persistent inflation and a “higher for longer” stance, the Fed will have to raise rates in the future. With that, the yield on the 30-year is too low. Going short on these bonds will result in plenty of profits for investors. Using ETFs makes that easy-to-follow Ackman’s lead.