4.5%. That’s the current seven-day yield of the Fidelity Government Money Market Fund (SPAXX). Investors in the Fidelity fund are not alone. These days, cash has quickly become king. With the Federal Reserve raising rates, yields on liquid and short-term funds have now hit levels not seen since before the Great Recession. And as such, investors are plowing their assets into cash at record rates.

However, that may be a bad idea.

It turns out our rush to cash may not be such a great thing over the long haul. Rather than placing all of our money into cash, bonds could be the better choice and offer better risk-adjusted returns for portfolios.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

A Record Amount of Cash

After a decade of earning zero percent interest on cash and cash-like investments, the humble savings account, CDs, and money market funds are now paying some hefty yields. Kicking out the biggest banks—which are still paying 0.01% because they have too much cash—the average savings account is paying close to 4%. Short-term CDs and money market funds are paying closer to 5%.

With yields that high, investors have taken advantage. According to investment researcher, ICI, investors have plowed more than $19.3 trillion into bank deposits, money market funds, and certificates of deposit as of the beginning of March. Money market funds alone hold over $4.8 trillion in assets.

And it looks like there is no sign of stopping. Reuters and ICI report that cumulative inflows for the year have grown to a massive $427.4 billion as of the end of April. All in all, fund flows have eclipsed the rates seen during the worst of the pandemic.

A Potentially Bad Idea

However, the rush to cash may not be such a great idea. Having some short-term reserves is a good idea for liquidity and emergency fund purposes, but the sheer amount of excess cash investors are holding may be doing more harm than good. Investment manager Lord Abbett outlines the case as to why.

For starters, inflation is still eating away the purchasing power of that cash. While headline CPI rates have sunk, the 6% current rate of inflation is still chipping away what that cash—even at 4.5% interest—can pay for. Over the long haul, cash has historically underperformed rates of inflation by a wide margin. Investors need some additional spread/return over cash to keep ahead of inflation.

Second, the yields on investment-grade and short-term bonds are also at higher rates not seen in years. The great bond meltdown of 2022 has somewhat ‘reset’ the fixed income marketplace and bond yields across various sectors are now closer to historical norms. For example, the Bloomberg 1-3 Year U.S. Corporate Bond Index is now yielding over 5%.

But the real reason to hold less cash is long-term excess returns.

According to Lord Abbett’s research, while cash may win out over the short term and during periods of tightening, bonds will win out over the longer haul and once the Fed pauses. Truth be told, periods of tightening tend to be short on average. And given the rising recessionary risks, the Fed may be forced to pause sooner rather than later. This is where bonds and their excess yield win out.

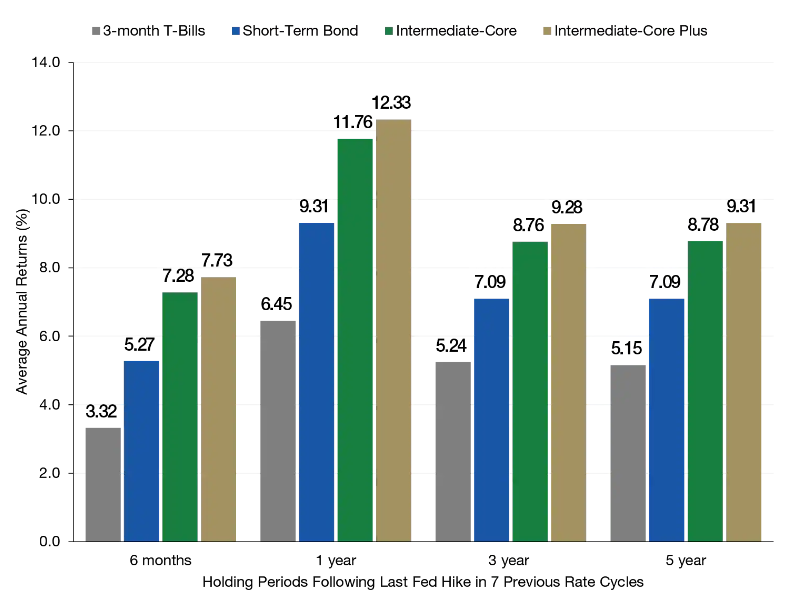

Measuring the performance of the Morningstar Short-Term Bond, Intermediate-Term Core, and Core Plus Bond categories, Lord Abbett looked at returns from 1984 as of the last Fed rate hike and compared them to T-bills/cash. You can see the results in this chart. Bonds end up crushing cash by a wide margin over six-month, one-, three-, and five-year periods.

The reason for the excess returns comes from investors moving into bonds when the Fed pauses. The capital appreciation—which you can’t get from cash—adds to the outperformance.

Source: Lord Abbett Insights

Moving Out of Cash

For fixed income investors, the allure of cash and its current high yield ultimately isn’t the best decision. Losing purchasing power to inflation and future returns makes holding too much cash a bad proposition. To that end, buying bonds now could be a great play. Lord Abbett suggests several areas to focus on.

One is intermediate investment-grade bonds. Both medium-term Treasuries and corporates were some of the hardest hit bonds last year and now represent bargains in the space. A fund like the iShares Core Total USD Bond Market ETF (IUSB) could be all you need. However, Lord Abbett suggests that being opportunistic within the space may be better. Core Plus funds—which can change their weightings amid bond indexes—could be a top choice, with Lord Abbett Core Plus Bond Fund (LAPLX) offering a nearly 5% yield.

Another place investors can find gains? Just outside of cash and in short-term bond funds. Investors can still maintain the liquidity of cash, but score slightly higher yields and that could be enough of a win. The SPDR SSgA Ultra Short-Term Bond ETF (ULST) and Vanguard Ultra-Short Bond ETF (VUSB) make fine, low-cost choices.

To summarize, here is a list of some of the top-performing funds to get exposure to the bonds.

| Name | Ticker | Type | Expense Ratio | AUM | YTD Return |

| SPDR SSgA Ultra Short Term Bond ETF | ULST | Active ETF | 0.20% | $381 mn | 3.3% |

| Vanguard Ultra-Short Term Bond ETF | VUSB | Active ETF | 0.10% | $3.8 bn | 2.37% |

| Lord Abbett Core Plus Bond A | LAPLX | Mutual Fund | 0.68% | $478 mn | 2% |

| iShares Core Total USD Bond Market ETF | IUSB | Index ETF | 0.06% | $17.8 bn | 1.7% |

The Bottom Line

Fixed income investors are sitting on too much cash. The surge in yields has caused a rush into cash and cash-like securities. But with inflation looming and better returns to be had elsewhere, moving into bonds could be the better bet.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.