Bonds have historically played the core role in income portfolios. Thanks to their steady nature, retirees and other income-seeking investors could build a base of bonds – as well as other traditional fixed-income assets like CDs and Money Market Funds – and fund the bulk of their future income streams. Their high yields and lower volatility made this possible.

Until it didn’t.

The Great Recession flipped this idea on its head, and the ongoing COVID-19 pandemic has kept the trend going. With central banks around the world continuing to keep interest rates at zero, or in same cases negative rates, bonds aren’t like their traditional selves anymore. They are no longer providing a stable, steady base of income, and their prices continue to move more like equities.

Which begs the question do you really even need bonds these days? Or can dividend stocks provide more of the heavy lifting when it comes to your fixed-income portfolio?

Explore the Income Equity section to browse through mutual funds and ETFs to meet your income requirements.

Bonds Traditional Role Starts to Vanish

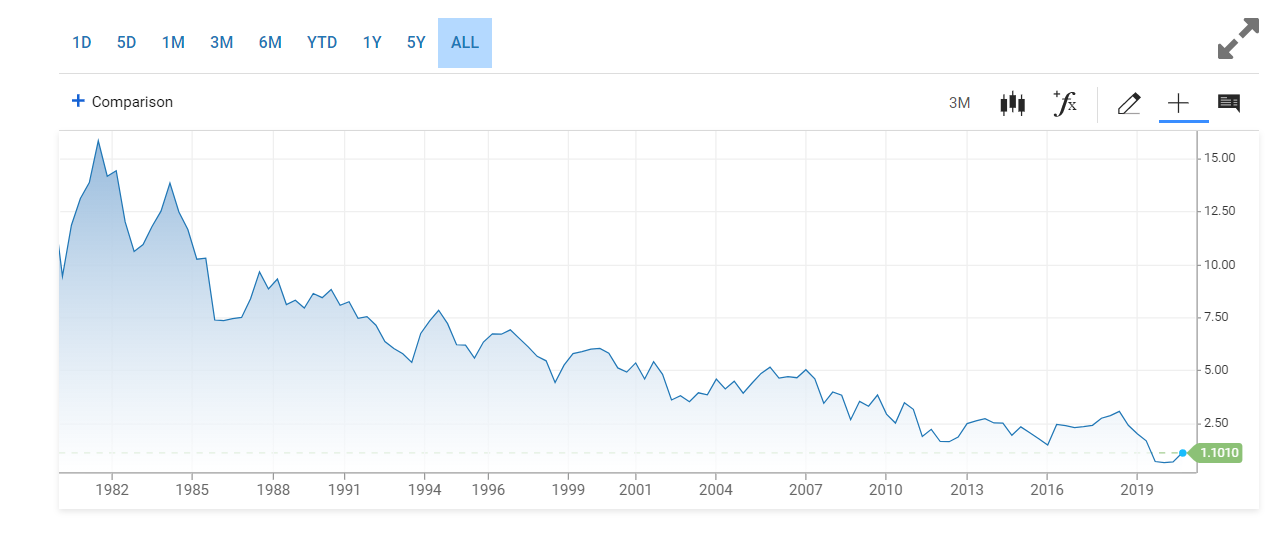

Twenty years ago, you could have purchased a 10-year U.S. Treasury that yielded about 6%. In the aftermath of the Great Recession, that yield was closer to 3%. These days and at the time of writing, a 10-year bond will net you a 1% yield. And you can see by this chart just how dramatic the fall has been in the last decade or so.

Source: CNBC

The culprit has been the continued drift to lower rates from the Federal Reserve and other central banks around the world. Given the severity of the Great Recession and the COVID-19 pandemic, banks have pulled out all the stops in order to restart economies. And with little to no inflation and poor economic growth, the Fed and others have kept rates trending towards zero for the long haul.

For income seekers, this has caused bonds’ leadership as a source for high, stable income to vanish. No longer can they rely on bonds to get it done.

Meanwhile, bonds’ other role of providing stability in a portfolio could be questioned as well. It turns out the idea that bonds and stocks move in opposite directions is more myth than truth. It also turns out that the negative correlation between stocks and bonds is more of a relatively new phenomenon that emerged since the 1990s. According to Bank of America, the preconceived concept that stocks and bonds move in opposite directions has been false for most of the last 65 years. They do, in fact, move in sync with each other – and often.

Even recently, the dip in interest rates/yields has once again flipped bonds and stock correlations back to their more historically in sync pattern.

Meanwhile, bonds have become more volatile in recent years. Thanks to the drop in interest rates and “meddling” by the Fed, bond prices have acted more like stocks, witnessing big swings. In fact, long bonds – those with maturities over 10 years – were one of the best-performing asset classes and actually returned more than the stock market.

Don’t forget to explore our Fixed Income Channel to learn more about fixed income investment concepts and trends.

Higher Yields In Stocks

With bonds paying so little, volatility of the asset class rising and correlations with the stock market increasing, bonds’ role in a portfolio is certainly being questioned. This is especially true when dividend-paying stocks have some interesting new advantages.

For one thing, stocks on average are paying way more than Treasury bonds at the current moment and have been since the end of the great Recession. Currently, the yield on the S&P 500 is close to 2%. However, many top dividend stocks such as Cisco (CSCO) and Coca-Cola (KO) are paying north of 3%.

Meanwhile, equities can provide something bonds can’t: rising income. Even accounting for the recent widespread dividend cuts during the pandemic, the long-term average for dividend growth for the S&P 500 is 5.1% per year. That beats long-term inflation rates by a wide margin.

Finally, we can’t forget Uncle Sam when looking at the equation. Dividends continue to feature better tax advantages over bond interest. The average investors will pay just 15% in taxes on their dividends versus ordinary income rates on a bond’s interest. That rate can be as high as 39%. Depending on where assets are held, this tax difference can be significant for portfolios and income potential.

With dividend-paying equities, we’re getting higher initial yields, growing income and better after-tax income for roughly the same volatility and stability. Under this lens, equities may have a real advantage over bonds.

Modifying Bond’s Role

So, how do we go about using bonds in a modern portfolio?

Several prominent research firms and analysts now suggest that the classic 60/40 stock/bond portfolio could be dead in the water. Even the Oracle of Omaha, Warren Buffett, has suggested that investors hold 90% in stocks and just 10% in short-term bonds for their portfolios.

Perhaps that’s a bit extreme, and investors may not want to abandon bonds all together. This is especially true if you’re buying individual bonds and holding them through maturity. Here, the stability aspect of bonds reigns supreme and can function as a real anchor for a portfolio. Price action doesn’t necessarily matter when you’ll get your principal returned from Uncle Sam.

Bond funds, on the other hand, function differently and roll their bonds over to meet their maturity mandates. Here, price volatility and yield constantly change. Given the volatility in recent years, the appeal of owning bond funds has diminished.

The next question comes down to how much to hold?

Given the longer-term returns and appeal of dividend equities, investors should consider giving the asset more room in their portfolios. What role did bonds historically play? Lower volatility and stability of income. Equities can now provide that in spades. The old adage used to be “hold your age in bonds.” A 65-year-old investor would have roughly 65% of their portfolio in bonds. These days, they may want to lower that number by 10 or 15 basis points. And the bonds they should hold could very well be individual ones to maturity.

The Bottom Line

Thanks to the long-term trend for lower interest rates, bonds simply aren’t getting it done like they used to. No longer can income seekers rely on them for stable returns and high income. To that end, their role in portfolios has changed. With equities now providing a host of benefits for less risk, investors may want to consider leaning on them more than bonds in their portfolios.

Be sure to check out MutualFund.com’s News section here.