High-yield bonds have been stronger performers over the past year with an average yield of around 6%, but the bullish performance comes with a high degree of risk. Investors should adjust their portfolio allocations to reflect these risks by gravitating toward higher quality issuers and reducing their exposure where appropriate.

Let’s take a look at the role that high-yield bonds play in a portfolio, whether they still make sense given current market conditions, and some tips to avoid taking on excessive risk.

Learn more about fixed income investment strategies on our Fixed Income Channel.

What Are High-Yield Bonds?

Most investors use bonds to reduce risk in their portfolio. For example, target date retirement funds typically shift from equities to bonds over time. Most bonds also provide investment income from coupon payments to support retirement income requirements. Investors often look at bonds along the spectrum of risk versus yield.

High-yield bonds have credit ratings below investment grade and offer higher yields to compensate for the added risk. On average, these bonds have outperformed higher-quality fixed income securities over time—behaving like a hybrid between bonds and equities—making them an attractive option for nearly any investment portfolio.

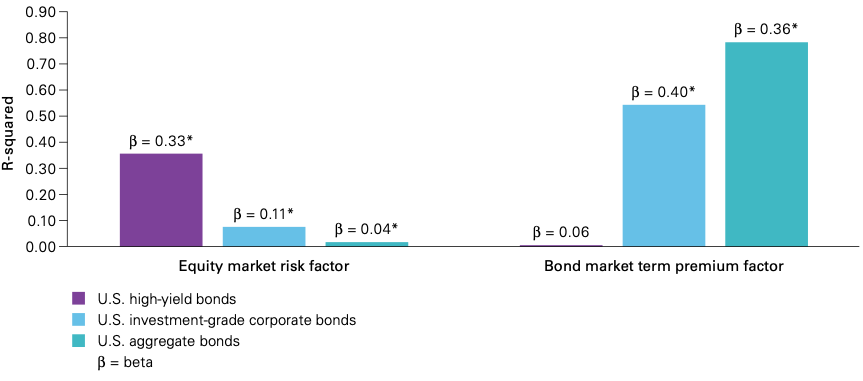

In fact, a comparison of beta coefficients, a measure of risk and volatility, by Vanguard shows that high-yield bonds are much more similar to equities than bonds.

Many investors group high-yield bonds into their equity allocation given their risk-to-reward profile. While they experience periods of both bond-like and equity-like returns, Vanguard’s research suggests that they have the most beneficial impact when using equity allocations rather than bond allocations, where they might introduce too much risk to a portfolio.

Do High-Yield Bonds Still Make Sense?

Interest rates have been near record lows since the 2008 financial crisis. More recently, the COVID-19 pandemic forced many central banks to cut interest rates again to zero or near-zero to stimulate economic activity. These moves have led to a growing interest in high-yield bonds as a way to generate greater income than investment-grade bonds.

In fact, investors who purchased high-yield bonds between March 30, 2020 and August 31, 2020—the peak of the first wave of COVID-19—would have generated a return of 18.4%, according to Mercer, which primarily came from price appreciation! Actively managed funds that made the move could have seen significant returns in just five months.

While an influx of capital has pushed down high-yield bond yields, the perilous global economy has made them even riskier. Bonds issued by commercial real estate, entertainment companies, restaurants, and other hard-hit sectors have a significantly higher default risk than they did during normal economic times prior to COVID-19.

The option-adjusted spread (OAS), measuring the spread between high-yield bonds and the risk-free rate of return, during the COVID-19 outbreak was more significant than the prior market disruptions apart from the 2008 financial crisis.

High-yield debt issuance has surged thanks to asset sales, refinancing, and M&A activity despite the highest default rate since 2009, falling credit spreads since March 2020, and barely any support from the Federal Reserve. In addition, high-yield bonds have underperformed equities (that share a similar risk profile), which have soared to record levels during the year.

How to Invest in High-Yield Bonds

High-yield bonds may be a risky asset class, but that doesn’t mean investors should ignore them in their portfolio.

Investors in individual high-yield bonds may want to stick to high-rated debt to avoid any problems. For example, you may want to search for bonds with a “BB” rating rather than simply screening for the highest yields. The yield on “BB” bonds may not be as high as lower-rated bonds but the repayment capability is likely to be much higher.

There are also various pockets of opportunities:

- Senior Secured Debt has less risk than subordinate or unsecured bonds since they have liquidity preference.

- Collateralized Loan Obligations have less risk than single issuer bonds since they represent diversified pools of debt from multiple issuers.

- Distressed Debt opportunities are exceptionally high risk, but they could become opportunities on the back end of the pandemic if companies have trouble raising capital.

- Fallen Angels are diversified high-quality companies that have temporarily fallen on hardship, but typically have numerous levers at their disposal to repay debt.

If you invest in high-yield bond funds, actively managed funds have the flexibility to assess credit quality and maximize income compared to passively managed funds that indiscriminately invest in the lower-rated corners of the market. If you only want to invest in passive ETFs, you may want to prioritize funds that allocate to higher-rated “BB” bonds.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

The Bottom Line

High-yield bonds have been strong performers over the past year with an average yield of around 6%, but the bullish performance comes with a high degree of risk. By adjusting allocations and focusing on higher-quality issuers, investors can avoid many of the risks while looking in certain corners of the market for opportunities.

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.