Fixed income markets have come under pressure after the central banks began raising interest rates earlier this year in response to soaring inflation. While inflation has shown signs of slowing down, October’s 7.7% reading remains well above the Federal Reserve’s 2% target, suggesting that further interest rate hikes could be in the cards.

According to CME FedWatch, traders expect the Fed’s target rate to increase from 425 to 450 basis points on December 14 before rising to as much as 500 to 525 basis points by mid-2023 (~36% odds). But, of course, the pathway to higher or lower rates depends on several factors, including inflation and employment data.

Let’s look at one portfolio manager’s dynamic model and a few lessons to heed when looking back at rising rate periods.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

Building a Dynamic Model

JP Morgan’s Andrew Norelli, who is a member of the bank’s Global Fixed Income, Currency & Commodities (GFICC) group, sees quantitative tightening affecting the fixed income market in three phases. By recognizing these phases on a high level, it’s easier for investors to understand how they might react on a more granular level when specific events occur.

First, Norelli believes monetary tightening removed cash and increased the supply of non-cash assets, causing financial asset prices to move lower beginning in January. He favors short-duration bonds during this phase, which have been strong performers in recent months.

Second, Norelli predicts that tighter financial conditions will eventually affect the underlying economy. While this weighs on risk asset prices, government bond prices will rise as markets anticipate a dovish course correction from the Federal Reserve. He favors high-quality duration during this phase to capitalize on these dynamics.

And third, Norelli predicts that the Fed will acknowledge the impact of its tightening and make a dovish course correction. During this period, there could be a continued negative correlation between risk assets and duration. However, risk assets will recover while government bond prices fall. He favors shorting Treasury duration in this phase.

Taking a History Lesson

Many asset managers are looking toward historical performance during Fed tightening cycles for guidance in today’s market. While past performance is no guarantee of future results, history can provide some clues about how different fixed income assets behave during similar rising interest rate environments.

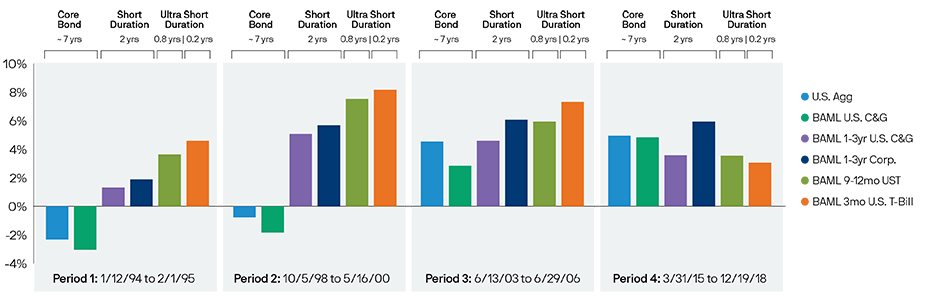

Total cumulative returns of select indexes over rising rate periods. Source: Bloomberg, JP Morgan

In the figure above, JP Morgan analysts dissected four rising rate periods to see what indices performed best. Not surprisingly, they found that short-duration strategies typically outperformed, but the level of outperformance depended on the pace and length of the rate increases. In addition, they discovered that higher-yielding assets performed better.

T. Rowe Price’s Christopher Brown and Anna Dreyer suggest that investors look for relative value across different sectors and tactically adjust duration based on market dynamics. They also found that credit derivatives tend to perform better than cash bonds during a credit sell-off, making them a potentially valuable replacement in a portfolio.

The Bottom Line

There’s little doubt that the Federal Reserve will hike interest rates from today’s levels, despite signs of inflation slowing down. As a result, fixed income investors should continue to exercise caution and dynamically adjust their portfolios to control risk and exploit opportunities.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.