Focusing on factors has long been a way for sophisticated investors to achieve extra alpha and market-beating returns. By honing in on certain attributes, the idea is investors can achieve enough of an edge in certain markets to beat and add returns. A few years ago, factor investing became all the rage when fund sponsors launched countless ‘smart-beta’ exchange-traded funds (ETFs) designed to exploit various factors and bring the investing style to the masses.

The only problem? The vast number of these funds focused on the equity side of the equation.

That’s a shame because factor investing works very well in fixed income. Bonds have their own unique factors just like stocks. By exploiting them, investors can also achieve additional returns. With that in mind, it may be time to consider adding a dose of factor investing to your bond portfolio.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

Factor Investing Takes Shape

Investors’ fascination with factors might have started with research done by famed economist Fama & French. Their work looked at stock returns over long periods of time and then isolated certain factors of stocks. At their core, factors are specifically focused attributes that drive the return of an asset class. Fama & French’s work taught us how size, value, growth, and quality have all played out over the long haul and in different market conditions.

Since then, numerous fund groups and asset managers like Research Affiliates, AQR, and Dimensional have done additional research and launched funds covering various factors to improve returns.

However, fixed income investors have been left out in the cold for much of this research and fund launches. That’s a shame because fixed income could be the biggest beneficiaries of so-called fundamental indexing and factor investing.

For one thing, most fixed income indexes are flawed. Many traditional bond indexes—such as the benchmark Bloomberg US Aggregate Bond Index—are crafted by weighting the bonds based on outstanding debt. Those firms with more IOUs on their books get a higher placement in the index. Think of it this way: by using the index, you’re basically betting on the person with the most credit card debt to be the longest-term winner. That seems counterintuitive.

A Focus on Fixed Income Factors

Just like with equities, bonds have style factors that can be used to overcome this problem and identify the best opportunities for investment. Like equities, these include Value, Momentum, Low Volatility, and Quality. While all the factors can improve outperformance, a few make a difference.

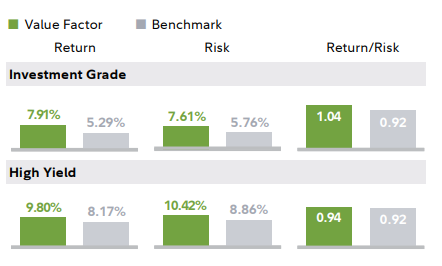

For example, the value factor in bonds looks at price relative to underlying fundamentals. Here, cheaper fixed income securities have historically outperformed expensive bonds. This is true across both investment-grade and high-yield sectors, as you can see on the charts from Fidelity’s research.

Source: Fidelity Institutional

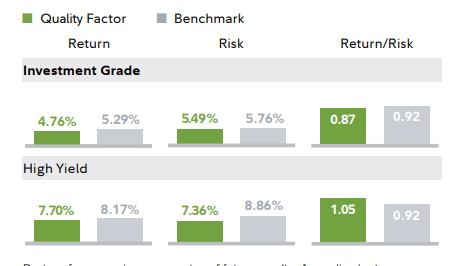

Likewise, quality—which looks at items like cash flows, sales, and other payback abilities—shows that bonds with a lower probability of default can outperform those with a higher probability of default on a risk-adjusted basis.

Source: Fidelity Institutional

Additionally, investors can also use factors on the macro side of the equation—such as duration, liquidity, and credit spreads—to hone in on ‘better’ bonds.

The proof is in the pudding. According to a recent study by Northern Trust Asset Management, a global investment-grade fixed income portfolio that overweights quality and value factors generates more yield—about 1.55% more—and better total returns than its benchmark. At the same time, it has a similar level of credit risk as the benchmark.

Taking a Look at Factors for Your Bond Portfolio

After last year’s drubbing of bonds, now could be the best time for investors to look at factor investing for a bond portfolio. By honing in on certain factors—such as value, quality, and duration—investors can create a portfolio of bonds that could outperform the broader aggregate index.

You can certainly do this on your own. But that’s probably more trouble than it’s worth to run analysis on the 30 or so bonds needed to craft an ‘OK’ bond portfolio. A better bet? Consider one of the new fixed income smart-beta ETFs that have recently launched.

Fund sponsors have started to get the hint that investors want these products and launches have been swift. These days, it’s pretty easy to craft a portfolio or add a sleeve of factor fixed income. For example, the Goldman Sachs Access High Yield Corporate Bond ETF (GHYB) can be used to tap ‘quality’ bonds within the junk space and the iShares Investment Grade Bond Factor ETF (IGEB) can be quickly added to own investment-grade bonds with a value and quality tilt. Investors now even have choices to exploit individual factors as well. The FlexShares High Yield Value-Scored Bond Index Fund (HYGV), for example, only hones in on value factors.

And this doesn’t include long-standing mutual funds offered by the three factor pioneers listed above.

The Bottom Line

Factor investing or smart-beta has long been a place for stock investors to tread. But it turns out it works wonders for fixed income. For investors seeking a bit more from their bond portfolios, exploiting factors could be the key to getting better returns in the new year. And now we have plenty of choice for just that.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.