The Federal Reserve is in a tough spot these days. On the one hand, the economy remains hot, and they don’t want to risk re-igniting inflation. But on the other hand, keeping interest rates high for too long could hurt economic growth and cause a recession. The sweet spot is the so-called ‘soft landing’ that appears remarkably possible.

In this article, we’ll look at the central bank’s latest policy statement and subsequent meeting and discuss what it might mean for investors.

Economic Growth Remains Strong

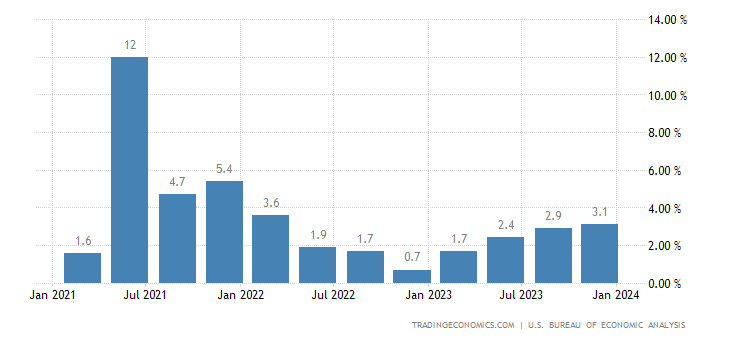

Recent economic indicators suggest that economic activity has been expanding at a solid pace, according to the Federal Reserve’s policy statement. While many economists expected a recession in 2023, the economy continued to grow at a brisk 3.3% annual pace from October through December, although that’s down from 4.9% last quarter.

U.S. GDP has been growing at a steady rate since the beginning of last year. Source: TradingEconomics

Consumer spending—which accounts for about 70% of the total economy—expanded at a 2.8% annual rate. Despite elevated consumer prices, demand for clothing, furniture, recreational vehicles, and services like hotels and restaurant meals soared. The University of Michigan’s Consumer Sentiment survey also jumped by the most since 1991 in Q4.

Despite the strong Q4 GDP reading, there are signs the economy could still see a recession in 2024. Manufacturing and service firms have cut their payrolls, credit card delinquencies hit a record high, and S&P 500 corporate net profit margins shrank last quarter. And, of course, the yield curve remains inverted, which is a reliable recession indicator.

Inflation Seems to Be Easing

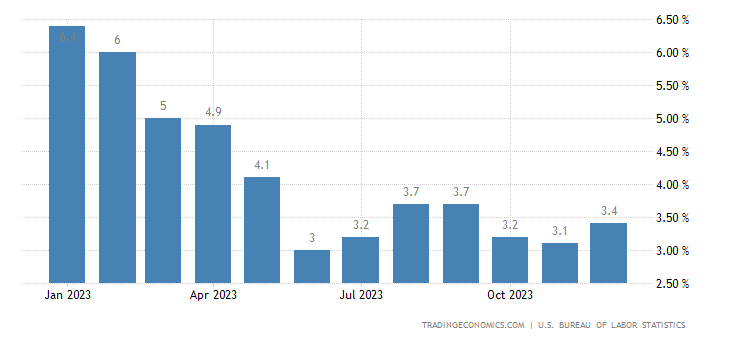

The annualized inflation rate clocked in at 3.4% in December 2023 (the next reading is coming on February 13). While that’s well ahead of the Federal Reserve’s long-term 2% target rate, it’s sharply lower than the 8% average in 2022. And, as we’ve seen earlier, the elevated rates don’t seem to be slowing consumer spending.

Inflation fell sharply throughout 2023 and continues to show signs of easing. Source: TradingEconomics

Still, the Federal Reserve was quick to note that it remains “highly attentive” to inflation risks, opting to maintain the target range for the federal funds rate at 5.25% to 5.50%. The central bank also made it clear it does not expect it to be appropriate to reduce the target range until it has gained greater confidence inflation will fall.

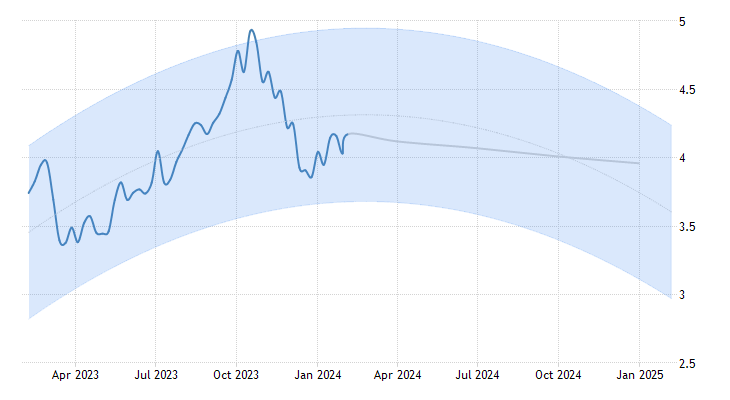

The market consensus is interest rates will fall toward the latter half of the year, with a 63.2% likelihood of settling into a range of 4.00% to 4.50% by December’s meeting, according to FedWatch. However, the first cuts aren’t expected until the June meeting, meaning high rates could take their toll over the coming months.

The Market's Response

The S&P 500 fell 1.6% in response to the Federal Reserve’s statement as the market repriced the expectation of a March interest rate cut. However, the long-term outlook remains unchanged, driving U.S. Treasuries lower amid expectations of a series of interest rate cuts later this year. Treasuries across most maturities fell around 13 basis points in immediate response to the policy statement.

10-Year Treasury yields are expected to fall over the coming months. Source: TradingEconomics

In fact, the bond market seems more convinced than the Federal Reserve that interest rate cuts will be necessary sooner rather than later. According to Bloomberg, swap contracts were still pricing in nearly six Fed quarter-point cuts by the end of December, which is about double the median projection from the central bank’s own quarterly rate forecasts.

How to Adjust Your Portfolio

Interest rates appear likely to fall toward the end of the year. Inflation seems to be abating while the economy is on shakier ground. So, fixed income investors may want to consider buying bonds as lower yields will push prices higher, although the bond markets appear more convinced of future rate cuts than the Fed’s own forecasts.

The Shiller P/E remains elevated from a historical perspective. Source: Multpl

On the other hand, equities appear quite expensive when looking at inflation-adjusted price-earnings ratios (Shiller P/E). With the risk of a recession on the horizon, investors may want to consider a more defensive posture for their portfolios over the coming months, moving into utilities, consumer staples, or healthcare instead of tech.

But, of course, the old axiom, “The market can remain irrational longer than you can remain solvent” is always worth remembering. After all, the economy defied expectations in 2023 and it could do the same in 2024. So, it’s worth following economic developments to maintain an accurate forecast over time as the Fed’s balancing act plays out.

The Bottom Line

The Federal Reserve doesn’t plan on cutting interest rates until the latter half of the year since the economy remains strong on the surface. But under the hood, there are signs of cracks that could lead to a recession in 2024. As a result, investors may want to position their portfolios accordingly to lock in high rates and reduce equity exposure.