Given the higher risks yet higher rewards, ABS bonds could find a home in your portfolio. Buying them individually is pretty much a no-go unless you are a high-net-worth investor or a major client at an investment bank. That means the rest of us need to use funds to purchase them.

Many broad bond index funds have some exposure to ABS bonds; albeit, usually less than 1%. ABS bonds are also a favorite stomping grounds of many actively managed total return bond funds. You may already have some exposure in your portfolio.

Investors willing to take on the additional risk and make ABS bonds a sleeve of their portfolio have some specific choices. For example, the BlackRock AAA CLO ETF (CLOA), Virtus Newfleet ABS/MBS ETF (VABS) and Panagram BBB-B CLO ETF (CLOZ) offer direct exposure to asset-backed securities, while the Loomis Sayles Securitized Asset Fund (LSSAX) uses a mutual fund to get access.

Adding a swath of these funds could be key to getting some additional yield into a portfolio. However, investors need to understand the risks and keep the positions small.

In the end, asset-backed securities provide an interesting fixed income asset class for portfolios. While there are risks, investors do get higher yields. For more aggressive investors, ABS could be top-notch play.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.

Adding ABS Bonds to a Portfolio

Preferred stock is one of the few classes of so-called hybrid securities. That is, they blend the line between bonds and common stocks. When you buy a share of Walmart, you are buying an ownership stake in the company. When you purchase a 10-year Treasury bond, you are essentially lending the U.S. government money with a promise to pay you back plus interest. Bonds are loans, stocks are ownership.

Preferred stocks offer the best of both worlds. On the bond side, they are issued at a certain amount called par value, usually at $25 or $1000 per share. Like a bond, preferred shares feature a maturity date. After that date, the issuing company can call the security and investors will receive the par value for their shares. This creates a price floor and bond-like stability.

But preferred stock also features stock-like attributes. For one thing, preferred stock represents equity or ownership in the underlying business. And because of their ‘preferred nature.’ these securities have a higher placement in the capital stack. That means all dividends must be paid to preferred shareholders first before a penny is paid out to common shareholders. Preferred shares are very stock-like in their trading too. Based on demand and market forces, preferred stock can be issued at premiums or discounts to their par value, allowing for potential capital appreciation.

The Real Estate Rundown

The vast bulk of preferred stocks in the United States are issued by financial institutions like banks and insurance firms. Utilities make up the next batch. Rounding third, but perhaps offering the best opportunity, are real estate investment trusts (REITs).

Building and buying commercial properties can be a very expensive endeavor. The rub is that most banks and lenders will not provide more than 80% of required capital as a commercial mortgage. And most will only provide 60% to 70%. That funding gap needs to be made up by the real estate investor. Rather than pay cash for the difference, a real estate company will often tap other lines of credit. Another solution, and one that investors tend to like, is issuing preferred stock to cover the purchase.

This provides capital for the real estate firm, while providing a layer of safety to those investors funding the project. When it comes to REITs, preferred stock is often issued when the firm is making a large purchase of multiple properties in a buy-out or major construction expansion. But the concept is the same.

The win for investors in real estate preferred stock is that they get a higher placement in the capital stack, but also get additional yield over common shares. Just how much more yield? Try nearly double. For example, Public Storage (PSA) is one of the largest REITs on the planet and currently yields 3.97%. However, its class H preferred shares are currently yielding closer to 6%. And PSA isn’t alone in this fact.

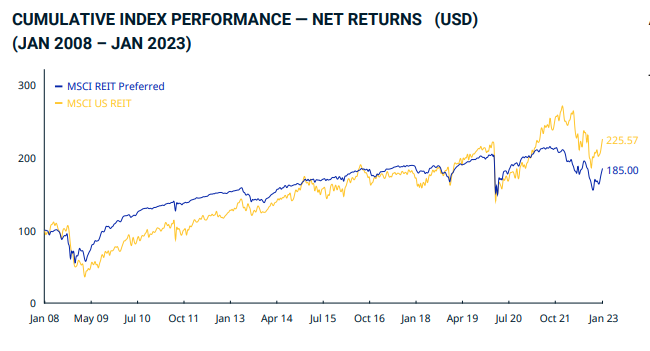

As for default rates, REIT preferred shares have been solid. Even during the Great Recession, the vast bulk of the sector continued to stand tall. Given the cumulative nature of many preferred stock—meaning any missed payments must be made up before common equity holders receive anything—many kept preferred dividends going during the dark times. As a result, returns for REIT preferreds have been pretty good.

You can see by this chart from MSCI of the U.S. REIT Preferred Index that the sector has done well in many markets versus equity REITs. It was only recently that the sector underperformed due to the Fed’s raising of interest rates. It should be noted that dividends have continued to flow in recent quarters.

Source: MSCI

Buying REIT Preferreds

Given the recent underperformance, high yields, and preferential placement in the capital stack, real estate preferred stocks are looking pretty good. Ultimately, they give fixed income investors another way to profit from real estate’s appeal.

Making a purchase is quite simple. There’s one ETF — the InfraCap REIT Preferred ETF (PFFR) — that focuses solely on REIT preferred shares. Using it to get a foothold in the sector could be a good choice.

Individually, there are plenty of choices as well. Many top REITs like Realty Income (O), Vornado (VNO), Kimco (KIM), and SL Green (SLG) offer preferred shares. Simply researching tickers and placing a buy on your brokerage platform is all you need.

Now there is one caveat and that’s taxes. Since these are REIT shares, dividends from real estate preferred stock are not qualified. That means you’ll pay higher tax rates. At the same time, if you buy a preferred for below par value and it’s called, you’ll pay taxes on the gain. That makes real estate preferred stocks wonderful additions to a tax-deferred or tax-free account. Another issue is trading volume. Most investors buy and hold, so volumes are low. That means using limit orders.

The Bottom Line

Real estate preferred stock offers fixed income investors a wonderful chance to participate in the real estate sector with high yields and plenty of stability.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.