Global sustainable funds attracted $32.6 billion of net new money during the second quarter of 2022, according to Morningstar, despite the broader market seeing $280 billion in net outflows. At the same time, 245 new sustainable funds launched worldwide as asset managers continue to repurpose conventional products into sustainable offerings.

Greenwashing – or misleading investors about the environmental merits of an investment – is one of the biggest concerns for ESG investors. For example, a bond issuer might highlight its sustainability in one area while neglecting to mention its shortcomings in another part of its business. As a result, investors may be inadvertently doing harm.

Let’s take a closer look at greenwashing, evolving regulations designed to prevent it, and how investors can avoid it by turning toward independent verification.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

What Is Greenwashing?

Greenwashing involves intentionally misleading investors about the environmental benefits of a particular investment. For instance, China’s Three Gorges Dam operator issued a $840 million green bond to back wind power projects in Europe. But, under the surface, Three Gorges Dam is a known source of water pollution and environmental damage.

Two structural problems lead to greenwashing:

- Lack of standardized terminology: Fund managers might cite sustainable, socially responsible, ESG and impact investing strategies, but these terms aren’t well-defined.

- Lack of standardized strategies: Fund managers can use any method they choose to implement ESG criteria. And, in some cases, ESG factors may not even be central to choosing a fund holding.

Fortunately, the U.S. Securities and Exchange Commission (SEC) is following in the footsteps of its European counterparts and developing better disclosure standards. In particular, the agency’s proposed rule on the Enhancement and Standardization of Climate-Related Disclosures aims at greenwashing and improving compliance.

How To Avoid Greenwashing

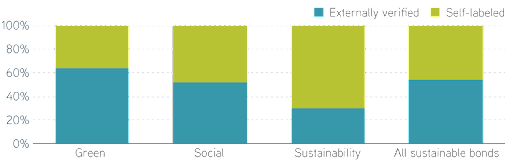

The SEC may be way off from implementing new ESG standards, but fortunately, third-party organizations can fill the gap. According to S&P Global Ratings (see below), approximately half of all global sustainable bonds are externally-verified. As a result, investors should take precautions and conduct the due diligence necessary to verify the impact.

Most green bonds are externally-verified, but few sustainability bonds have similar reassurances. Source: Parametric Portfolio

The most prominent group is the Climate Bond Initiative, an international non-profit working to mobilize global capital for climate action. The organization maintains the Climate Bond Standard and Certification Scheme, along with Policy Engagement and Market Intelligence work, providing investors with the information they need.

For instance, the VanEck Green Bond ETF (GRNB) holds a portfolio of supranational, government and corporate green bonds designated as “green” by the Climate Bond Initiative. As a result, investors can be confident that they’re avoiding greenwashing and that their dollars are really going towards projects helping the environment.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

Sustainable investments have become increasingly popular over the past few years, but greenwashing remains a problem. While the SEC is developing better disclosure rules, investors can turn toward third-party validators like the Climate Bond Initiative to verify that green bonds and other sustainable investments continue to meet high standards.

Make sure to visit our News section to catch up with the latest news about income investing.