Many investors associate high-yield bonds with the leveraged buyouts of the 1980s and colorful Wall Street personalities like Michael Milken. But today’s high-yield bonds are a much broader market. And with their equity-like returns and comparatively low volatility, you might consider a permanent allocation to diversify your portfolio.

Let’s look at how to add high-yield bonds to your portfolio using exchange-traded funds (ETFs).

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

What Are High-Yield Bonds?

High-yield bonds, also known as ‘junk bonds,’ are issued by companies that don’t qualify for an investment-grade rating by a credit rating service. Typically, these issuers will pay a higher interest rate to compensate investors for the higher credit risk. But fortunately, investors can mitigate the risk of any individual bond default with diversification.

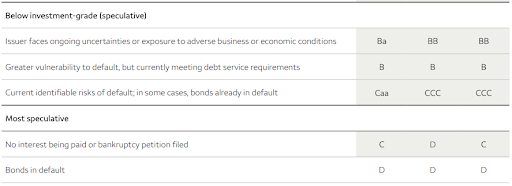

High-yield bonds may fall into several rating categories:

Source: Wells Fargo Advisors

They also come in several different structural flavors:

- Cash-pay bonds pay a fixed-coupon interest rate, paid in cash, until maturity.

- Step-coupon bonds pay an initial fixed-coupon interest rate until a specified date when the issuer may opt to call the bond or pay a higher rate until the final maturity date.

- Zero-coupon bonds are sold at a deep discount to their face value and pay no current interest to bondholders. At maturity, the bondholder receives the compounded interest and principal.

- Convertible bonds enable bondholders to convert the bond into a specified number of common shares or cash of equal value.

In the context of a portfolio, high-yield bonds are ‘hybrid assets’ exhibiting the characteristics of both fixed-income and equities. They offer coupon payments like fixed-income securities with the dynamics of equities. For example, their price depends more on the business’s success than prevailing interest rates.

Strong Long-term Performance

High-yield bonds have historically provided equity-like returns with less volatility than stocks, making them an attractive asset class.

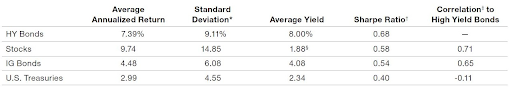

An October 2022 research published by T. Rowe Price found that high-yield bonds returned an average of 7.39% with a 9.11% standard deviation over the past 20 years (see below). By comparison, equities offered a 9.74% annual return with a 14.85% standard deviation, and investment-grade (IG) bonds provided a 4.48% annual return with a 6.08% standard deviation.

Source: T. Rowe Price

Moreover, the same T. Rowe Price analysis found that high-yield bonds only had negative returns in five of the last 25 calendar years. And investors that stayed in the bonds often saw an immediate outsized return following a bad year. These strong results persisted regardless of market cycles, which separates the asset class from pure equities or IG bonds.

Despite these strong performance figures, investors should remember that high-yield bonds come with unique risks. Most issuers repay bonds at maturity, creating an asymmetric risk profile. If there’s a default, investors risk missing out on coupon payments and never receiving a repayment of the principal amount.

Most Popular High-Yield Bond ETFs

Exchange-traded funds (ETFs) are the cheapest and easiest way to add high-yield bonds to your portfolio. And with nearly hundreds of options to choose from, you have ample flexibility when selecting a fund for your portfolio.

The largest high-yield bond ETFs include:

| Name | Ticker | AUM | Expense |

| iShares iBoxx $ High Yield Corporate Bond ETF | HYG | $19 billion | 0.48% |

| SPDR Bloomberg High Yield Bond ETF | JNK | $9.8 billion | 0.40% |

| iShares Broad USD High Yield Corporate Bond ETF | USHY | $8.8 billion | 0.15% |

| iShares 0-5 Year High Yield Corporate Bond ETF | SHYG | $7.2 billion | 0.30% |

| SPDR Blackstone Senior Loan ETF | SRLN | $6.4 billion | 0.70% |

Not surprisingly, interest rate hedged high-yield bond funds and senior loan funds have been the best performers in today’s bear market. These funds eliminate the impact of rising interest rates that lead to higher yields and lower bond prices. At the same time, senior bonds have less default risk as the economy looks poised to enter a recession.

Some funds that fit into these categories include:

| Name | Ticker | YTD Performance | Expense Ratio |

| iShares iBonds 2022 Term High Yield & Income ETF | IBHB | 1.12% | 0.35% |

| ProShares High Yield Interest Rate Hedged ETF | HYHG | -0.58% | 0.50% |

| iShares Interest Rate Hedged High Yield Bond ETF | HYGH | -1.47% | 0.52% |

| iShares iBonds 2023 Term High Yield & Income ETF | IBHC | -1.55% | 0.35% |

| First Trust Senior Loan Fund | FTSL | -2.45% | 0.86% |

The Bottom Line

High-yield bonds have a bad reputation from the 1980s, but these days, they can serve as a valuable long-term allocation. With their equity-like returns, low volatility, and attractive income potential, these bonds can help boost any portfolio during uncertain times. The key is picking the right fund based on the market conditions.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.

All data as of November 25, 2022.