Junk bonds have been a wild ride for investors since the 1970s and 1980s. After the 2008 financial crisis, a record low interest rate environment created even more demand for junk bonds to shore up income. However, the recent combination of rising inflation and record low interest rates creates a dangerous environment for junk bond investors.

Let’s examine why investors may want to beware of junk bonds, as well as some alternatives to consider for yield.

To learn more about different ways to generate income, visit our Fixed Income Channel.

Inflation on the Rise

The Consumer Price Index, a measure of inflation, rose 0.9% in June 2021 to a 5.4% annualized rate. That’s the fastest 12-month increase since 1991 when excluding food and energy. Used cars and trucks, new vehicles, airfares, and apparel saw the most significant price increases while rising housing prices have experts concerned inflation won’t be temporary.

Despite the rising inflation, bond yields remain near record lows. Currently, 10-year Treasury bonds yield 1.25%, off their 2020 lows of around 0.5%, but far from their 4.34% long-term average or ~3% levels in 2018. Expectations for near-zero interest rates through 2023 and ongoing government stimulus have fueled the record low rates.

Many experts warn that the recovering economy, rising inflation, and record low rates could signal pain for fixed-income investors. For example, Warren Buffett warned fixed-income investors in March that they could face a bleak future over the coming years. But, of course, timing is everything in the market, and predicting a recovery is a challenge.

Does Quality Matter?

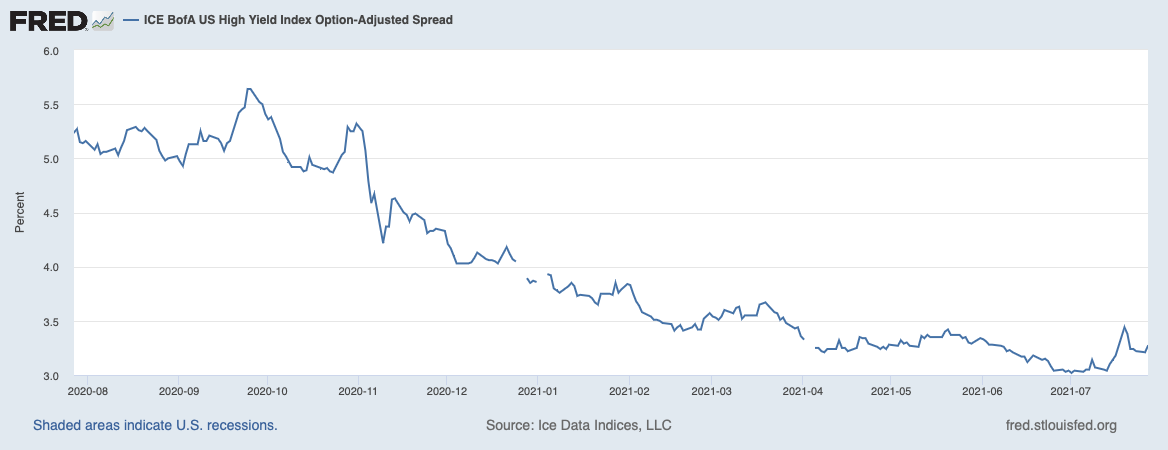

The spread between junk bond yields and risk-free yields has also reached 25-year lows. These spreads are the compensation that investors earn above the risk-free benchmark for taking on greater risk. The narrowing of these spreads suggests that yield-starved investors are increasingly willing to forgo quality for income.

Junk Bond Spreads vs. Treasuries – Source: FRED

Some of these trends are justified.: Defaults in the junk bond market are near historic lows, and the Federal Reserve hasn’t pulled back its monthly $120 billion bond-buying programs. In some ways, junk bonds have become safer during the COVID-19 crisis thanks to a range of fiscal and government support programs to keep them afloat.

The problem is that these support programs are only temporary. Some broader support programs are already starting to disappear, leading to higher yields and lower prices for junk bonds. With these support systems removed, investors may begin to scrutinize junk bonds more closely when searching for higher yields than investment-grade alternatives.

Watch These Catalysts

Several catalysts could trigger the next big moves in the junk bond market and the broader bond market.

The rise in COVID-19 cases throughout parts of the United States could lead investors to reassess economic growth projections. In particular, with the delta variant causing the fourth wave of infections, investors will be keeping an eye on everything from further supply chain disruptions to forced closures, especially with the winter season coming up.

In August, Federal Reserve officials will meet in Jackson Hole, Wyoming to discuss their next moves. These meetings always have the potential to be market-moving, but the high level of uncertainty surrounding inflation and COVID-19 could make these movements even more volatile. Any rise in benchmark rates could lead to a bond market sell-off.

Other Sources for Yield

Stocks provide an excellent hedge against rising inflation and interest rates, and dividend-paying stocks offer a source of income. While dividend yields fell along with interest rates, the recent economic recovery has led many companies to increase their dividends, and buybacks have reduced the number of outstanding shares.

In addition to stocks, many investors have turned to alternative investments for yield. For example, private real estate investments provide a source of rental income and the potential to generate capital gains. Similarly, private and peer-to-peer lending offers an opportunity to increase yield while creating a diversified portfolio.

Check out our list of the Highest Safe-Yield Securities

The Bottom Line

Junk bonds have been a popular asset class since the 2008 financial crisis with low interest rates worldwide. However, the recent resurgence in inflation and already record-low rates have created a dangerous environment. As a result, investors may want to consider alternatives to shore up yield in their portfolios until junk bond spreads widen.

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.