Income seekers are still having to navigate the problem of low rates. Thanks to the pandemic, the world’s central banks have once again sent benchmark interest rates to zero in an effort to restart the economy. As a result, traditional income products like CDs, bonds, and money markets are basically paying nothing. The problem is that an old foe is starting to return.

We’re talking about inflation.

As the economy has reopened, inflation has begun to pick up. With the Fed’s mandate of inflation averaging, inflation may be allowed to run higher than normal as the Central Bank focuses on its other goals. For investors, it’s a one-two punch: lower current income and higher losses to purchasing power.

But there may be a solution. Senior and bank loan funds may offer some inflation protection and higher yields needed to get through the current malaise.

Have you heard? We’re launching the premier event for ETF investors. Learn more about the Exchange here

Lending Money for Higher Yields

Senior loans or bank loans are a weird bird when it comes to fixed income investing. They have elements of the more common junk bond market, treasury inflation- protected securities, and asset-backed securities all rolled into one bond type.

At their core, senior loans are just that: loans made by banks to corporations bundled together for investors. Typically, senior loans are often issued to companies with credit ratings below investment grade. This means they offer higher starting yields than Treasury bonds. The kicker is that they are typically tied to physical assets such as a pipeline, factory equipment, accounts receivable or even intellectual property. That provides a bit of safety to the bonds during bankruptcy proceedings. The ‘senior’ in senior loans means loan-holders are paid first if a company defaults. Often the bank will be able to take control of the pledged asset.

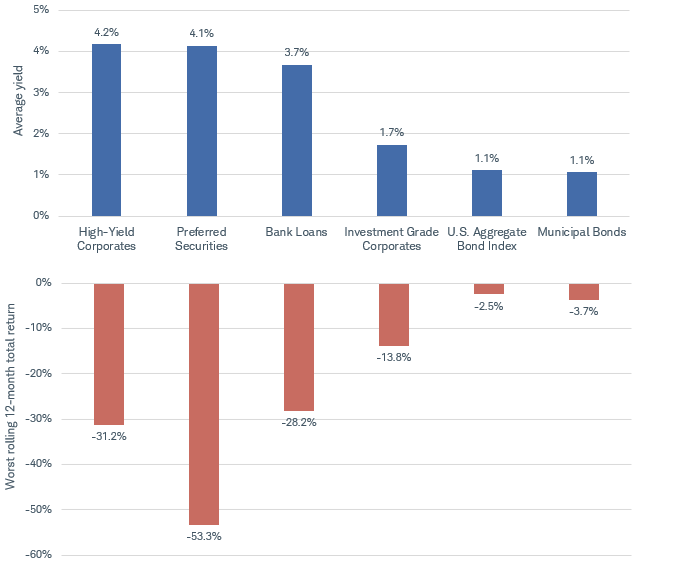

This provides a high yield similar to junk bonds without their typical risk profile. And you can see by this chart from Charles Schwab how the returns/losses for senior bank loans compare to other high yielding bond types. As you can see, senior loans feature smaller drawdowns while still providing a similar yield/return as other high yielding securities like junk bonds and preferred stock.

Source: Charles Schwab

A Secret Inflation Fighter

The real win for senior loans is that they have the ability to fight inflation as well. The coupons associated with the vast bulk of bank loans are floating. That is, they change as short-term reference rates — historically, the London Interbank Offered Rate (LIBOR) — shift every around. So, every 30 to 90 days, the interest rate a bank collects from its loan will change.

The win for inflation-fighting securities is that LIBOR and other short-term reference rates move higher as inflation grows. They feature some of the lowest durations in the bond world. Normally, the Fed and other central banks will raise rates as inflation increases to cool off the heating economy. Because of that, LIBOR and other short-term reference rates are able to react quickly to these changes and rise.

Issuing firms and investors are able to get an increasing yield as inflation rises.

Be sure to explore our Fixed Income Channel to learn more about income generating strategies.

Getting Senior With Your Income Portfolio

On the one hand, senior loans offer higher initial yields than many other fixed income products. On the other hand, they have the ability to raise that yield as inflation increases. This duality makes them an ideal holding for many investors looking to boost their income. There are some caveats.

For one thing, they are riskier than traditional corporate bonds. The average senior loan is issued to firms in the ‘junk’ ratings category (i.e., those rated BB+ or below by Standard and Poor’s or Ba1 or below by Moody’s Investors Services). So, Microsoft or Walmart aren’t the kinds of firms issuing senior loans.

Secondly, buying them individually is nearly impossible unless you’re an institutional investor or ultra-high-net-worth investor. It takes millions of dollars to purchase them and cobble together a portfolio to reduce risk. Luckily, there are numerous funds — both active and passive — that allow investors to participate in the sector.

Finally, senior loan investors do need to worry about taxes. Interest income from senior loans count at ordinary income rates. So, holding senior loans in a tax-deferred or tax-free account is best.

Learn more about bank loan funds here

In terms of ETFs, both the Invesco Senior Loan ETF (BKLN) and the SPDR Blackstone Senior Loan ETF (SRLN) are the two largest in the sector. BKLN offers a passive/index-hugging approach, while SRLN is active. Both feature billions in assets, swift trading volume, and access to hundreds of senior loans all for a low cost. Better still, the ETFs yield 3.29% and 4.76%, respectively.

Mutual funds have often been a prime stomping ground for senior loan funds. Active management can play a huge role in fixed income returns as credit research is often subjective and based on skill. There are more than 50 mutual funds in the category, with the Fidelity Floating Rate High Income (FFRHX), T. Rowe Price Floating Rate (PFFRX ), and Voya Senior Income A (XSIAX ) all earning top marks from ratings agencies. Like the previous ETFs, investors can get access to a wide portfolio of loans, high yields, and inflation protection.

Perhaps the best part of either choosing ETFs or mutual funds is that these vehicles often pay their dividends monthly.

The Bottom Line

For investors looking to fight inflation and get high current income, there aren’t many choices that offer all the benefits of senior loans. Offering floating rates and a higher place in the bankruptcy ladder, investors may want to consider them as part of their income portfolios.

Make sure to visit our News section to catch up with the latest news about income investing.