If you’re like me, you’ve probably noticed that your weekly grocery bill or the cost to fill up your tank has been getting a bit more expensive. After years of zero-to-low price increases, inflation is back with a vengeance. Measures of consumer and producer prices have exploded, relatively speaking, in recent weeks as a variety of factors have come to fruition.

And while the U.S. is nowhere near reaching Zimbabwe-style hyper-inflation rates just yet, the potential for higher prices and a return to normal with regards to inflation is considered market-wise a certainty. The time to prepare is now.

That’s why investors should take a tip with regards to, well,TIPs.

Long ignored in our recent low-inflation world, Treasury Inflation-Protected Securities (TIPS) are still one of the best instruments for fighting rising prices. The bonds can be complex to understand, but they can also be used to form a base of inflation-fighting cash. Given the recent return of inflation, now could be the best time to consider adding TIPs to your fixed-income portfolio.

To learn more about different ways to generate income, visit our Fixed Income Channel.

Rising Inflation

To be honest, we’ve been spoiled. Thanks to efforts to reignite the economy after the Great Recession and now the COVID-19 crisis, interest rates have been at zero for what feels like a decade. With the continued slow but steady growth caused by both of these events, measures of rising prices have been mostly muted. All of that seems to be changing in the post-pandemic world.

Consumer prices have surged. According to the Bureau of Labor Statistics, the latest Consumer Price Index for All Urban Consumers (CPI-U) figures for April showed a whopping 4.2% year-over-year increase. This follows March’s 2.6% jump to consumer prices. Producers’ prices have also seen a similar surge higher.

Perhaps worse is that the jump in inflation could be a return to normal. The Fed continues to support a policy of inflation-targeting, which lets the central bank run above its 2% target, in order to fight high unemployment. Meanwhile, supply constraints and shortages due to the pandemic have continued to boost prices. And, finally, the opening of the world’s economy has continued to support growth with stimulus measures adding an extra oomph.

With all of this, we could be back to a normalized 2 to 3% inflation rate per year.

TIPS to the Rescue

With the return of inflation, investors have once again started to take a serious look at Treasury inflation-Protected Securities or TIPS. Since last September, the bond variety has seen a huge amount of investor interest and we haven’t had a negative week of inflows into the security type since then.

The bonds are a sort of weird animal in the fixed-income world. The easy way to think about TIPS is a bond that provides investors a fixed yield plus an extra boost of continually ongoing adjustments designed to offset inflation. However, they are a bit more complex than just that.

For starters, TIPS function like traditional savings bonds or zero-coupon bonds. What that means is that investors don’t actually receive interest payments each year. When you buy a regular Treasury bond, like the benchmark 10-year, twice a year, Uncle Sam will send you a check for the interest. Most corporate bonds function in the same way. Whereas, this isn’t the case for TIPS.

For TIPS, their face value is tied to the CPI and adjustments are based on rates of inflation. The Treasury pays the set coupon interest on the adjusted face value of the bond, so investors get this inflation adjustment stream of income. When the bond matures, investors will receive the original value plus all of the inflation kickers that were added to the bond.

In practice, it looks like this: An investor buys $1,000 worth of a 10-year TIPS with a 2% coupon rate. In the first year, inflation spikes to 3%, and then the face value of the bond rises by that amount to $1,030. The investor now receives their coupon payment of 2%. Since the face of the bond has risen, they’ll get $20.60 this year.

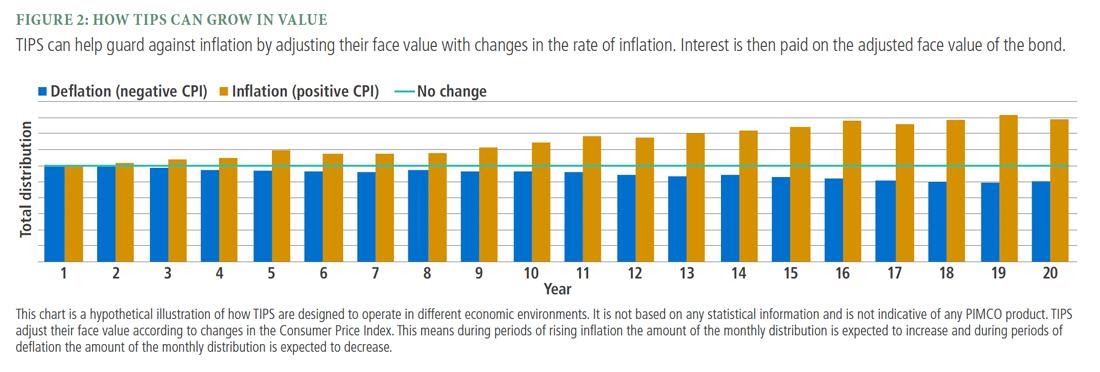

You can see by this chart from PIMCO how TIPS basically function with regards to inflation fighting.

Source: PIMCO

A Few Caveats to Look out For

As we know, there’s no such thing as a free lunch. Because TIPS are designed to provide a real return, that means they can also produce lower returns for portfolios, which is illustrated by the blue bars in the chart above. In cases of deflation, the face value does adjust lower – and that sort of happened a few times over the last decade or so.

Secondly, despite not paying out their interest, you’ll pay taxes on those coupon payments each year as you receive them. Dubbed “phantom income,” this tax can be avoided by holding TIPS in tax-deferred or tax-free accounts.

Finally, TIPS are subjected to the same rules as regular bonds when it comes to interest rates. When the Fed raises rates, newly issued bonds will carry a higher coupon. This tends to send the price of already issued bonds lower in order to match the new higher coupon rate. If you’re planning on holding a TIPs to maturity, this isn’t an issue. But if you need to sell, you could experience losses. This plays into the idea of break-even rates versus regular bonds. TIPS often trade on the secondary market at discounts or premiums based on expectations for future inflation.

How to Use TIPS

For investors, TIPS make an ideal way to protect purchasing power in a portfolio. With them, you’re basically able to push inflation-protected cash out for future use. Getting your hands on them is pretty easy.

You can buy them directly from the Treasury via their Treasury Direct website for a minimum of $100. You can have the Treasury withhold phantom income taxes as well. Buying TIPS directly is great if you can hold them until maturity.

However, there are countless mutual funds and ETFs that hold TIPS as their assets. The iShares TIPS Bond ETF (TIP) is the largest ETF in the sector, while the Vanguard Inflation-Protected Bond (VIPSX ) is a top-rated mutual fund. Both offer broad exposure to TIPS and can be used to quickly gain exposure. Better still, they can be placed inside tax-deferred accounts like IRAs to avoid phantom taxes. Investors can also find ETFs and mutual funds that focus on the smaller end of the maturity scale to help protect against rising interest rates.

The Bottom Line

Inflation hasn’t been a problem for the last few years. However, that looks like it’s all about to change. With key measures of inflation rising, it could mean that it’s finally time for investors to embrace Treasury Inflation-Protected Securities (TIPS) again. The bond type could be exactly what investors need going forward in these unprecedented times.

Use the Mutual Funds Screener to find the security that meet your investment criteria.