To be honest, it’s pretty difficult to be a bond investor these days. The current environment is a tough nut to crack. On one hand, low interest rates mean that shorter-term bonds and cash are paying next to nothing. This is a huge issue considering the high rates of inflation currently affecting the economy – an issue that hurts longer bonds as well. Rates will rise sooner than later, which will push down prices for longer-dated bonds, resulting in potential losses.

But those seeking income from their portfolios may have a way to get some yield back while mitigating interest rate effects.

The answer may be in private credit.

Once an asset class reserved for institutional and high-net-worth individuals, private credit options are now available to the average Joe. Given the asset class’ unique benefits, it could be worth a portfolio addition in the current environment.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

Making Loans

Right now, bonds aren’t paying anything. Even with the threat of rising rates, the benchmark 10-year Treasury is currently yielding around 1.66%. Shorter bonds are paying much less, while longer-dated bonds will see their prices fall as rates rise, which could produce capital losses for investors. Fixed income investors are truly facing a major quandary: – how to get a real yield while still having the diversifying effects of bonds.

Private credit funds could provide exactly what investors are looking for.

Essentially, private credit is a pool of loans, which may include small business loans, venture debt, consumer loans, accounts receivable loans, law financing, fleet financing, etc. Key is that they are made by non-bank lenders. Historically, this has been the realm of private equity groups and institutional investors. They differ from so-called senior loans, which are often made by banks and are tied to a certain asset like a pipeline or manufacturing equipment.

They differ in another way as well: They aren’t publicly traded. Often, private funds feature periods in which capital is essentially “locked up” and investors can’t withdraw their money or exit the pool of loans.

But in exchange for this lock-up period, investors are treated to some great benefits.

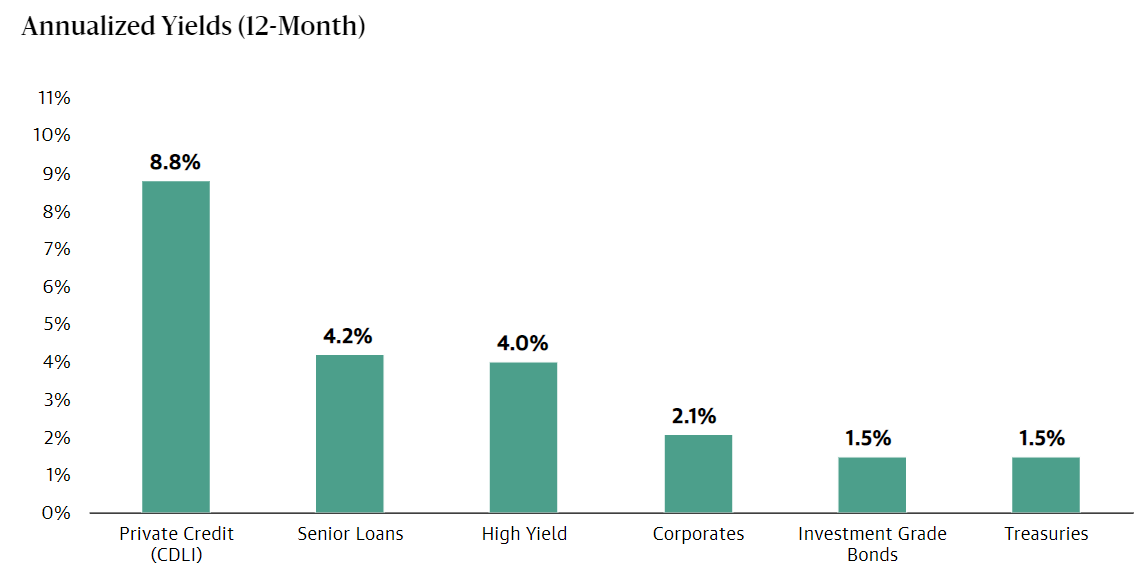

For one, yields on private credit are higher – about double what traditional high-yield or junk bonds are yielding. This chart from private equity group BlackStone, which offers a variety of private credit options, shows the sheer yield that investors can get from private credit.

Source: BlackStone

Secondly, private credit offers higher, longer-term returns. Looking at junk bonds and senior loans – which are its closest competitors – private credit has managed to produce an extra 2-basis points in return versus junk bonds over the last 15 years at more than half of the volatility. Meanwhile, it’s doubled senior returns at about half the volatility as well.

Finally, private credit has managed to do this while being non-correlated with the broader bond market. Looking at the benchmark investment grade Bloomberg US Aggregate Bond Index, private credit has a negative 0.27 correlation.

The combination of these factors offers investors a unique and alternative asset class.

Accessing the Once Inaccessible

The win for investors is that the private credit market is starting to open up to regular Joes. Previously, it was the stomping ground for high-net-worth investors, pension funds and university endowments. We’re talking accretive investors and high initial investments of $1 million or more.

These days, private credit is opening up through a variety of different means. Thanks to changes in regulation, there are numerous direct platforms that allow investors to buy into private loans. For investors who aren’t comfortable with tech start-ups, more traditional asset managers are getting in on the act. This includes mutual and interval funds designed to own private credit loans.

One of the biggest is from BlackStone as the non-traded Blackstone Private Credit Fund (BCRED). The fund invests in private credit and can be had for a low initial investment of $2,500. Another example could be the interval mutual fund FS Credit Income Fund (FCREX). The fund also owns private loans and features a $1,000 initial investment for IRA accounts. Private credit can also be found as a sleeve in many multi-alternative mutual funds these days.

Another route for private credit could be found in so-called business development companies, or BDCs. Here, investors own shares of firms that make these sorts of private credit loans. While the correlation isn’t one-to-one and market risk is now added on, BDCs can provide high yields thanks to their pass-through tax structures. For example, both Apollo Investment (AINV) and Goldman Sachs Business Development (GSBD) yield nearly 10%.

Finally, investors can take the ETF route to private credit. The Virtus Private Credit Strategy ETF (VPC) owns BDCs, closed-end funds, and other private credit vehicles to give investors an alternative income source. Again, while it’s not a perfect correlation to private credit, VPC does provide an all-in-one approach.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

With rates rising and bonds yielding next to nothing, fixed income investors are in a muddle – which is where private credit can come in. The asset class can provide plenty of extra yield and diversification benefits to a portfolio. And now, investors have plenty of access to it.

Make sure to visit our News section to catch up with the latest news about income investing.