Investors are sitting on a lot of cash. After the various stimulus measures, gains, and rising uncertainty of the last year, cash balances have continued to grow. And while cash may be the safest of all asset classes, it doesn’t mean it’s risk free.

Just ask depositors in Silicon Valley Bank or First Republic.

With the recent bank failures and risks still growing in the financial sector, investors both big and small are rethinking their approach to cash management. Balancing liquidity and safety are key issues. But luckily, there are ways for investors to have their cake and eat it too.

The Wave of Bank Failures & Our Cash

People forget that when you deposit money at a bank, technically, the money becomes an asset of the bank. During the Great Depression, depositors learned this lesson the hard way. In the modern day, FDIC insurance protects our deposits, but only to a point. Here again, a lesson was learned in recent months.

Banks only hold a certain amount of liquid cash themselves, investing the rest in their reserves. Typically, safe assets like bonds, Treasuries, and mortgage-backed securities are the asset of choice. It turns out this was a mistake in the current rising rate environment. In the case of both First Republic and Silicon Valley Bank, questions were raised about their solvency and value of those reserves held in longer dated bonds.

For depositors, this was a nightmare. Thanks to their high-net-worth nature, there were questions about deposits above the current FDIC limits of $250k. And while bank transfers/failures have an orderly process, it still limits liquidity as the transfers take place.

The problem is that risk to the banking sector is still real. With the Fed still keeping rates at elevated levels, commercial/residential real estate prices falling, and investor concerns about liquidity, many smaller regional banks are facing a precarious position.

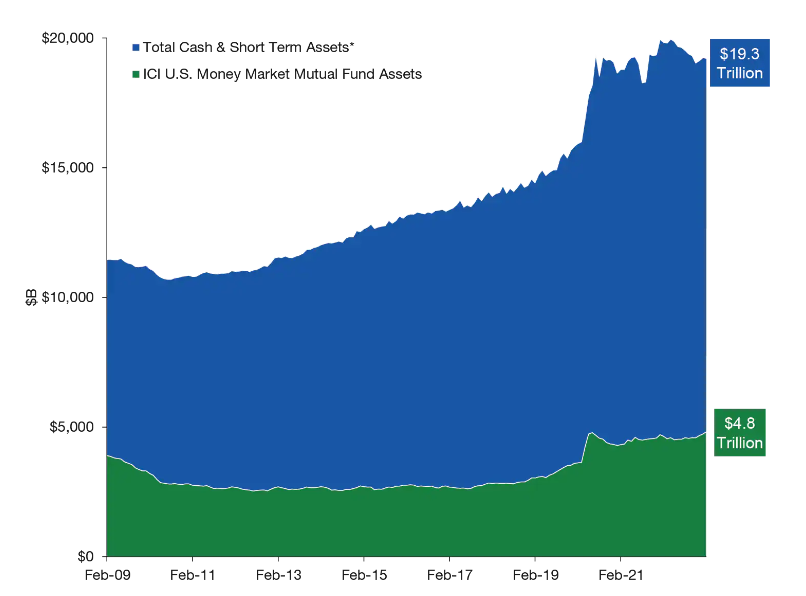

We have a lot of cash too. According to the latest data from investment researcher ICI, investors held more than $19 trillion in bank deposits, money market funds, and certificates of deposit (CDs) as of the end of February 2023. 1 This chart from Lord Abbett shows the sheer amount of cash build-up over the last decade.

Source: Lord Abbett

Ultra-Short Duration Funds to the Rescue

For savers and investors, the current banking issues and build-up of cash beyond FDIC limits means we’re having to think about our cash holdings in a new way. To that end, adapting and using new solutions is key.

According to JPMorgan, the latest banking issues require investors to create cash segmentation in their portfolios. This means using a combination of instruments. Investors should think about their cash in terms of four buckets: daily needs, six months to one year, one to three years, and over three years.

For daily needs, this might mean a simple savings or checking account at their bank. For investors with more cash, new cash management accounts could be the answer. These brokerage accounts sweep deposits into a variety of programs, so each one holds only up to the FDIC limit. This provides liquidity and insurance on deposits.

Short duration bonds have been a category for a long time. But in recent years, a new category of bond and bond fund has emerged. Ultra-short duration bonds are those with less than a year to maturity, and sometimes as little as overnight. It’s here that investors can get yield, liquidity, and cash-like functionality without having to be above FDIC limits.

For example, the iShares Ultra Short-Term Bond ETF, JPMorgan Ultra-Short Income ETF, and PGIM Ultra Short Bond ETF are all actively managed to provide a high yield, while maintaining a very short duration profile. Moreover, as ETFs they provide liquidity. The best part is the very short maturity profiles of their holdings has allowed all three to experience very little in terms of price volatility, making them ideal candidates for a cash segmentation strategy.

Moving further out, more traditional short duration bond funds like Vanguard Short-Term Bond Index Fund or Goldman Sachs Short Duration Bond Fund—with durations in the one- to three-year range could be used for the rest of the cash segmentation pie.

Better still is that investors in high tax brackets have plenty of choice for limiting taxes when it comes to cash segmentation. Thanks to the rise of ultra-short duration muni bond ETFs like the JPMorgan Ultra-Short Municipal Income ETF, tax-aware investors can also limit what they owe to Uncle Sam while providing liquidity.

Here’s a list of some top-performing funds that can be used for cash segmentation.

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| PGIM Ultra Short Bond ETF | PULS | ETF | Yes | $2.76 billion | 2.5% | 0.15% |

| SPDR® SSgA Ultra Short Term Bond ETF | ULST | ETF | Yes | $381 million | 2.2% | 0.2% |

| iShares Ultra Short-Term Bond ETF | ICSH | ETF | Yes | $6.36 billion | 2.1% | 0.08% |

| JPMorgan Ultra-Short Income ETF | JPST | ETF | Yes | $19.2 billion | 1.7% | 0.18% |

| Vanguard Short-Term Bond Index Fund | BSV | ETF | No | $70.5 billion | 1.4% | 0.04% |

| JPMorgan Ultra-Short Municipal Income ETF | JMST | ETF | Yes | $3.36 billion | 1.3% | 0.18% |

| Goldman Sachs Short Duration Bond Fund | GDFIX | Mutual Fund | Yes | $2.14 billion | 0.4% | 0.43% |

The Bottom Line

In the end, the bank failures have forced investors to rethink their cash and how they hold the asset class. What once was safe may not be as safe as they think. The key is to focus on their needs. Segmenting cash into various buckets and using many of the new ultra-short term bond ETFs can provide the liquidity and cash-like attributes they crave without having to rely on one financial institution or moving beyond FDIC limits.

The initial banking crisis may have ended, but it exposed the risks with having too high a cash balance. Smart cash management and using segmentation can go a long way toward protecting portfolios and savers from headaches.

1 Lord Abbett (March 2023). Finding a Home for Excess Cash