Let’s face facts – cash is a boring asset class. People get excited about the latest tech stock or healthcare innovation. Money market accounts? Not so much. This has only been exacerbated over the last decade or so. Since the Great Recession and continued low/zero-level interest rate environment, cash has been a losing proposition. Literally. As a result, investors have rightfully forgotten about their cash allocations and relegated holding cash to the backburner.

But cash does play an important role in almost every portfolio – even for younger investors.

The key is to think outside the box and get reacquainted with cash in a new way. Yes, the asset class is boring. But boring doesn’t mean it’s not important, nor does it mean we can’t get a better return than 0%. And thanks to a host of new products, ETFs and funds, we can do our cash allocations justice.

Learn more about portfolio management on our Portfolio Management Channel.

Cash Still Has a Place

These days, it’s hard to remember why we hold any cash in our portfolios at all. A quick search of money market funds shows results that are abysmal. According to financial website Bankrate, the average interest rate on a money market account is currently 0.08%. At that rate, a $10,000 investment would net you a cool 67 cents after a year. That’s terrible. And that return is even worse when you factor in inflation. With rates so low, holding cash is actually losing purchasing power.

On the flipside, other asset classes have continued to rise. In the subsequent years after the crisis, stocks have continued to rally – with the S&P 500 as represented by the SPDR S&P 500 ETF (SPY) surging more than 400% since its bottom in the Great Recession. Treasury and corporate bonds have followed suit.

And with the Fed pledging to keep rates low for much longer than anticipated, cash and its negative returns just doesn’t make sense in today’s world.

Except that it does.

Holding some investment cash – which should not be confused with an emergency fund – makes sense for investors on a number of reasons.

The biggest benefit for holding cash over other asset classes is liquidity needs. Obviously, if you have the need to spend a portion of your portfolio relatively soon, then having it in an easy-to-sell and non-volatile asset class makes a ton of sense. If you need money to live off of or plan for short-term expenses, then you can’t take on too much risk.

For retirees or investors with unstable employment situations – think freelancers –cash offers a huge buffer when the market experiences a downturn. Nothing is worse than having to sell assets in the bottom. Having a cash buffer is crucial to providing a buoy for investors.

Finally, even younger investors can benefit from having some of their portfolio in cash. Cash can be used for market opportunities. Having some dry powder that’s ready to take advantage of declines is critical to earning better long-term returns. While market timing usually never works, the market does occasionally provide “gifts” for long-term investors.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

Stepping Just a Tad Bit Out

The truth is cash makes a ton of sense for most investors and the fact that we’ve been ignoring it for other asset classes might not be a great thing. The conundrum for portfolios is how to get any sort of return from our cash holdings. The key may be balancing duration with yield.

Enter ultra-short or limited duration bonds. These bonds are fixed income securities that have maturities of 180 days to 1.5 years. By going slightly outside traditional cash or money market holdings, investors can pick up yields in the 0.5% to 1.40% range. They won’t make you rich, but that’s not the point. We’re looking for a cash substitute that pays more than, well, zero.

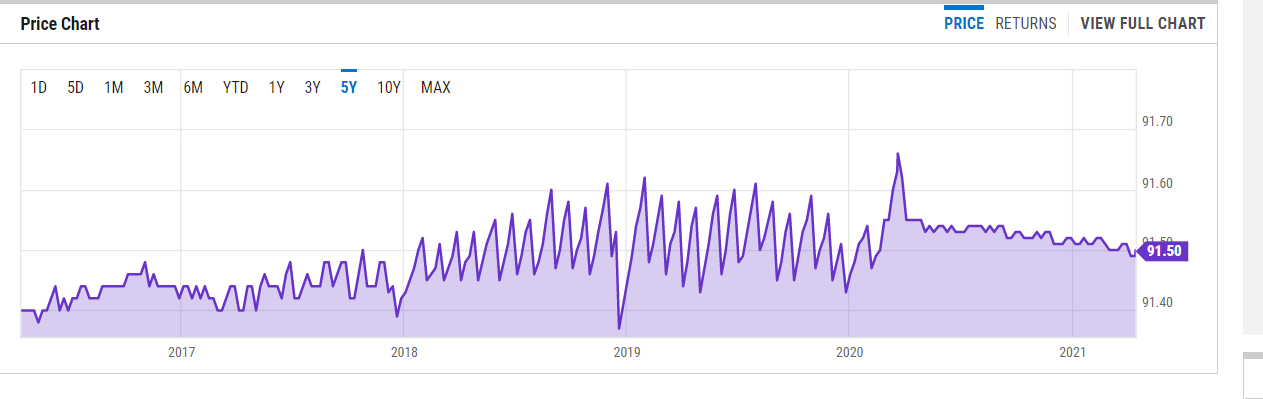

Meanwhile, the period from 180 days to 1.5 years seems to be the sweet spot when it comes to providing plenty of liquidity needs. Bonds and funds that track these asset classes have shown to be pretty stable in terms of share price. Just take a look at this chart from the SPDR Barclays 1-3 Month T-Bill ETF (BIL ). The share price has only fluctuated a few pennies over the last five years.

And this is just one example. The point is, investors can have their cake and eat it too.

Don’t forget to explore our Fixed Income Channel to learn more about fixed income strategies.

Making a Cash-Like Play

Given that cash still makes plenty of sense for investors, having some exposure to the asset class is critical. By taking some of that allocation and moving a tad bit further out on the duration ladder into ultra-short and limited duration bonds, investors can get extra yield, better returns and still benefit from having cash.

There are numerous ways to do that in both mutual funds and ETFs.

Both the PIMCO Enhanced Short Maturity ETF (MINT) and iShares Ultra Short-Term Bond ETF (ICSH) are two of the largest funds in the sector. Both feature billions in assets, swift trading volumes and low expenses. While their portfolios vary, both move out on the duration scale and have been stable in their share prices throughout their histories.

Looking elsewhere, there are plenty of mutual funds that play in the sector as well. Both the Fidelity Limited Term Bond (FJRLX) and Vanguard Ultra-Short-Term Bond Admiral (VUSFX) are two top-ranked funds that have delivered on their “cash-like” nature. And thanks to their low expenses, they provide a better yield than many other mutual funds in the category.

In the end, it’s a shame that we’ve forgotten about cash as an asset class. But with limited term and ultra-short duration bonds, our cash holdings can get some of their mojo back.

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.