Bond investors are certainly facing a quandary with regard to duration. On the one hand, the Fed seems ready to pause on its path to tightening. On the other hand, inflation and other pressures have the potential to keep the Fed raising rates for the long term. In either scenario, higher for longer has quickly become the mantra for many fixed income investors.

The question is how to position your bonds accordingly.

Asset manager and fixed income specialist, Lord Abbett, may have the answer. Thanks to continued changes to the Fed’s interest rate policy and the return of a steeper yield curve, short-term bond funds and assets could remain a lucrative choice for fixed income investors for the quarters ahead.

The Set-up

The Federal Reserve had a tough job of breaking some of the worst inflation on record. After the COVID-19 pandemic, excess stimulus cash, ultra-low interest rates, rebounding global growth, and supply chain woes all combined to create a very high inflationary period.

As its main arrow, the Fed began one of the most aggressive periods of monetary policy ever. The Fed moved to raise interest rates from essentially zero to the current 5.5%. That quickly managed to drop inflation from levels not seen since the 1980s.

The issue is that many investors and analysts expected the Fed’s pathway of higher rates would crater the economy. The vast bulk of U.S. recessions were all caused by Fed policy and high interest rates. Many analysts predicted that the Fed would not engineer their soft-landing, but create a hard-landing scenario, thereby plunging the U.S. into recession.

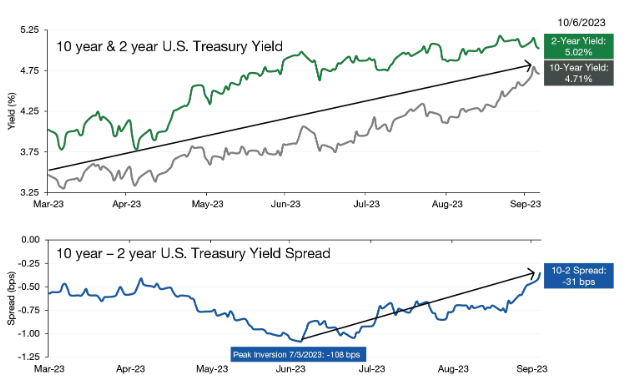

Looking at the yield curve—which is the yield of the 10-year Treasury bond minus the yield of the two-year—data suggested the potential of Fed cuts in the near term. The so-called 2s/10s curve hit a peak of -108 back in July.

Hard-Landing to No Landing

However, that hard-landing has given way to a potential no-landing scenario. Rates are just higher for longer.

It turns out that inflation has proven to be a stubborn horse that seems to not want to be broken. That’s the gist from the latest CPI readings. Yes, we certainly have moved lower from the 9% highs seen last year, but we’ve hovered at 3.2% to 3.5% for several readings now, bouncing higher and then lower, back and forth. That’s still off from the Fed’s 2% target.

At the same time, economic data seems to be still strong. Measures of labor health and manufacturing are still going strong, while demand for energy and other commodities hasn’t dwindled significantly.

The problem is data isn’t exactly screaming bullish numbers. We’ve seen some slippage in labor recently and unemployment has ticked up a bit. The same could be said for many other data points. The economy is still showing expansion, but nothing to knock your socks off.

This is causing all types of issues for the Fed and the central bank seems to be stuck in middle gear. And bond investors have adjusted to this new normal and higher for longer potential.

Investors have reacted to this potential by selling longer duration bonds, pushing yields up on the 10-year. According to Lord Abbett, the 10-year has moved more than 125 basis points higher from its lows. This has a dramatic effect on the yield curve. Looking at the 2s/10s curve, the curve has steepened from the -108 difference to -30 basis points at the beginning of October. This chart shows the changes. 1

Source: Lord Abbett

This has begun to normalize the yield curve, where longer dated bonds yield more than shorter dated ones.

Shorter Is Winning Out

The yield curve normalization is not done yet and there could be more room for the Fed to act. But the Fed seems paralyzed to move because of the poor economic performance. This continues to drive the no-landing scenario. And that has very different investment considerations.

The answer remains in short dated bonds. According to Lord Abbett, the shift in expectations and yield curve normalization caused the 10-year to return a negative 5.13% during the third quarter. The two-year? A 0.54% gain.

The reason comes down to placement in the yield curve. Investors are still expecting more from the Fed, which has hit prices of longer bonds. However, the uncertainty about keeping rates the same and pausing has continued to prop up short-term bonds. This so-called ‘bear steepener’ favors short-term bonds for the near to medium term.

Staying Short

Given the changes to the yield curve and the higher for longer nature of the Fed’s current path, investors looking to position their bond portfolios may want to focus on the shorter end of the curve. But this doesn’t mean cash. Cash assets will be the first to falter if and when the Fed cuts. Just moving out into short duration bonds and ‘locking in’ yields will benefit during that scenario.

Short-Term Bond ETFs

These funds are selected based on their ability to tap into short-term duration bonds at a low cost. They are sorted by their YTD total return, which ranges from 2.1% to 4%. Their expense ratio ranges from 0.03% to 0.56%, while they yield between 1.9% and 6.6%. They have AUM between $730M and $58B.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| DFSD | Dimensional Short-Duration Fixed Income ETF | $1.55B | 4% | 6.6% | 0.18% | ETF | Yes |

| FSIG | First Trust Limited Duration Investment Grade Corporate ETF | $731M | 3.8% | 4.8% | 0.56% | ETF | Yes |

| SPSB | SPDR Portfolio Short Term Corporate Bond ETF | $7.3B | 3.5% | 4.6% | 0.04% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26B | 3.2% | 3.6% | 0.15% | ETF | No |

| BSV | Vanguard Short-Term Bond ETF | $58B | 2.9% | 2.9% | 0.04% | ETF | No |

| LDUR | PIMCO Enhanced Low Duration Active ETF | $989M | 2.9% | 4.5% | 0.51% | ETF | Yes |

| SCHO | Schwab Short-Term U.S. Treasury ETF | $12.4B | 2.5% | 4.5% | 0.03% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | 2.1% | 1.9% | 0.07% | ETF | No |

At the end of the day, the yield curve is starting to change and reflect a higher for longer scenario. In that, short-term bonds are winning out and could be the best bet to play the Fed’s inaction.

The Bottom Line

Thanks to stubborn inflation and a mixed economic picture, the Fed has continued to keep rates high. This higher for longer scenario has continued to change the yield curve. For investors, the answer to playing the changing curve may lie within shorter duration bonds.

1 Lord Abbett (October 2023). Bond Market Update: Navigating a Rising-Rate Environment