Municipal bonds have long been a favorite spot for investors looking to score tax-free income. Issued by states and local governments to fund their daily activities or special projects, munis are generally free from federal taxes. They’re also free from state taxes from the issuing state. As a result, upper income individuals have prized muni bonds as a portfolio position.

But there’s more to the muni market than just general revenue obligation bonds.

In fact, there’s a whole sector of taxable municipal bonds out there. The best part is that these taxable munis could offer a host of benefits to investors looking to boost their income and get a dose of safety for their portfolios. And in many cases, taxable munis could be a better buy than corporate bonds with similar durations. For investors, taxable munis are one fixed income sector to keep on your list.

Our Best Dividend Stocks List has 20 of the highest-rated stocks by our proprietary Dividend.com Rating system. Go Premium to find out the entire list.

Taxable? Municipal Bonds?

Most investors are familiar with tax-free municipal bonds and the bulk of the $3.8 trillion muni bond market falls within this category. Here, state governments and agencies as well as local municipalities issue bonds to fund their activities. These bonds have been a portfolio staple for decades thanks to their tax advantages. This is especially true for investors in higher tax brackets.

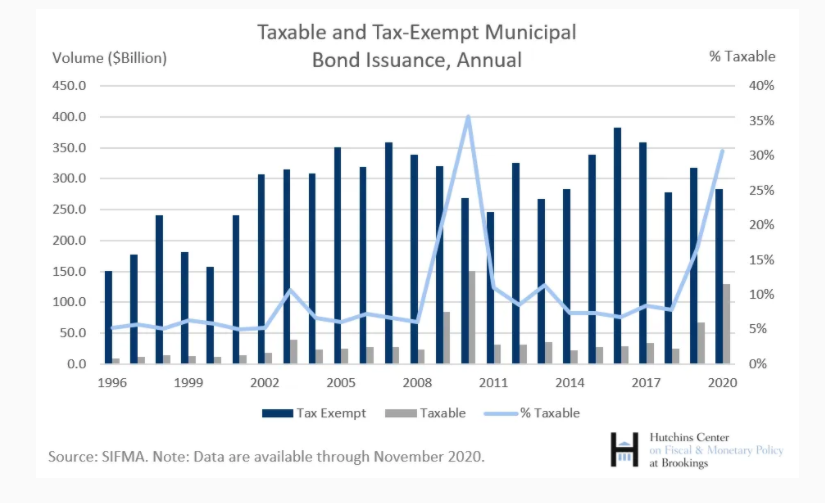

However, there is a tiny—and quickly growing—sliver of the muni bond market that falls under the taxable umbrella. Back in 1986, the federal government restricted the activities that tax‐exempt munis could be used to fund. As a result, many states started issuing taxable muni bonds. This issuance has exploded in recent years. The Republican tax cuts of 2017 included legislation that prohibited cities, states, and other municipalities from issuing tax-free bonds to restructure their existing debts. As the ban was enacted, issuance of taxable munis has exploded to $170 billion in 2020. That’s more than double what was issued in 2019.

You can see by this chart from the Brookings Institute the spike in taxable muni bond issuance. The previous spike in 2009/2010 was through the Build America Bond program designed to spur infrastructure growth and end the Great Recession. That program has since ended and is not responsible for the increased issuance today.

Source: Brookings.com

Big Benefits

So, why would anyone want to consider taxable munis for their portfolios? After all, the main appeal of municipal bonds is the fact that they offer tax free income, right? It turns out the tax advantages may not be as great for many investors.

For one thing, taxable muni bonds are still exempt from state and local taxes, just not federal taxes. For investors in high tax states—such as California or New York—who are in lower tax brackets, this fact could prove to be advantageous. This is particularly true when you consider the next piece of the equation: their high yields.

Because they aren’t exempt from federal taxes, taxable munis yield more than their tax-free sisters. But the real advantage comes when looking at corporate bonds. Yields on a taxable muni have been historically 0.5 percentage point to 1.5 percentage points higher than corporate debt with a similar credit rating and duration. And remember, we still get a state tax benefit. There’s no tax advantage to owning corporate bonds. For many investors in the 32% or lower tax bracket, taxable munis can offer much better after-tax yields than traditional muni and corporate bonds.

Finally, taxable munis could be one of the safest things you can buy. The vast bulk of taxable muni insurance is for refinancing and restructuring efforts. As a result, taxable munis have low default rates. For example, the State of Ohio can just raise taxes to fund its bond issuance. Just over 78% of the taxable muni market is rated in the top two rungs of credit quality. This compares to just 7% of total corporate bonds and 72% of tax-free munis.

The combination of factors makes taxable munis a pretty decent portfolio addition for income-starved investors.

Have you heard? We’re launching the premier event for ETF investors. Learn more about the Exchange here.

Getting Taxable With Your Munis

Perhaps the only problem comes down to getting your hands on taxable munis. Already, buying individual muni bonds is hard. Given the small size of the taxable muni segment, buying individual issues is pretty much impossible. However, there are numerous funds that offer exposure.

Looking at traditional mutual funds and exchange traded funds (ETFs), there are really two ways to get exposure. The MainStay MacKay U.S. Infrastructure Bond Fund Class A (MGVAX ) and Invesco Taxable Municipal Bond ETF (BAB) offer an active and indexed approach to the market segment.

For investors looking outside the box, there are several closed-end funds that offer exposure to taxable munis. BlackRock Taxable Municipal Bond (BBN) and Nuveen Taxable Municipal Income (NBB) are two prime examples. CEFs trade like stocks based on supply/demand. This can mean that they can be bought at a discount—or premium—to their net asset values. Meanwhile, a little leverage can boost yields. For example, both BBN and NBB are currently yielding above 5%.

With the taxable muni segment growing by leaps and bounds and President Biden looking to review the Build America Bond program, the number of vehicles offering access to the segment has expanded. Investors should be on the lookout for more ways to get access to taxable munis in the near future.

The Bottom Line

When we think of munis, we think of their tax-free benefits. However, the taxable muni bond sector could offer just as many, if not more, benefits than their sisters. With high yields, low default rates, and still some tax advantages, investors should consider taxable munis when they construct their portfolios.

Be sure to check our News section to keep track of the recent fund performances.