Sometimes perceived risk doesn’t equal the potential rewards. That’s predominantly true in the fixed income space. Often investors view many bond types other than Treasuries or investment-grade bonds as very risky. After all, fixed income investors tend to be a conservative bunch. But the reality is there are plenty of IOUs that can offer high yields without taking on that much more risk.

Case in point: emerging market bonds (EMBs).

And right now, emerging market debt may offer plenty of upsides, higher yields, and potential. Economic haziness has provided cover, but emerging market debt is still shining behind the clouds. This is where investors can potentially score a great deal.

Emerging Market Bonds: A Primer

As the name suggests, EMBs are issued by developing nations either on a corporate level or government level. These bonds are issued by nations all over the world, and investors can buy bonds from Asia, Latin America, Eastern Europe, Africa, and the Middle East. And just like bonds from the U.S. government or PepsiCo, emerging market bonds feature credit ratings all the way from investment-grade down to speculative junk.

However, because these issuers are not the U.S. Treasury or PepsiCo, they are often perceived as riskier, even if they hold an investment-grade rating. Because of the extra risk, investors will demand more yield to compensate and, as such, EMBs often have yields in excess of 2% to 4% above Treasuries.

Another factor, with regard to EMBs, remains currency, with Brady bonds and local currency-issued debt.

EMBs can be issued in U.S. dollars (Brady bonds) or local currencies. The differences in forex fluctuations can add additional alpha or returns to emerging market debt above and beyond a coupon payment. This can be advantageous in good years. Meanwhile, the extra yield of EMBs can help compensate for bad ones.

EMBs Make Sense Today

So why add a swath of emerging market debt today? The answer could be some of the strongest returns in years coupled with low valuations.

The valuation front is easy to see. The election and incoming second term of President Trump do bring a certain level of volatility to global markets. As an America-First style president, Trump’s policies tend to skew toward domestic production/consumption. And his ‘shoot from the hip’ policy points throw plenty of uncertainty into the mix. This has clouded the outlook of EMBs, which have been dipping since November.

However, economic activity in the emerging world—which pays these bonds—is set to be strong for the year. JPMorgan predicts that emerging markets will post economic growth of 4.2%. That’s a big 2.5% difference over what U.S. economic growth is predicted to be.

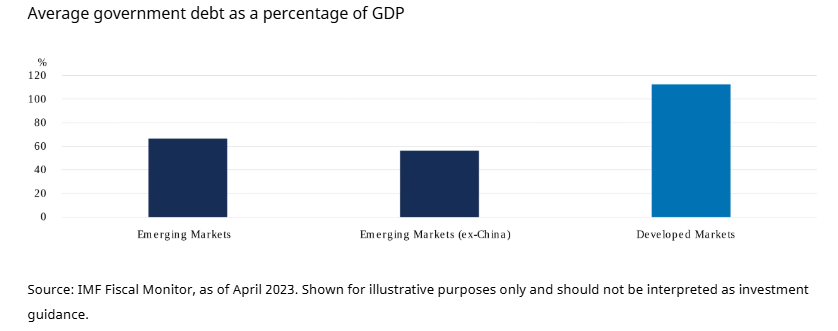

At the same time, emerging markets as a whole are better suited to perhaps handle their debt than the developed world. That’s because debt-to-GDP ratios for emerging market nations are more favorable. For example, the U.S. has a debt-to-GDP ratio of 120%, while the average emerging market is around 60%. This chart from investment bank Schroder’s highlights the difference.

Source: Schroders

Against this backdrop of low valuations, we have some unique historical returns data to consider. EMBs often do very well in a post-rate cut environment for several reasons. First, investors are forced to find yields outside of cash and safe Treasuries, which boosts the fortunes of all higher-yielding debt varieties. Second, lower rates and the weaker U.S. dollar that comes from those rate cuts make Brady bonds and dollar-denominated EMBs easier for nations and companies to pay off. It takes fewer Bhat or Rupees to translate into dollars. This is a net positive for the credit quality of EMBs and investors react accordingly.

The result is that EMB returns 24 weeks after the first Fed cut range from 7.4% for EM Hard Currency Bonds to 11.5% for U.S. dollar-denominated debt in soft landing scenarios. Even in recessionary-induced rate cuts, JPMorgan data shows that EMBs have historically matched U.S. Treasury returns. 1

Right now, there’s an interesting convergence of these factors that can propel emerging market bonds higher in the new year. These include lower valuations, Fed cuts, and strong credit quality despite the ‘emerging’ name.

Making an EMB Play

Given the potential and overall strong outlook for EMBs, investors may want to look at these bonds for their portfolios. EM stock investors may want to consider them as well. EMBs—like U.S. junk bonds—can provide stock-like total returns with far less volatility. They could offer a serious in-road into emerging markets at a fraction of the jumpiness associated with equities.

The question is: how do you buy them?

Like most bond types, logging onto your brokerage account and buying a sovereign issue from Thailand is a pretty hard endeavor. But as the size and scope of the emerging market bond market has grown, numerous funds have launched that allow investors to take advantage. Here, both active and passive options exist across investment-grade, hard or USD, high-yield, and even sovereign vs. corporate bonds. For most investors, a simple slice of broad exposure could be more than enough.

Broad Emerging Market Bond ETFs

These ETFs were selected based on their exposure to emerging markets, either local or USD issued. They are sorted by their one-year total return, which ranges from -3.2% to 15.7%. They have expenses between 0.20% and 3.74% and AUM between $290M and $15B. They are currently yielding between 4.6% and 12.7%.

| Ticker | Name | AUM | 1-Year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| EMD | Western Asset Emerging Markets Debt Fund | $609M | 15.7% | 12.7% | 3.74% | MF | Yes |

| EMB | iShares J.P. Morgan USD Emerging Markets Bond ETF | $14.9B | 5.9% | 5.44% | 0.39% | ETF | No |

| VWOB | Vanguard Emerging Markets Government Bond Index Fund | $5.87B | 5.8% | 6.2% | 0.20% | ETF | No |

| EMHC | SPDR Bloomberg Emerging Markets USD Bond ETF | $291M | 4.2% | 7.2% | 0.23% | ETF | No |

| PCY | Invesco Emerging Markets Sovereign Debt ETF | $1.33B | 3.4% | 6.8% | 0.50% | ETF | No |

| EBND | SPDR® Bloomberg Emerging Markets Local Bond ETF | $1.94B | -1.7% | 4.6% | 0.30% | ETF | No |

| EMLC | VanEck J.P. Morgan EM Local Currency Bond ETF | $2.67B | -3.2% | 6.8% | 0.31% | ETF | No |

Overall, emerging market bonds are considered risky. However, the current valuations and potential of these bonds has only enhanced the risk/reward proposition. For investors, it makes sense to consider these bonds for your portfolio. Higher yields and strong total return await.

Bottom Line

For investors, emerging market bonds offer a strong total element to a portfolio and the chance to buy them is now. Thanks to a cloudy geopolitical picture, they offer some big discounts to their potential. That potential may not last long.

1 J.P. Morgan (January 2025). The window of opportunity is open