The best time to buy an umbrella isn’t when it’s raining. That could be the case when it comes to Treasury inflation protected securities or TIPS. After seeing huge investor interest back in 2022 as inflation raged, TIPS have been placed on the backburner so far this year. Investors have chosen bread-and-butter Treasury bonds instead.

But investors may want to rethink that choice.

Right now, TIPS are offering some of the best real yields in over a decade. With inflation potentially running higher for longer, TIPS could be a great play for investors, particularly those looking to protect their income in retirement.

A Complex Bond

TIPS were originally created in 1997 by the Treasury as a way to raise funds while still providing investor-demanded inflation protection. Issued in five-, 10-, and 30-year increments, the bonds take an interesting approach to providing that protection against the invisible hand of rising prices. That involves both changes to interest and principal repayment.

First, like any bond, TIPS come with a set coupon rate. Usually, this initial rate is less than a comparable Treasury bond. For example, a 10-year TIPS may pay 1% when issued, while a 10-year Treasury bond may pay 1.5%. The interesting and potentially confusing factor is what happens next.

TIPS reset their payouts by resetting their principal values based on changes to the CPI. So, if an investor owns a $1,000 TIPS with a 1% coupon and there is no change to the CPI, they’ll get $10 in interest. This is where we get to the confusing part for many investors.

Using the same bond, if the CPI jumps by 2%, then the TIPS will adjust its principal upward by 2% to reach $1020. Then the 1% coupon based on the new principal payout will now net the investor $10.20 in interest payouts. However, if there is deflation—which has happened before—the principal adjusts downward. Taking the same bond and realizing a 5% decrease to inflation would adjust the principal to $950. Then the payout would be 1% of that number or just $9.50.

At the same time, TIPS trade on the secondary market, adding confusion to the value of the bonds. They can be bought and sold at premiums or discounts to their values based on market conditions. They can also get hit hard as the Fed raises rates as new TIPs come to the market with higher initial coupons. This is exactly what happened last year. While the bonds did pay more with inflation, the surge in interest rates still managed to dent the prices, not principals, of the bonds.

The Real Yield

Given this mixture of hard to value points, many investors ignore TIPS. However, right now, they might want to rethink that stance and deal with some of the complexities. TIPS are now offering some of the best real yields in decades.

What is a real yield?

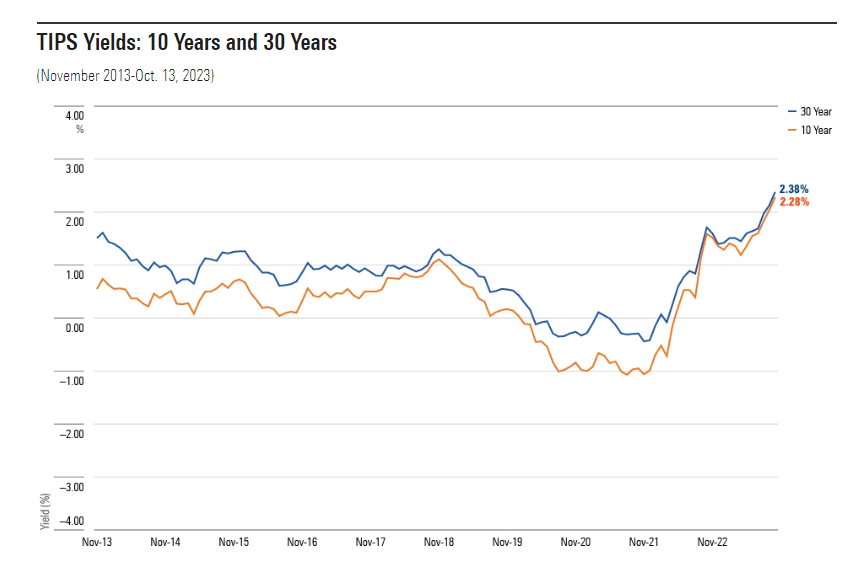

That’s basically the premium over regular Treasuries that investors are getting with a TIPS. Right now, the getting is good. Just take a look at this chart from Morningstar.

Source: Morningstar

Those yields are some of the highest points in nearly 15 years. And while it may not be exciting to think about a 2.38% yield, remember that TIPS also adjust their principal payment based on CPI. With inflation running at 3.5%, you are actually looking at yields closer to 6% when factoring in the higher principal adjustment. This makes TIPS a better current buy than regular Treasury bonds.

This is particularly true if inflation stays higher for longer as many analysts now predict. Moreover, with the Fed pausing its path to rate hikes and potentially even cutting them amid souring economic data, TIPS’ advantage becomes even stronger. Investors won’t ‘flee’ current TIPS for new, higher initial couponed ones. Long-term inflation expectations are still running high.

To that end, TIPS are a pretty good way to buy inflation protection at a super cheap rate.

Following the Tip on TIPS

For investors, TIPS offer a wonderful way to protect their savings from inflation. This is particularly advantageous for retirees who need a level of spending cash during their golden years. Getting exposure is actually the easy part. Despite the complexities of the bond, as a Treasury security, getting your hands on them is simple and there are numerous ways to do so.

You could actually buy them directly from the Treasury at Treasury Direct or via a brokerage account. Here, it’s best to hold them through till maturity. As such, investors can create a so-called TIPS Ladder of variable maturities to ensure an annual spending amount. Another choice to do this could be BlackRock’s new TIPS series of iBond ETFs. A fund like the iShares iBonds Oct 2026 Term TIPS ETF holds TIPS that will mature in 2026. As such, investors will get their principal back at that time, while earning inflation-protected interest. The SPDR Bloomberg 1-10 Year TIPS ETF builds a perpetual ladder within one ticker.

Speaking of ETFs, the fund structure has quickly become one of the best ways to get TIPS exposure. Both the iShares TIPS Bond ETF and Schwab U.S. TIPS ETF provide low-cost exposure to the theme. One thing to remember is that TIPS suffer from duration risk. So, if the Fed does keep raising rates, TIPS’ current values may fall. Adding a short-term TIPS fund like the Vanguard Short-Term Inflation-Protected Securities Index Fund could be a smart bet to reduce duration risk.

As for getting active with TIPS, there aren’t any ‘pure’ choices in the sector. Many funds like the PIMCO Real Return Fund focus heavily on TIPS. However, many add other floating rate debt and inflation-protected assets, such as international TIPS, to their portfolios. For example, the Fidelity Strategic Real Return Fund includes assets like real estate and commodities to its mix. While that’s not necessarily a bad thing for inflation-fighting, it’s not the same as pure TIPS exposure.

Treasury Inflation Protected Securities (TIPS) ETFs & Mutual Funds

These funds were selected based on their low-cost exposure to TIPS and are sorted by their YTD total return, which ranges from -1.3% to 2.8%. They have expenses between 0.03% and 0.78%, and assets between $500M to $53B. They are currently yielding between 3% and 7.5%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| VTIP | Vanguard Short-Term Inflation-Protected Securities Index Fund | $52.4B | 2.8% | 3.87% | 0.04% | ETF | No |

| STIP | iShares 0-5 Year TIPS Bond ETF | $9.4B | 2.8% | 3.06% | 0.03% | ETF | No |

| TDTT | FlexShares iBoxx 3-Year Target Duration TIPS Index Fund | $1.95B | 2% | 4.17% | 0.19% | ETF | No |

| TIPX | SPDR Bloomberg 1-10 Year TIPS ETF | $1.3B | 1.3% | 5.1% | 0.15% | ETF | No |

| PRRIX | PIMCO Real Return Fund - Institutional | $8.53B | 0.3% | 4.48% | 0.67% | MF | Yes |

| FSRRX | Fidelity Strategic Real Return Fund | $544M | -0.21% | 7.4% | 0.78% | MF | Yes |

| SCHP | Schwab U.S. TIPs ETF | $11.51B | -0.94% | 3.9% | 0.03% | ETF | No |

| TIP | iShares TIPS Bond ETF | $20.53B | -0.99% | 3.03% | 0.19% | ETF | No |

| SPIP | SPDR Portfolio TIPS ETF | $1.53B | -1.27% | 3.94% | 0.12% | ETF | No |

No matter how investors choose to get their TIPS fix, the bonds currently offer wonderful inflation protection advantages today. Adding a dose of TIPS makes a ton of sense.

The Bottom Line

Treasury inflation protected securities or TIPS are widely ignored by many investors due to their complexities. However, today, they offer high yields and inflation-fighting prowess. Investors should consider removing their prejudices and buy the bonds. ETFs and direct means make it easy.