The COVID-19 pandemic has shut down large swaths of the global economy, leading to record levels of unemployment and a historic contraction in economic growth. At the same time, governments and central banks have spent trillions of dollars to contain both the loss of life and damage to their economies. The big question for investors is: what comes next?

Let’s take a closer look at government and central bank spending on COVID-19 relief efforts thus far and what these debt levels mean for investors over the coming years.

Click here to explore the fixed income channel and learn more about different concepts.

Government Spending on COVID-19 Relief

The world’s largest economies have committed more than $9 trillion in the form of spending, loans and loan guarantees to help individuals and businesses weather the COVID-19 pandemic. According to the International Monetary Fund, more than half of the response has been in the form of investment in assets, with the rest coming in the form of fiscal spending measures.

Most governments and central banks have responded by providing businesses with credit through the banking system, but in the U.S., a lot of credit flows through the capital markets. In particular, the Federal Reserve has been primarily focused on maintaining liquidity in the Treasury market, which is the foundation for most securities trading around the world.

The U.S. Federal Reserve took several actions throughout the crisis:

- Interest rates were lowered by 150 basis points to a 0-25 basis point range with the promise to keep rates low for the foreseeable future.

- Quantitative easing resumed with the purchase of Treasury securities, mortgage-backed securities and other systemically critical assets.

- Lending and backstopping programs were reintroduced to ensure that the corporate bond and municipal securities markets had sufficient liquidity.

- The central bank expanded its lending programs to major corporate employers and introduced a lending program for small to mid-sized businesses.

The U.S. government’s fiscal spending measures augmented these efforts:

- The $2.3 trillion CARES Act included one-time tax rebates, expanded unemployment benefits, food safety nets, corporate loans, and other measures to support state and local governments, as well as international programs.

- The $483 billion Paycheck Protection Program and Health Care Enhancement Act was passed to provide funding for small businesses and the healthcare system.

- The $8.3 billion Coronavirus Preparedness and Response Supplemental Appropriations Act and $192 billion Families First Coronavirus Response Act provided additional protections for those affected and funding for healthcare.

- The government is negotiating a second trillion-dollar COVID-19 response package that could be worth between $1 trillion and $3 trillion in size based on the size of the House and Senate versions of the bill.

These efforts were mirrored in many other countries. For example, the European Union introduced a €750 billion Next Generation EU recovery fund and a second €540 billion package to support individuals and businesses. The European Central Bank also expanded its asset purchases by €120 billion until the end of 2020 and relaxed certain restrictions.

Use the Dividend Screener to find the security that meet your investment criteria.

Implications of Rising Spending and Debt

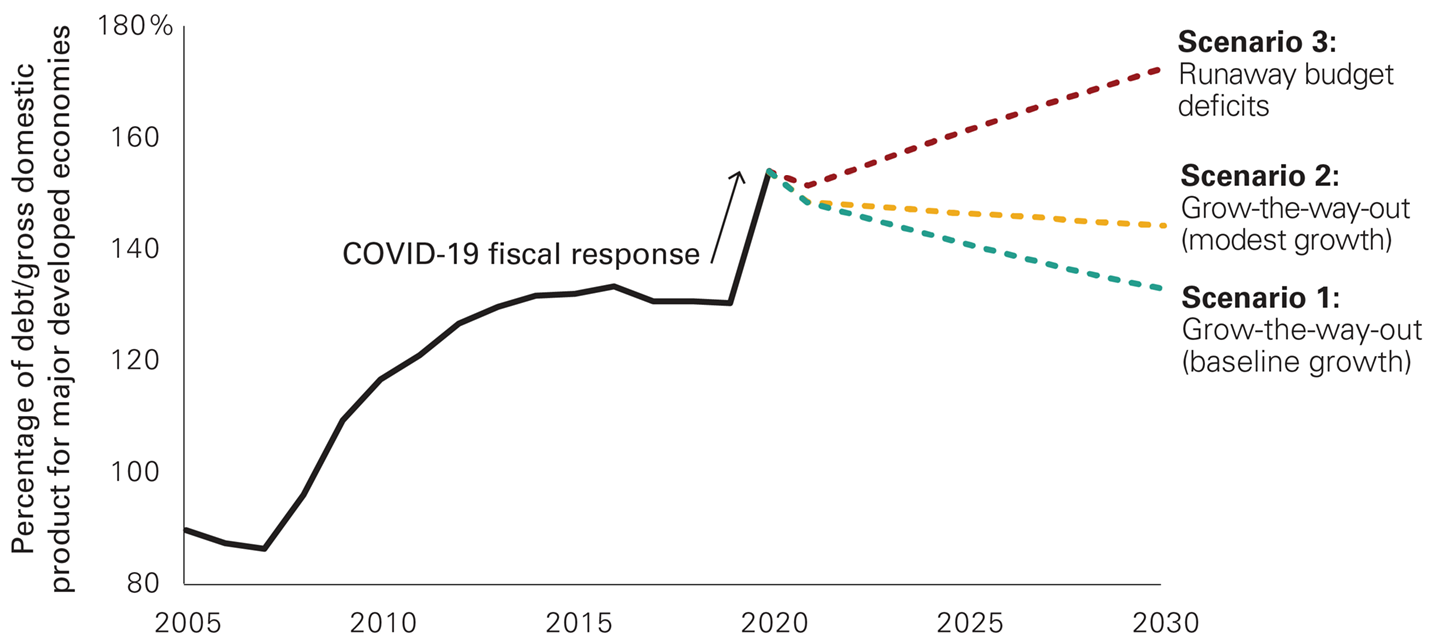

The debt to gross domestic product ratio for most developed economies have jumped by nearly a quarter (24%) thus far during the COVID-19 pandemic, according to a Vanguard analysis. At the same time, central banks’ balance sheets have dramatically expanded as they have stepped in to provide liquidity to the financial markets and support lending efforts.

The sheer size of fiscal debt may seem challenging to repay over the coming years, but already record-low interest rates could mitigate the impact. With modest growth rates and fiscal austerity of less than 2% to 3% of GDP, Vanguard believes that most major economies could return to pre-pandemic levels by the end of the decade.

Source: Vanguard

Central banks will need to adopt forward-guidance frameworks to help reassure the financial markets given their expanded balance sheets, but could unwind their balance sheets when economic growth resumes. At the same time, higher inflation could have the beneficial effect of eroding the value of one-off debt, assuming that bond yields don’t catch up to interest rates and make the cost of new debt more expensive to service.

These scenarios depend on reductions in fiscal spending and moderate growth rates. In reality, maintaining economic growth during a period of fiscal austerity is a challenge. The keys to success will be maintaining a strong credit rating (to reduce borrowing costs), unlocking the potential of balance sheet assets, optimizing revenue streams and reducing expenditures by scaling back public programs or finding ways to reduce wasteful spending.

While emerging markets could benefit from selling sovereign assets or improving transparency, developed markets are largely restricted to cutting fiscal spending or raising taxes. Some likely candidates for cost-cutting include the reduction of government subsidies, reductions in government payrolls and the centralization of spending to realize discounts.

Learn more about dividend investing here.

The Bottom Line

The COVID-19 pandemic has dramatically reshaped the global economy and investment climate. While significant fiscal spending and monetary policy has contained the damage, governments will have to reckon with the debt overhang over the coming years. The deficit-reduction requirements may be modest and doable, but there will be some cost involved.

Be sure to check our News section to keep track of the latest updates around income investing.