The Federal Reserve’s move to increase interest rates to combat inflation has taken a toll on bonds in 2022. The iShares Core US Aggregate Bond ETF (AGG) is down about 13% since January, but investment-grade (IG) corporate bonds have been among the worst-performing subsets of the market due to their low yields and a potential recession.

Let’s look at how corporate bonds performed in 2022 and whether they will likely make a comeback in 2023.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

A Terrible 2022 Performance

The iShares iBoxx Investment Grade Corporate Bond ETF (LQD) fell more than 18% since January. While that’s marginally better than the SPDR S&P 500 ETF’s (SPY) 19% drop, it’s far from a safe-haven asset class and did little to blunt a sharp decline in the equity markets. In fact, by some measures, these losses were more significant than at any time since 1926.

While corporate bankruptcies remain historically low thus far, companies could struggle to pay or refinance their debts next year. For example, Carvana’s revenues fell sharply in 2022 while spending on interest payments soared. With its stock down 90%, it’s easy to see why its bonds are trading at less than 50 cents on the dollar.

A More Bullish Outlook for 2023?

The narrative affecting fixed-income investments will likely shift from interest rates to the economy in the new year. With inflation falling from a high of 9.1% in June 2022 to 7.1% in November, the Federal Reserve is unlikely to require any upside surprises. In fact, the central bank could start exercising more restraint to avoid hurting the economy too much.

At the same time, Moody’s expects the lackluster economy to send default rates among non-IG corporate bonds from 2.3% in September 2022 to 7.9% by September 2023. Some recent casualties falling into these categories are companies like Revlon, which filed for bankruptcy in June 2022 after failing to pay interest on its $3.8 billion debt load.

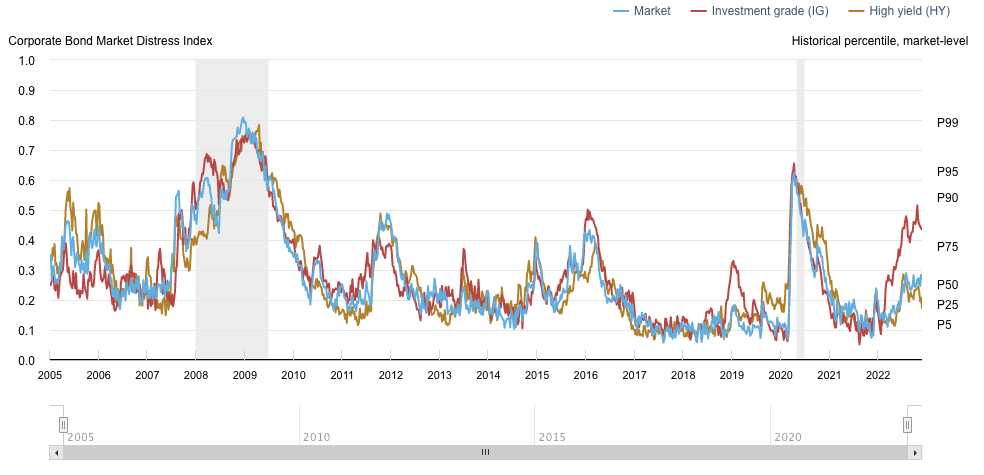

On the other hand, IG corporate bonds are relatively strong. The New York Federal Reserve’s Corporate Bond Market Distress Index is below its historical 65th percentile, while IG corporate bonds remain closer to the 25th percentile. After all, many of these higher-rated issuers have ample cash on hand with no need for near-term refinancing.

Finding Opportunities in the Market

Fixed-income investors have relied on policy-driven catalysts, like quantitative easing, over the past decade. But with interest rates rising, they may have to find new catalysts to drive value in 2023. In particular, investors should seek out higher-quality credit and companies with solid fundamentals, healthy cash flows, and low leverage.

The high and flat yield curve also means investors can find attractive yields in short-term bonds. But, with the Fed’s narrative changing, longer-duration bonds could see the most significant price increase if the central bank pauses or reverses its interest rate hikes. So, investors should consider their income versus capital gains priorities.

Some IG corporate bond ETFs to consider include:

| Name | Ticker | Expense Ratio |

| Vanguard Short-Term Corporate Bond ETF | VCSH | 0.04% |

| Vanguard Intermediate-Term Corporate Bond ETF | VCIT | 0.04% |

| iShares iBox Investment Grade Corporate Bond ETF | LQD | 0.14% |

| iShares 1-5 Year Investment Grade Corporate Bond ETF | IGSB | 0.06% |

| iShares 5-10 Year Investment Grade Corporate Bond ETF | IGIB | 0.06% |

| iShares Broad Investment Grade Corporate Bond ETF | USIG | 0.04% |

The Bottom Line

Corporate bonds have had a rough year in 2022, but the outlook may be considerably brighter in 2023. While the economy is heading toward a recession, high-quality IG corporate issuers could offer investors attractive yields and potential capital gains upside.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.