[Updated March 15, 2018 by Sam Bourgi] AT&T (T ) and Verizon (VZ ) have been favorites for many dividend investors, but which stock is the better buy?

If you only want one telecommunication stock in your portfolio, you might have to choose between these two, which is difficult because both of these companies are members of the Dow 30 and offer investors great yields. Below are seven charts that compare these two telecom companies to help you make the decision that’s right for your portfolio.

*All data as of March 15, 2018.

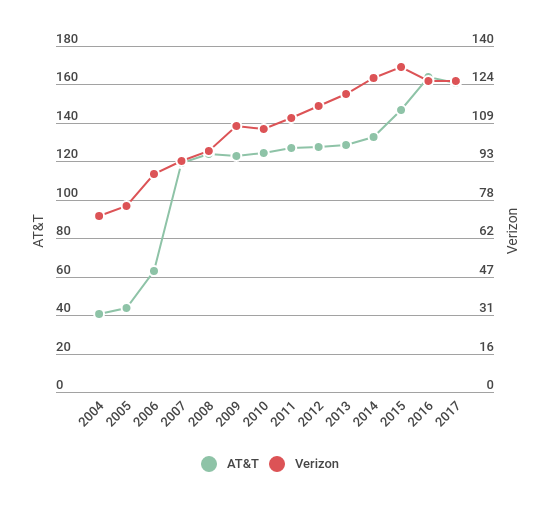

AT&T vs. Verizon: Sales

Since 2007, AT&T has been consistent with reporting higher revenues than Verizon.

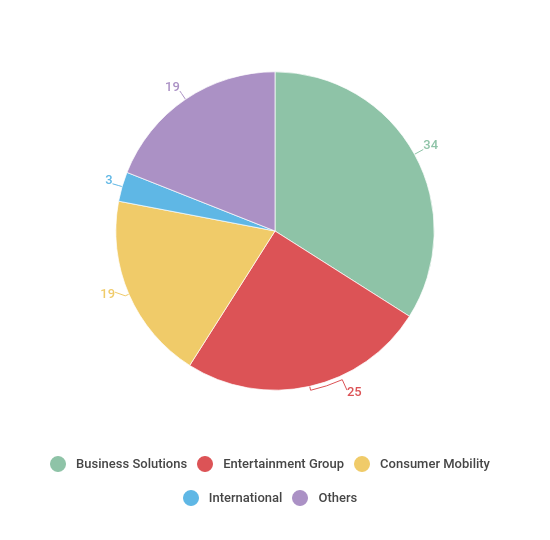

VZ obtains about three-quarters of its revenue from its Wireless segment, while AT&T’s business revenues are more balanced across multiple segments. For investors seeking stocks that are able to grow annual revenue, both VZ and T are great picks – but AT&T may be the better choice.

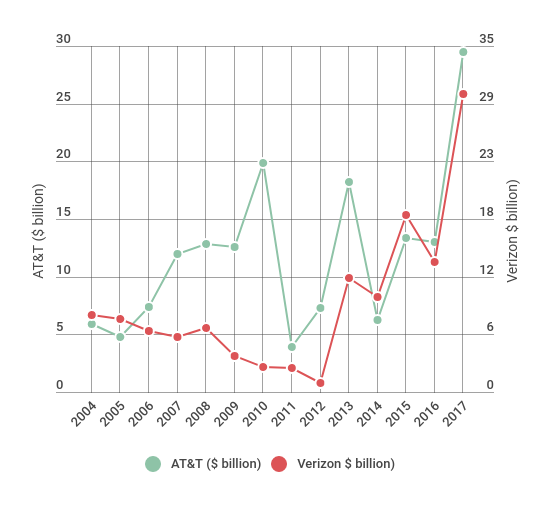

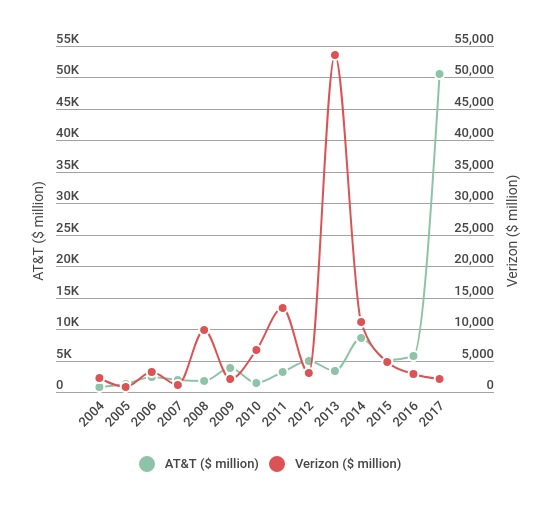

AT&T vs. Verizon: Earnings

Like revenue, AT&T has consistently reported higher earnings than its rival. Both companies obtain the majority of earnings from their wireless businesses. Earnings are a very important factor for many investors. Although both companies saw a decline in earnings in 2011 and 2012, AT&T has been the better stock as far as income.

Learn more about AT&T in The Complete History of AT&T.

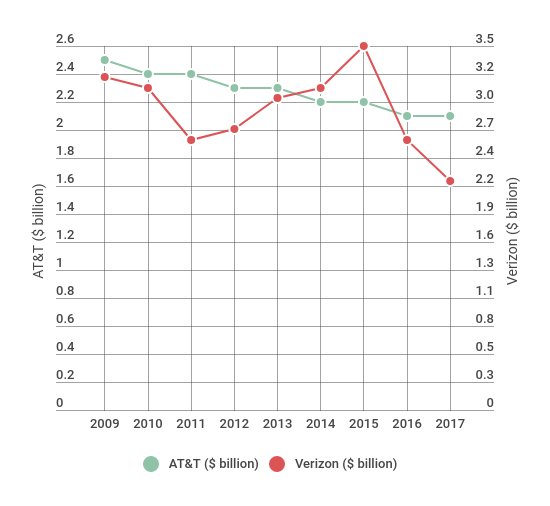

AT&T vs. Verizon: Dividend Growth

Both of these companies are great for dividend investors, offering attractive yields and growing dividends. Although both of these companies have been lifting dividends every year, Verizon’s dividend growth tends to be slightly higher than AT&T. Investors seeking dividend growth in a stock will find both of these stocks to be comparable.

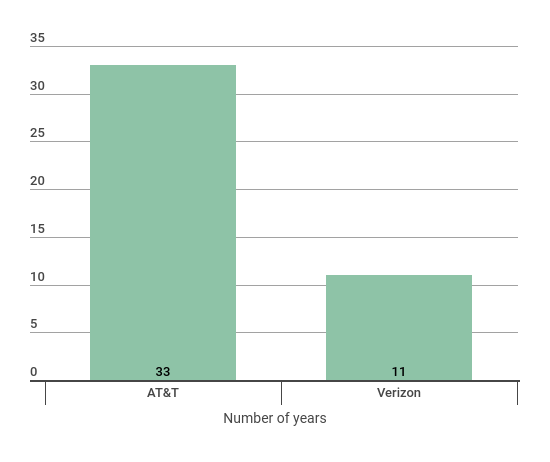

AT&T vs. Verizon: Consecutive Dividend Increases

The two companies have shown commitment to dividend investors, but only AT&T can call itself a dividend aristocrat – with a 33-year history of raising its dividend. With Verizon’s 11 years of consecutive increases, AT&T clearly wins when it comes to dividend history.

AT&T vs. Verizon: Cash

In terms of cash and cash equivalents, both companies have seemingly reversed roles in recent years. By 2015, AT&T’s cash pile had eclipsed Verizon’s, a trend that would intensify over the next two years. That being said, both companies are a solid pick for dividend investors seeking cash-heavy plays.

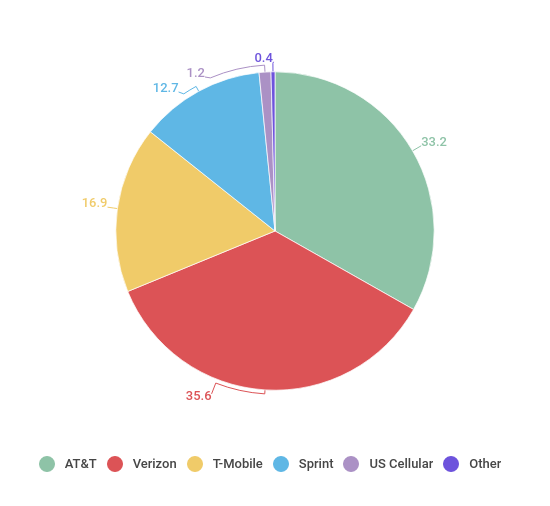

AT&T vs. Verizon: Market Share

AT&T and Verizon have been on top of the wireless industry, with T-Mobile (TMUS) in third place. Verizon has slightly more U.S. market share than AT&T with 35.6%.

Both companies have seen their share of the total market dwindle in recent years, with Sprint (S) and T-Mobile boosting their presence.

AT&T vs. Verizon: Business Segments

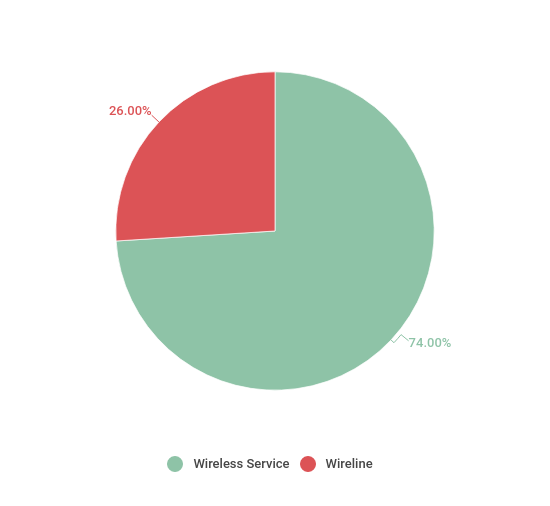

Verizon

While Verizon focuses primarily on its Wireless business, AT&T’s businesses are more evenly balanced. As shown below, both companies obtain significantly more revenue from the Wireless segments.

AT&T

AT&T has expanded its business segments to include wireless service, fixed strategic services, legacy voice and data services, other service and equipment and wireless equipment.

From Q3 2015 onwards, the company announced a change in its segment reporting structure. Accordingly, the contribution of different segments to the overall revenue of AT&T is shown below.

Analysis

Verizon and AT&T are both leaders in the telecommunications industry. On their own, they easily surpass Sprint and T-Mobile in terms of subscribers and overall network size. This predicament is unlikely to change in the future as both companies maintain their duopoly status in the market.

Although both companies offer similar advantages for yield-seeking investors, AT&T has adopted a more aggressive strategy by attempting to acquire Time Warner Inc. If successful, this strategy will allow AT&T to become a full-fledged telecommunications and media powerhouse. With that distinction comes the ability to bundle wireless, TV and internet services to customers across the country.

Verizon has also made a splash in the internet business by acquiring Yahoo for $4.5 billion. The newly acquired segment will be part of Oath Inc. – the subsidiary, which houses AOL, created to house the digital content subdivisions.

In addition to strategic acquisitions, both companies are boosting infrastructure to build the next-generation wireless network. This is clearly reflected in the heavy debt loads both companies carry. The development of 5G technology could dictate which company comes out on top over the next ten years. At present, Verizon appears to be making a bigger push in the direction of wireless, as demonstrated by its oversized revenue stream dedicated to this segment.

The Bottom Line

AT&T and Verizon have their strengths and weaknesses in different categories, but are both great dividend stocks for investors. Both of these stocks are among the highest-yielding stocks. Although AT&T is a more established dividend payer, Verizon is a member of the Dow Jones Industrial Average, which also gives investors a sense of stability about its value as a long-term investment.