S&P Dow Jones Indices LLC is the maker of the world’s most widely followed indices. The most well-known indices in the world are the S&P 500 and the Dow Jones Industrial Average—more than a 100-years-old, they are still the standard benchmarks used by investors and financial media to judge the health of the economy. The indices are regularly refreshed (companies added, companies removed) to keep it relevant.

Index Investing is Cheap and Effective

Give investors (professional or individual) money to actively manage a portfolio and more often than not they are likely to make a mess of it. Even Warren Buffett prefers to invest money in the most simple and inexpensive way, such as index funds. Here is what he had to say in his annual letter to Berkshire shareholders last year:

“My advice to the trustee couldn’t be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.)”

Stock picking, or “active management”, is not suited for most individual investors—they neither have the time or the resources to research and implement complex strategies. On the other hand, by just investing in indices, investors are likely to get the most effective way to manage their portfolio.

Indices can be used in two ways:

- benchmarks to measure the relative performance of their portfolio

- invest in the indices directly (also known as “tracking an index”)

Diversifying Based on Region

Diversification is the most important investment principle one can implement in their portfolio—and there is no better way do it than using indices. It is good to have multiple asset classes and a fair share of sectors in your portfolio; however, diversifying based on region can often not only reduce risk in the portfolio but can also expose you to good companies from all over the world. This holds true even when dividends are an important consideration (or the main basis) of investing. The following indices will give you exposure not only to regions outside North America but also to the best dividend paying stocks in those regions.

Note: All figures below are as of the end of October 2015, returns are USD equivalent and numbers are approximate to one decimal.

Dow Jones Asia Select Dividend 30 Index

Highlights:

- Bloomberg Symbol: DJASD

- At a high level: “Financial, Tech, Industrial, Dividend stocks from major Southeast Asian Countries”

- China and Taiwan form 82% of the Index

- Financials, Technology and Industrials form 70% of the sectoral weightage. Top 3 weight companies are Chinese real estate companies (27%)

- Mean Div Yield: 6.6%

- Return: 7.3% in 2014, -3% (1 yr), 2.9% (3 yr)

Dow Jones Asia/Pacific Select Dividend 30 Index

Highlights:

- Bloomberg Symbol: DJAPSD

- At a high level: “Financial, Industrial, Telecom, Consumer Services Dividend stocks from major Oceanic & Southeast Asian Countries”

- Australia, Hong Kong, New Zealand 84% of the Index (more than half is Australia)

- Financials, Industrials, Telecom, Consumer Services form more than 72% of the sectoral weightage

- Mean Div Yield: 5.5%

- Return: -2.8% in 2014, -21.3% (1 yr), -4.2% (3 yr)

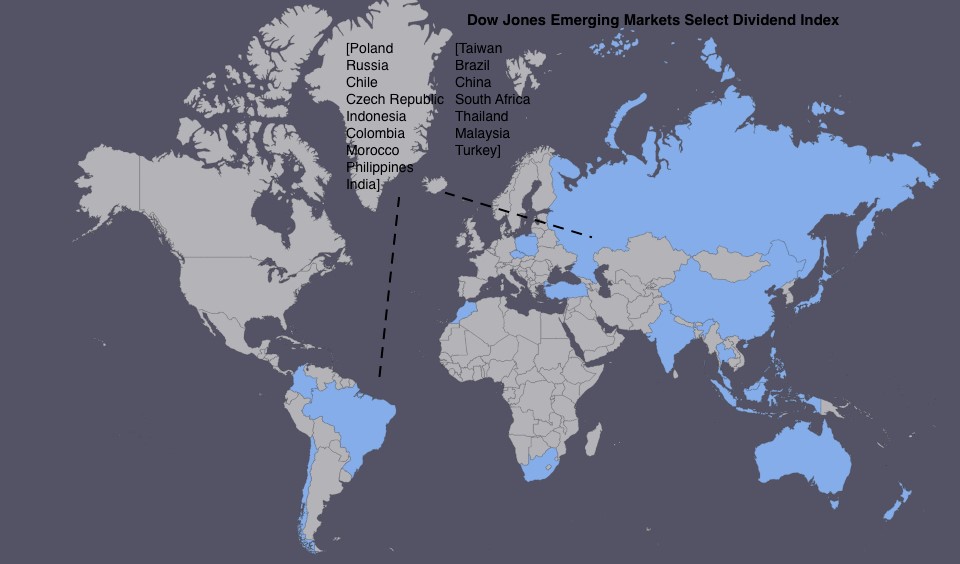

Dow Jones Emerging Markets Select Dividend Index

Highlights:

- Bloomberg Symbol: DJEMDIV

- At a high level: “Dividend stocks of diverse sectors from major emerging markets”

- Taiwan, Brazil, China, South Africa, Thailand 72% of the Index. Russia & India combined form <4%

- Financial, Industrial, Telecom, Materials, Utilities, Tech form more than 80% of the sectoral weightage

- Mean Div Yield: 6.1%

- Return: -9% in 2014, -23.4% (1 yr), -10.5% (3 yr)

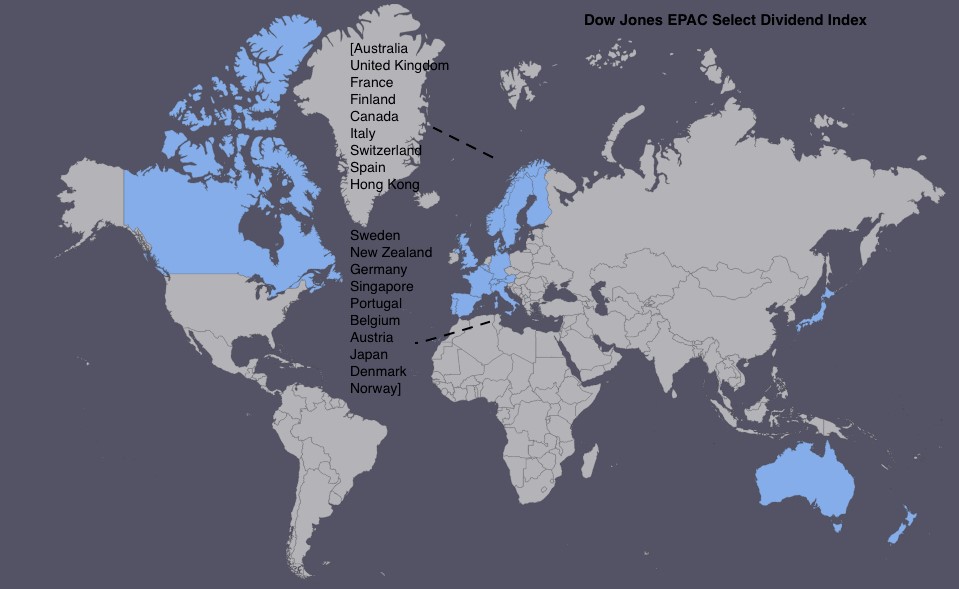

Dow Jones EPAC Select Dividend Index

Highlights:

- Bloomberg Symbol: DJEPCSD

- This is what it contains at a high level: “Dividend stocks of diverse sectors from major European countries, Australia and Canada”

- Australia, UK, France, Finland, Canada, Italy form more than 73% of the Index

- Financial, Industrial, Telecom, Materials, Utilities, Oil & Gas form more than 72% of the sectoral weightage

- Mean Div Yield: 5.6%

- Return: -4.9% in 2014, -12.2% (1 yr), -2.7% (3 yr)

Dow Jones Europe Select Dividend 30 Index

Highlights:

- Bloomberg Symbol: DJEUDIVD

- This is what it contains at a high level: “Dividend stocks of diverse sectors from major European countries”

- UK, France, Finland, Switzerland and Norway form more than 73% of the Index

- Financial, Industrial, Telecom, Utilities form more than 72% of the sectoral weightage.

- Mean Div Yield: 6.2%

- Return: -11.85% in 2014, -3.3% (1 yr), -1.2% (3 yr)

Dow Jones Eurozone Select Dividend 30 Index

Highlights:

- Bloomberg Symbol: DJEZDIVD

- This is what it contains at a high level: “Dividend stocks of diverse sectors from major Eurozone countries”

- France, Finland, Spain, Germany, Italy form more than 81% of the Index

- Financial, Industrial, Telecom, Utilities form more than 77% of the sectoral weightage

- Mean Div Yield: 5.7%

- Return: 3.5% in 2014, 6.3% (1 yr), 9.6% (3 yr)

Dow Jones Global Select Dividend Index

Highlights:

- Bloomberg Symbol: DJGSD

- This is what it contains at a high level: “Dividend stocks of diverse sectors from major developed European, North American countries & Australia”

- Australia, US, UK, Canada, France form more than 70% of the Index

- Financial, Industrial, Telecom, Utilities, Consumer Goods form more than 87% of the sectoral weightage

- Mean Div Yield: 5.7%

- Return: 0.4% in 2014, -9.9% (1 yr), 3.9% (3 yr)

Dow Jones Global Select Dividend Composite Index

Highlights:

- Bloomberg Symbol: click here

- This is what it contains at a high level: “300 Dividend stocks of diverse sectors from Developed and Emerging markets”

- Australia, US, UK form more than 70% of the Index. US forms more than 53%

- Financial, Industrial, Oil & Gas, Utilities, Consumer Goods form more than 75% of the sectoral weightage

- Mean Div Yield: 5.2%

- Return: 3.8% in 2014, -6.9% (1 yr), 6% (3 yr)

The Bottom Line

If you are heavily invested in US and Canadian stocks and want exposure to other uncorrelated markets, it might make sense to avoid Global Select Composite Indices. If you want to add an Asian component to your Dividend portfolio, then DJ Asia Select Index (DJASD) is a good option—it will expose your portfolio to Chinese and Taiwanese stocks (top 3 are Chinese real estate companies). If you want to mix Asian with some non-US-related developed countries then DJ Asia Pacific Select Index (DJAPSD) is a good option. For pure European exposure, you need to decide if Germany/Spain or UK/Switzerland will better suit your needs. France & Finland carry heavy weights in both DJ Eurozone Select Index and DJ Europe Select Index. US and UK markets are usually correlated to a large extent and if you don’t want that then you should consider the Eurozone Index.

DJ Asian Select Index (DJASD) and DJ Eurozone Select Index (DJGSD) have been the better performers from a return perspective in the last 3 years.

Follow me @tanmoyroy for more frequent updates.