This article comes at a time when France, along with the world, are still recovering from Paris’s attacks of November 13 that killed more than 120 people. Our heart goes out to the friends and families who lost loved ones in those barbaric attacks—and during attacks in other places around the world too. This attack might be an isolated and shocking event for the western world, but terrorism has been a constant phenomenon in other parts of the world: Iraq, Syria, Afghanistan, Pakistan and Nigeria have all suffered from terrorist attacks that are comparable to what happened in France. While we condemn all of them, this article is not political or investigatory in nature or motivated by religion. Instead, it explores how money and business are connected to terrorism & war. It is aimed at investors who can take informed decisions when such events occur.

The War of Budgets

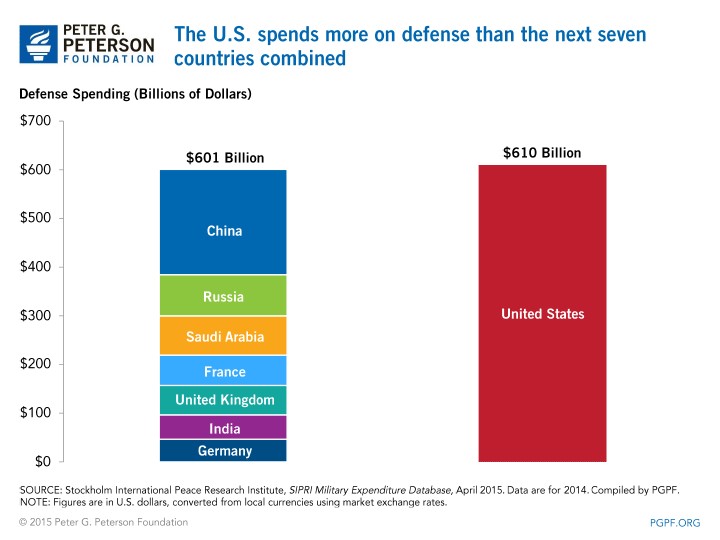

Before getting into specifics of what investors need to do, it is important to understand the scale of money being spent in fighting or defending these wars. There is a reason why the world looks at the U.S. for leadership, especially when it comes to military involvement. The U.S. spends more on their military than the rest of the next ten largest militaries put together—that is A LOT of money.

Even when a Russian plane is brought down, or an attack happens in the heart of a superpower, the world turns to the U.S. president for a reaction. Interestingly enough, Saudi Arabia and Russia (both on the top 10 military budget list) spend more as a % of their GDP when compared to the U.S. In fact, Saudi Arabia spends 10.4%, which is nearly 3 times the 3.5% U.S. spends on its military. Even during Truman’s time at the end of the 1940s, the U.S. spent as much as $357bn (inflation adjusted) on their military. Today the figure stands at more than $600bn. This doesn’t count the money spent on additional military-related spending by the CIA, Homeland Security or State Departments—it would probably cross into a trillion dollars if we counted them. Every relevant war has seen an escalation in US defence spending. It reached 22% of GDP during WW1, 41% during WW2 (the highest it has ever been), 15% during the Korean war and 10% during the Vietnam war and peaks of the Cold war.

Why Investors Need To Pay Attention Right Now

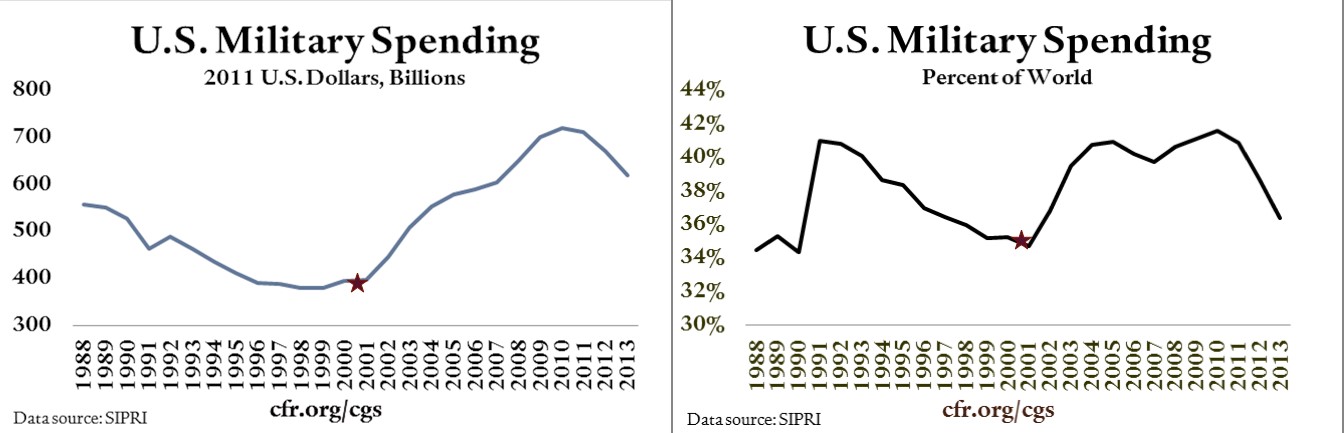

All of the above information leads us to the following main points. When 9/11 happened, the U.S. defense budget spending spiked for a good 10 years. In that time, the defence budget as a % of GDP increased from 3.5% to 5.6% (a difference of $200bn/year). By 2010, the U.S.’s share of the global military spending had crossed 40%.

There are many indicators that point to the fact that the Paris attack was a watershed moment in current defence spending of the world, including the U.S. It proved that the western countries were not safe or isolated from the crisis brewing in large parts of the middle east. Obama’s campaign about cutting down defence spending and cutting U.S. troop deployments might have been welcome in 2008, but it may not work in 2016. As of today, there is a growing sentiment that he, and other world leaders, failed to read the threat coming from ISIS correctly.

Just three days ago, Hillary Clinton, the leading candidate for becoming the next U.S. President, pointed to a “new phase” and broadening of the U.S.’s efforts. The 2016 Republican nomination hopefuls have come out in favor of strong U.S. military involvement. The topic of terrorism dominated the G20 talks that followed just after the Paris attacks, which could mean an increased spending on technology, personnel, research and operations/maintenance – in the U.S. and globally. All of this is in the backdrop of not just one incident but a rapid increase in the number of terrorist incidents since 2010. A lot of people estimate that ISIS makes $500mn/year a year from oil alone and they have other substantial revenue sources as well. The western world has woken up to realize it is not a rogue terrorist group they are dealing with. While all of this is both sad and discomforting, investors need to pay attention every time large amounts of money start to move in a certain direction.

What Happens To “War Stocks” After A Terrorist Attack?

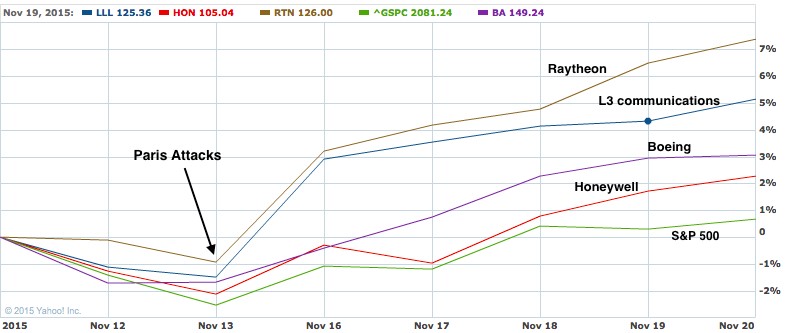

Below are some companies that contract with the government and make products that are relevant to a war-like situation (baggage scanning systems, guided missiles, aircrafts, surveillance systems).

If we take a look back on what happened to the prices of these companies after 9/11, the theory becomes even more clear. Below is a chart comparing stock performance just before and just after the 9/11 attacks. The NYSE and the Nasdaq remained closed until September 17, the longest shutdown since 1933. Of course the Paris attacks didn’t warrant such a situation, but given how seriously all world leaders are taking them, and also given how powerful they have become, there could be some long drawn out battles in store for 2016.

How Do Dividend Stocks Compare With Non-Dividend Stocks After A Terrorist Attack?

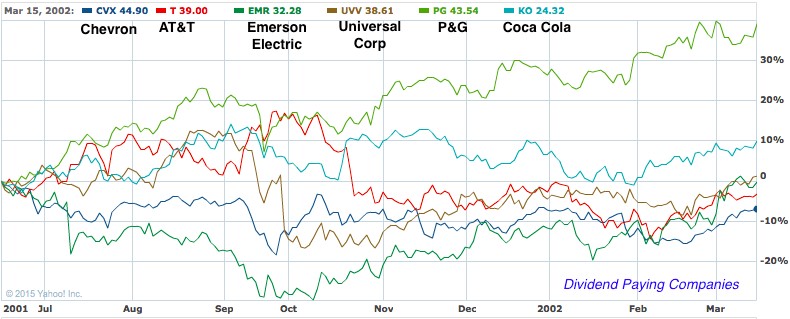

If we were to move beyond the obvious advantage of holding “war stocks”, it is interesting to see what might happen to the rest of your portfolio. Let us compare six dividend paying stocks (good historical track record) and six non-dividend paying stocks in the aftermath of terrorist attacks.

For the analysis below, Dividend.com picked good dividend paying stocks from varied sectors (FMCG, Telecom, energy, beverage, tobacco, engineering). Among the dividend paying stocks chosen, only P&G (PG ) and Coca Cola (KO ) returned 39% and 10% respectively. The rest of the stocks could barely come close to their levels from June 2001 (pre-9/11 days).

Again for comparison, Dividend.com picked some decent non-dividend companies from varied sectors (health care, tech, online retail, investment management, lab software, travel). Among the non-dividend paying stocks chosen by me, all except two (Anthem, AMG) gave good-to-exceptional returns considering the timeline was just nine months.

So, the quick and dirty analysis reveals that non-dividend paying companies might have a slight advantage over dividend paying companies in the situation of a terror attack. This of course assumes you didn’t pick any outliers in your list (e.g. companies that ran into fundamental problems or companies that just hit a substantial competitive advantage in the timeframe you picked).

The Bottom Line

Stock analysis done on limited criteria is almost never a good idea. Multiple factors come into play in the performance of a stock. Even though a terror attack does change a few things in the outlook of a company, how a particular company might perform depends a lot on its core fundamentals: cash flows, earnings, market share, margins etc. Hence, the findings of an analysis like this might be skewed, depending on the companies picked for analysis.

Having said that, some standard factors do apply just after a terrorist attack. For example, companies that manufacture products that assist governments to fight terror are likely to do well in the short-to-medium term, since there is almost always a spike in demand just after an attack. Companies operating in sectors like travel, leisure, insurance are likely to take a hit after such an event. In the current scenario, western governments are likely to take ISIS seriously and that means increased spending on defence. This may not be a bad time to get long positions in companies that are likely to benefit from the increased spending on defence.

Image courtesy of Chrisrolls at FreeDigitalPhotos.net